Caledonia achieves marginal increase in Q2 output

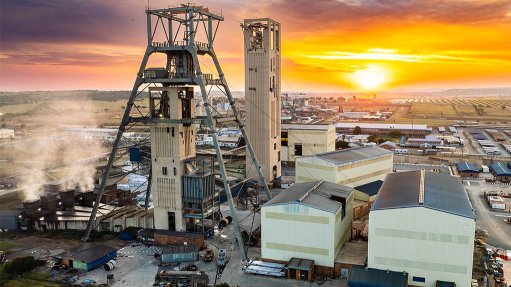

Toronto-headquartered Caledonia Mining’s 49%-owned Blanket mine, in Zimbabwe, produced 12 657 oz of gold in the second quarter ended June 30, marginally higher than that produced in the second quarter of 2017 and in line with expectations.

“The second quarter was a difficult quarter for the business as production was adversely affected by lower-than-expected grade and tonnes mined.

“Grade for the quarter was 3.19 g/t. This is below target due to difficulties in accessing broken ground at AR South and higher-than-expected dilution at the Blanket orebody due to the introduction of long-hole stopping on the grounds of safety,” CEO Steve Curtis said in a statement on Thursday.

Caledonia further reported an 86% year-on-year increase in adjusted earnings a share to 35.2c, mainly as a result of an increased export credit incentive (ECI) and higher deferred tax adjustments.

"Attributable profit for the quarter was substantially higher year-on-year at $2.6-million, boosted mainly by the increase in the ECI when compared to the same period in 2017.”

Cash generated by operating activities for the quarter was, however, lower than in previous periods due to substantial working capital movements.

Curtis stated that the negative working capital movements during the quarter had had an adverse effect on operating cash flow, with a net operating cash burn of $1.2-million during the quarter.

This, combined with capital investment of $5.6-million during the quarter, had a negative impact on the balance sheet with a net cash balance of $5.3-million at the end of the quarter.

"Capital investment for the quarter was in line with our capital expenditure (capex) plan for 2018 at $5.6-million, most of which was incurred at central shaft, which has now reached a depth of 1 106 m. We expect capex to decline substantially after 2019 after we commission the central shaft as planned in 2020."

Cost performance for the quarter was, meanwhile, satisfactory, with on-mine and all-in sustaining costs (AISC) being well-contained.

On-mine costs of $717/oz for the quarter were 3% higher year-on-year, while AISC was flat at $856/oz.

Caledonia reiterated that it remains on track to achieve production of 80 000 oz/y at the Blanket mine by 2021.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation