Barrick CEO says he does not know where Mali is keeping miner's confiscated gold

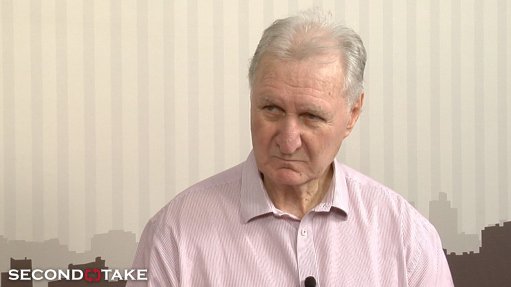

Barrick Mining is spending $15-million a month to keep its Mali mine running and doesn't know where Mali's government is keeping the gold it confiscated from the Canadian company, CEO Mark Bristow said on Wednesday.

In an interview about the long-running conflict with authorities in the West African nation, Bristow said the government there had walked back on an agreement to settle a tax dispute three times, and called the jailing of Barrick employees in the country a human rights violation.

"You have four executives from a Western world company incarcerated, which can be only described as human rights abuse," Bristow said.

He said that the jailed executives have worked harder for Mali than the people who are currently leading negotiations for its government. "We don't know where the gold is; it is allegedly in secure custody, but we don't know that," he said.

Barrick and Mali's government have been locked in a dispute for more than six months over the Loulo-Gounkoto complex, Barrick's largest mine in Mali.

In addition to arresting the four Barrick employees, authorities confiscated around 3 metric tonnes of gold in January following accusations that Barrick was not in compliance with its tax obligations, prompting the miner to shut down the mine. Based on the current gold price, the value of the confiscated gold is around $318-million.

Barrick reported a first-quarter profit on Wednesday that beat analysts' estimates, driven by a surge in gold prices that helped offset lower production.

Lower production was the result of the Mali mine production shutdown. When asked whether Barrick could look for a possible buyer for the asset, Bristow, who has overseen the mine's operations for nearly two decades, said it was "a controversial question, as very few people will be able to run the mine.

"It is one of the biggest mines in the world, it is very complex, and nobody is prepared to go into Mali," he said.

For Barrick's boss, the Mali standoff is not new. The miner has operations in some of the most volatile locations across the world, and Bristow has been part of some tough disputes elsewhere, including in Pakistan and Papua New Guinea.

On his future, Bristow said the company has indicated to markets that he will be in the current role until 2028, but there is a succession program in place that is overseen by the board. "In due course we will be sharing it, but (it's) too early to share", he said.

Gold prices surged above $3,100 per ounce in the first quarter of 2025, driven by safe-haven demand amid uncertainty over tariffs that could fuel inflation and reduce global economic growth.

Bullion has gained around 29% so far this year, after rising more than 27% in 2024.

For 2025, the Toronto-based company continues to expect total gold production between 3.15 million ounces and 3.50 million ounces, with Loulo-Gounkoto's output excluded from its outlook.

"We expect to update our guidance to include Loulo-Gounkoto when we have greater certainty regarding the timing for the restart of operations," Barrick said in a statement.

The miner, which has been streamlining its operations since it merged with Africa-focused Randgold Resources, said it is moving forward with plans to divest its Tongon mine in Côte, d'Ivoire and its Hemlo operations in Canada.

The company's average realized gold price for the first quarter rose to $2 898 per ounce from $2 075 per ounce in the same period last year. Total gold production fell to 758,000 ounces from 940,000 ounces.

Barrick's all-in sustaining costs for gold, an industry metric reflecting total expenses, rose 20.4% to $1 775 per ounce in the first quarter.

The per-ounce cost is expected to trend lower over the rest of the year on higher production, the company added.

On an adjusted basis, the company, previously known as Barrick Gold, earned 35 cents per share in the quarter, compared with analysts' average expectation of 28 cents per share, according to data compiled by LSEG.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation