Bunyu graphite project, Tanzania – update

Photo by Volt Resources

Name of the Project

Bunyu graphite project.

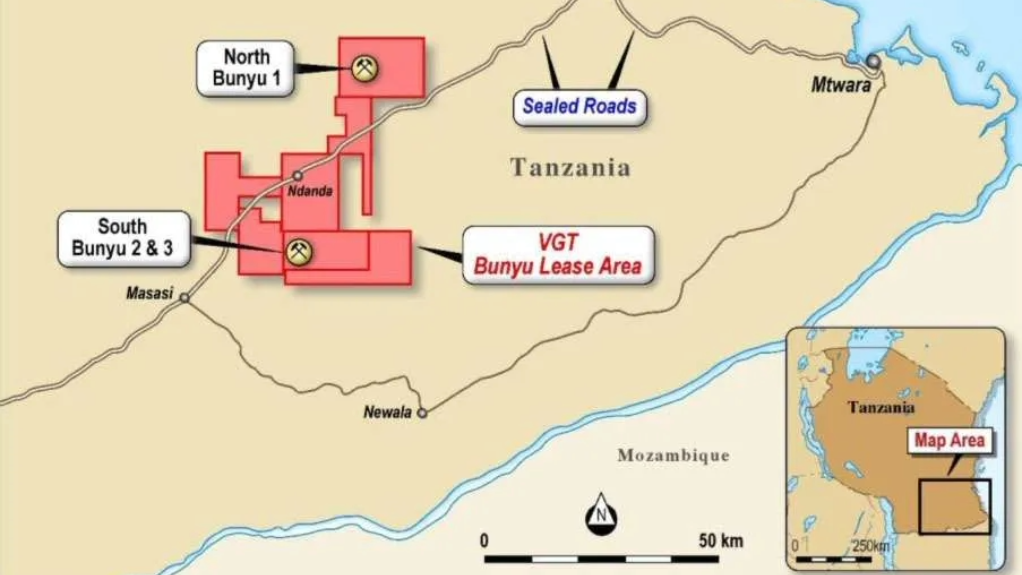

Location

Tanzania.

Project Owner/s

Critical minerals and advanced materials company Volt Resources.

Project Description

Bunyu is one of the biggest graphite deposits in the world, with a resource of 461-million tons at 4.9% total graphitic carbon (TGC) for 22.6-million tons contained graphite. The project includes a proven reserve of 127-million tons at 4.4% TGC.

The project will be developed in two stages.

An updated feasibility study on Stage 1 published in August 2023 proposes a mining and processing plant throughput rate of 400 000 t/y of ore to produce on average 24 780 t/y of graphite products over a 13.7-year mine life.

Volt intends to progress to Stage 2 to leverage the platform established by Stage 1, and Bunyu’s status as one of the biggest graphite resources globally, to dramatically scale production to 170 000 t/y and help meet the forecast global increase in demand for graphite products.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The updated PFS delivers a pretax net present value of $58.9-million and an internal rate of return of 31.5%, with a payback period of 2.9 years.

Capital Expenditure

The updated PFS has estimated a capital cost of $33.1-million, compared with the $31.8-million estimated in the 2018 PFS.

Planned Start/End Date

Not stated.

Latest Developments

Volt Resources has signed a binding term sheet with the Unbounded Opportunities Fund (UOF), which will provide funding and development support for the Bunyu graphite mine and processing plant.

The UOF will make a conditional $11.1-million equity investment through Volt’s subsidiary, Volt Graphite Tanzania (VGT), giving the UOF a 62% project stake, and Volt having 38%. The agreement sets out a joint development framework focused on boosting annual output, improving capital efficiency and keeping operating costs low.

As part of the arrangement, UOF will update the Stage 1 feasibility study, targeting a $37-million capital cost, 40 000 t/y of 94% TGC concentrate and a unit operating cost of $450/t. UOF will also fund any capital overruns, with its equity only adjusted if operating costs at 85% plant capacity exceed the target by more than 10%, subject to fuel and power price caps.

The funding structure will run through VGT, which holds all project permits, licences and intellectual property. UOF will create a special purpose vehicle (SPV) for its investment, after which VGT will be owned 62% by UOF and 38% by Volt. Tanzania’s government will receive a free carried interest through a separate SPV, diluting both partners while preserving UOF’s majority.

Responsibilities are split between the parties: the UOF will conclude mining, engineering, procurement and construction contracts, as well as lead construction and operations, while Volt will secure debt financing, offtake agreements and permits, in addition to overseeing local and community engagement. UOF’s investment remains subject to completing all financing and project agreements and meeting key conditions, including bankable offtake for at least 80% of production, nonrecourse debt covering 70% of capital costs, clear land rights, updated studies and models, special economic zone approval, and a final government framework and shareholders agreement.

Volt and UOF have four months, extendable by mutual consent, to finalise these conditions and execute definitive agreements. Upcoming priorities include completing the shareholders agreement, advancing lender and offtake discussions, delivering the updated feasibility study and closing all remaining permitting and regulatory steps in Tanzania.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Volt Resources, tel +61 8 9486 7788 or email info@voltresources.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation