Bushveld production to continue to decrease on liquidity challenges

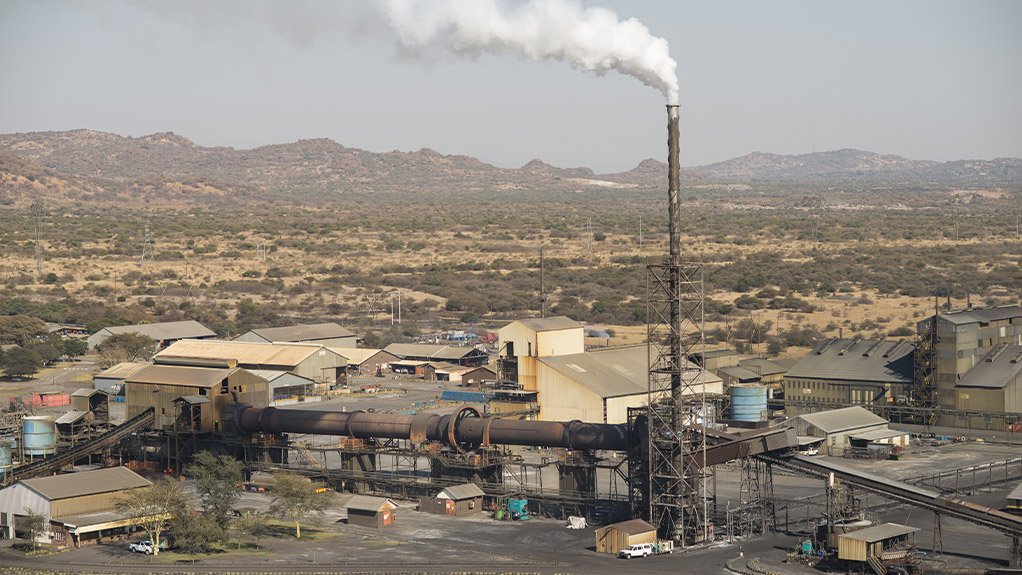

Owing to liquidity issues, a controlled slowdown of production has started at Vametco

Aim-listed Bushveld Minerals will continue with a controlled slowdown of production owing to liquidity challenges, CEO Craig Coltman says in an operational update for the three months and nine months to September 30.

“Due to the company’s cash position currently not being sufficient to fully sustain our operations or meet immediate liabilities, we are actively engaging with various stakeholders to explore various options to address our immediate liquidity position,” he points out.

Owing to liquidity issues, a controlled slowdown of production has started at Vametco, the length of which will be determined by the timing of receipt of sufficient further funds, as announced in October.

Production for the third quarter was 855 t of vanadium, a decrease from the 1 000 t produced in the prior year’s corresponding period.

Coltman says the period reflects lower volumes and a challenging quarter overall; however, the group’s commitment to operational efficiency and long-term sustainability remains its key focus.

Bushveld began work on cost-cutting initiatives and development works to return the company to profitability and secure its long-term future, with the potential to achieve annualised savings of $8-million to $10-million by the end of 2025.

Production for the nine months to September 30 was 2 546 t, compared with 2 784 t in the nine months to September 30, 2023.

“Bushveld has taken difficult, but necessary, steps this quarter to stabilise our financial position, including a reduction of the current labour complement at both Vametco and head office, and a controlled slowdown of Vametco due to current liquidity issues.

“We also achieved meaningful progress in rationalising our asset base during this period,” Coltman explains.

Bushveld completed the disposal of Lemur Holdings and the sale of the Vanchem vanadium processing plant, which Coltman said allowed it to focus on Vametco as the company’s core producing vanadium asset.

The completion of the disposal of Lemur Holdings resulted in Bushveld no longer being liable for the outstanding about $2.5-million debt owed to the Development Bank of Southern Africa.

All conditions relating to the sale of Vanchem, including Competition Tribunal approval, have now been met.

The transaction was completed on November 7. As a result, Vanchem is no longer part of the group.

Sales for the third quarter were 859 t, compared with 849 t in the third quarter of the previous year.

Sales for the nine months reached 2 492 t, compared with 2 945 t for the prior comparable period.

Owing to the company’s working capital conditions, guidance has been suspended for the remainder of the year.

The total recordable injury frequency rate for the nine months was 2.41.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation