BHP’s bid for Anglo casts cloud over $9bn fertiliser mine

BHP Group’s proposal for a $39-billion takeover of rival Anglo American is all about securing plenty of copper supplies — so now, the potential deal is throwing uncertainty over the future for Anglo’s massive fertiliser mine in England.

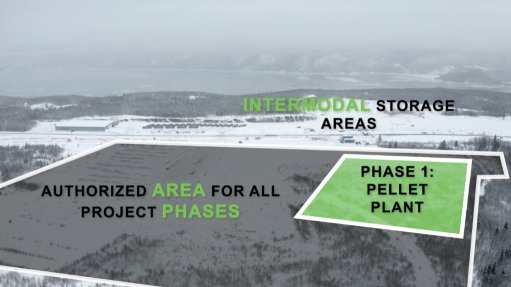

That’s largely because BHP is already building its own giant fertiliser project in Canada, called Jansen, to which it’s already committed more than $10-billion. With an accelerated expansion planned for Jansen, BHP is unlikely to be interested in also going big on Anglo’s Woodsmith site.

Underscoring the doubt is the fact that the Woodsmith project involves polyhalite, a relatively obscure fertilizer product with unproven demand. The project has a checkered past — its previous owner Sirius Minerals rode a wave of retail investor enthusiasm to develop it, only to fail to raise the final piece of financing.

If BHP is successful with its takeover deal, it would spark the industry’s biggest shakeup in more than a decade. BHP, already the largest miner, would gain control of roughly 10% of global copper mine supply ahead of a forecast shortage that’s expected to drive up prices. But on the fertiliser front, big questions remain over how much demand there will be for polyhalite, currently a niche product.

The Woodsmith mine makes the deal “very awkward indeed — it’s the reason why we didn’t think BHP would get involved with Anglo American,” said Ben Davis, a mining analyst at Liberum Capital. “BHP clearly doesn’t think much of it.”

On Friday Anglo rejected BHP’s all-share offer, calling it undervalued and “opportunistic.” But some investors are positioning for BHP to raise its bid. Elliott Investment Management has built a roughly $1-billion stake in UK-listed Anglo.

BHP has already made divestments a condition of its takeover bid and stipulated that assets beyond copper, metallurgical coal and iron-ore would be subject to “strategic review.”

Woodsmith is “implicitly in that bucket", Davis said.

Last year, Anglo took a $1.7-billion writedown on the project while also unveiling plans to spend almost $5-billion to bring the mine into production by 2027 — taking its total spending on Woodsmith to $9-billion.

The project is “probably more of a nuisance than anything else,” said Maxime Kogge, an analyst at Oddo BHF SCA. “The project is on good tracks, but demand prospects are still quite elusive as the market does not really exist today.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation