China’s ‘strategic metal’ in sharp focus as Shanghai Platinum Week gets under way

Shanghai Platinum Week under way.

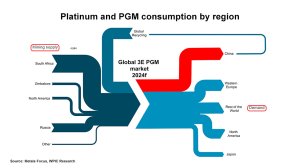

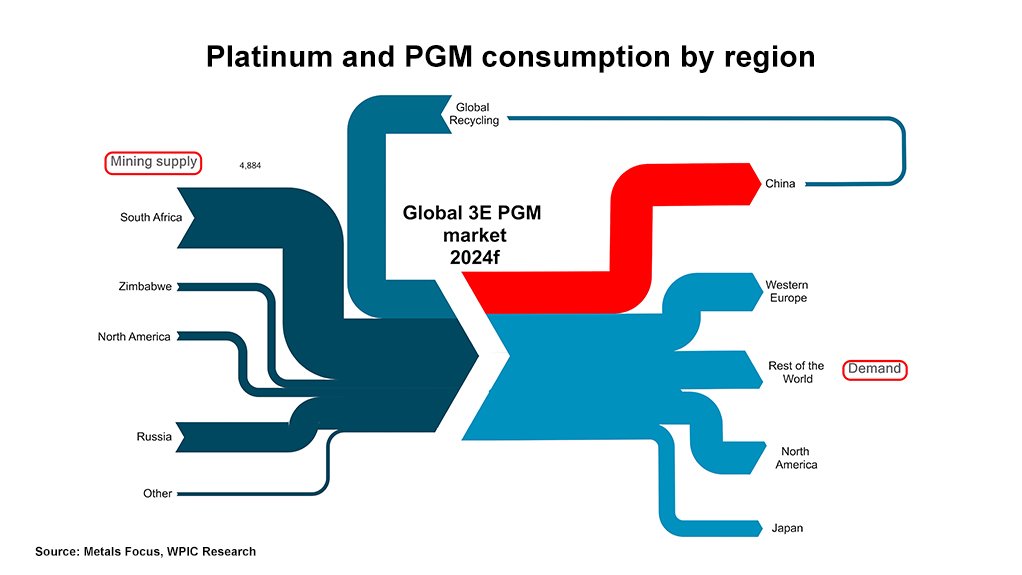

Platinum and PGM consumption.

Photo by World Platinum Investment Council

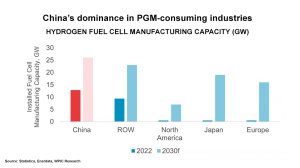

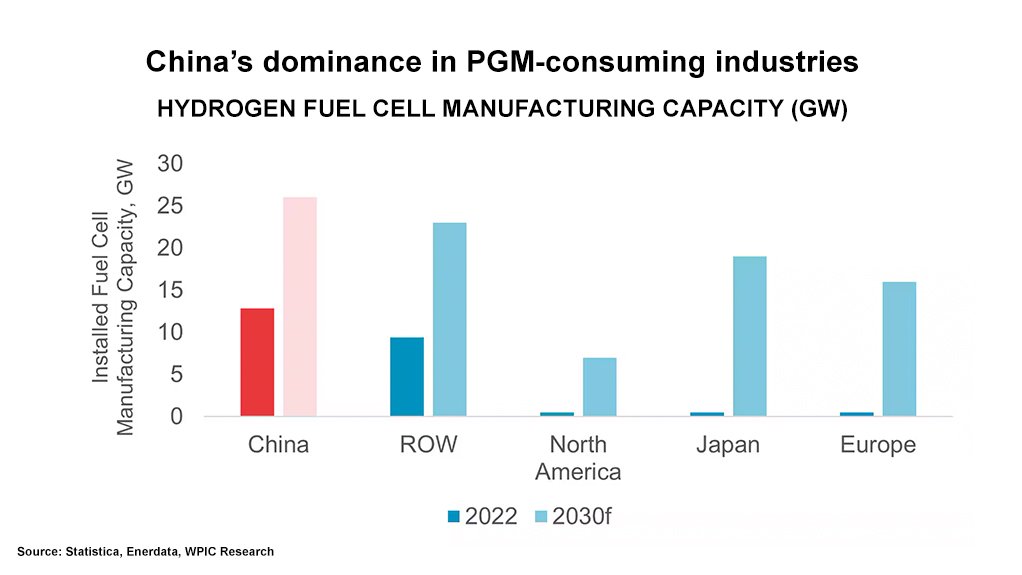

Platinum-based Hydrogen Fuel Cell Manufacture.

Photo by World Platinum Investment Council

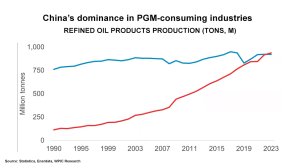

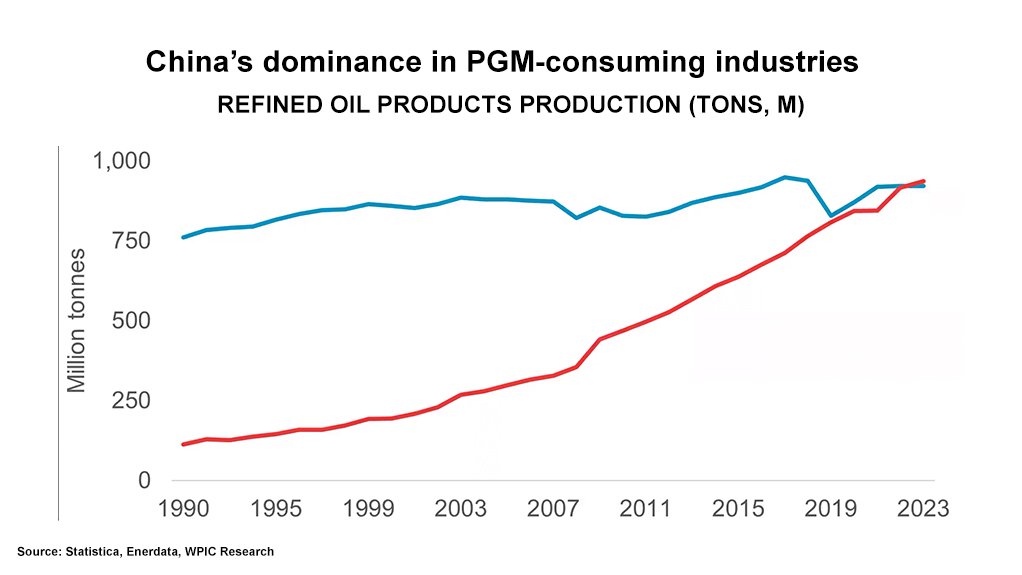

Demand in refined oil sector.

Photo by World Platinum Investment Council

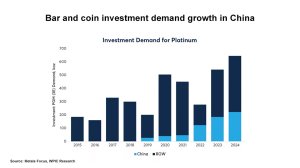

Platinum investment demand.

Photo by World Platinum Investment Council

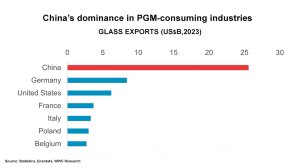

PGM demand in glass sector.

Photo by World Platinum Investment Council

JOHANNESBURG (miningweekly.com) – Shanghai Platinum Week kicked-off today in China where the silver-white transition metal with the symbol Pt and atomic number 78 has been declared strategic under the State Council’s New Energy Vehicle Industrial Development Plan, which encourages companies to improve their capacity to secure long-term supplies of platinum group metals (PGMs) needed to achieve China’s decarbonisation goals.

PGMs are key metals in proton exchange membrane (PEM) technology, used in electrolysers to make green hydrogen and in fuel cells to turn that green hydrogen back into green electricity.

Trade data shows that, since 2019, China has been importing considerably more PGMs than it needs in the short term.

China already leads the world in hydrogen mobility deployment, with more than 28 000 vehicles sold and 400-plus refuelling stations in operation as of 2024. By 2030, China aims to have one-million hydrogen vehicles and a thousand refuelling stations, ZEV Station CEO Jesse Schneider points out.

Currently, Mining Weekly can report that China still lacks exchange-traded spot and forward PGM markets, but a keynote speech delivered by Guangzhou Futures Exchange (GFEX) at last year’s Shanghai Platinum Week has raised hopes of platinum and palladium futures contracts being on the way.

It is hoped that the availability of platinum and palladium in ingot and sponge form will be a central point of the exchange trading of GFEX, a national futures exchange dedicated to green commodities essential for the energy transition.

The ability to take delivery of sponge could be transformative for industrial users of PGMs as well as automakers, as this is the main form typically used for their manufacturing purposes. No other exchange in the world allows delivery of sponge.

Other benefits of GFEX’s hoped-for futures may include providing a mechanism for businesses to hedge price risk and better manage their operations, something which is currently not freely accessible in China. For example, the removal of price risk will allow platinum jewellery and investment product fabricators to reduce the premium charged for platinum products as well as the discount on buyback.

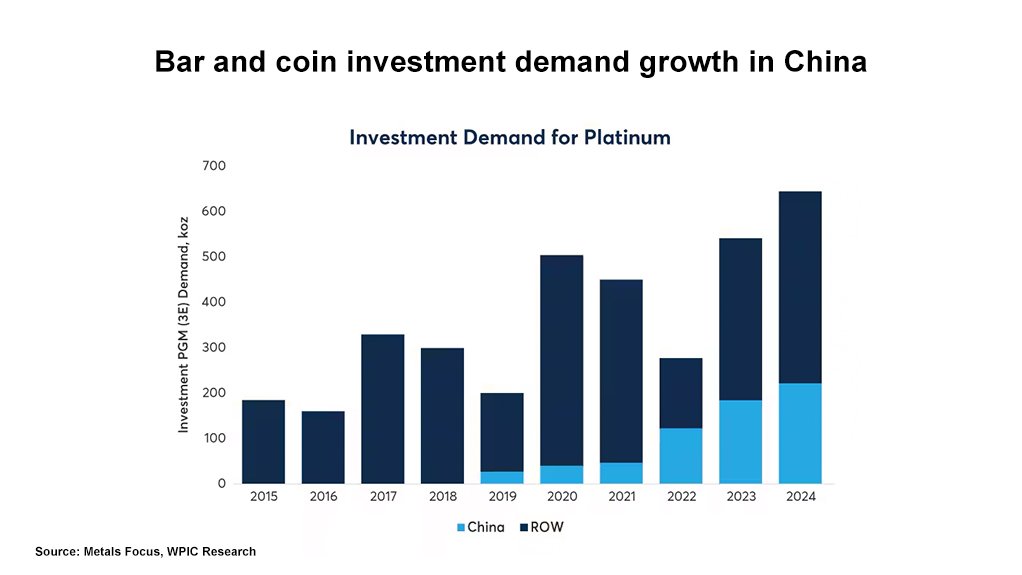

China has grown to be the number one market for platinum bar and coin investment, accounting for 64% of total platinum bar and coin demand in 2024, including platinum investment bars equal to or greater than 500 g. China’s number-one position is forecast to be maintained this year, also at 64%.

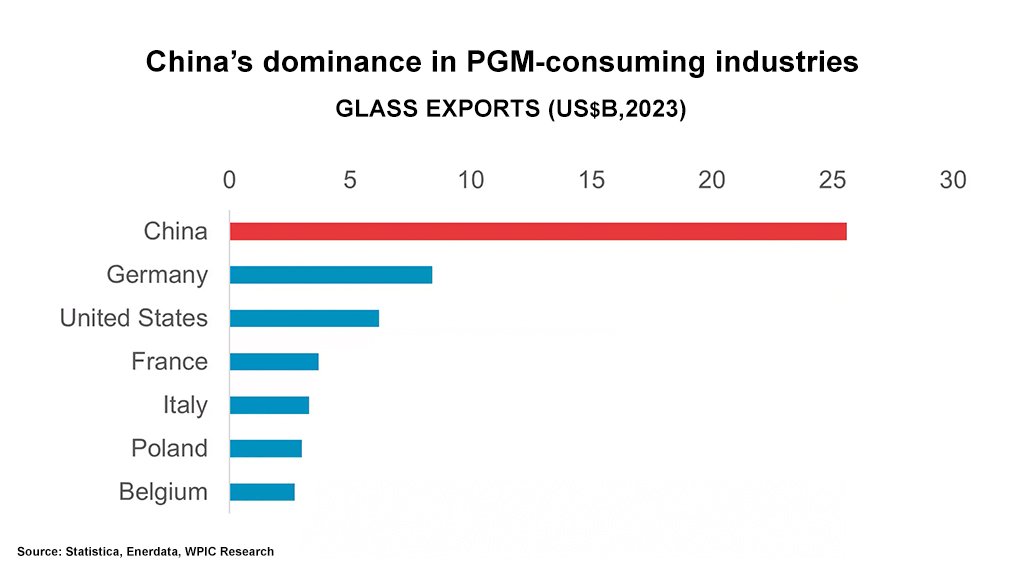

China, the single largest consumer of platinum globally, accounted for close to 30% of global platinum demand in 2024. The breakdown for 2024 was automotive demand 17%; jewellery demand 20%; industrial demand 31%; investment demand 32%, which accounts for 64% of total bar and coin demand, including investment bars equal to or above 500 g. China is also increasingly globally dominant in several PGM-consuming industries.

By carrying lower fabrication costs, larger investment bars of 500 g and above attract higher net worth investors, exemplified by China’s State-owned Gold Coin Group last year launching a large-size 1 kg platinum investment bar, made of 99.95% pure platinum. This was done in consultation with the Chinese central bank, which shows the extent to which interest in platinum as an investment asset is growing in China.

Platinum jewellery demand in China is forecast to grow by 15% this year to 474 000 oz, the key driver being platinum’s considerable discount to gold, which is encouraging fabricators and wholesalers to stock platinum.

“Given the nature of the China market, where precious metal jewellery has a quasi-investment status, there is a crossover being seen with the expansion of the range of platinum investment bars available occurring in large part due to jewellery fabricators moving into the investment space as well,” the World Platinum Investment Council (WPIC) writes in an update published by the CME Group.

WPIC expects China’s hydrogen-linked platinum demand to approach the level of one-million ounces a year by the late 2030s.

The growth of platinum investment holdings in China is helpful in this regard, as is the renewed interest in platinum jewellery, which effectively provides a domestic reserve of platinum owing to its quasi-investment status.

WPIC organises Shanghai Platinum Week with China Gold Association Platinum Committee, Precious Metals Industrial Committee, and China Material Recycling Association.

The event, which continues until Friday, July 11, includes the China PGMs Market Summit, where trends and future market directions are discussed. The big get-together, now in its fifth year, never fails to provide an insightful platform into China's market dynamics and emphasises South Africa’s position as the world’s largest producer of PGMs.

Fuel Cells Works reports that Toyota has announced a $139-million joint venture with Chinese conglomerate Shudao Investment Group to build a fuel cell plant in Chengdu, which has its eye on becoming the regional hydrogen hub for commercial vehicle applications.

Interestingly, Empowering African Entrepreneurs for Impact CEO Ajay Wasserman reports that China has abolished all tariffs on exports from 53 African countries, including South Africa, and that startups across the continent have secured more than $1-billion in angel funding, 40% higher than in the first five months of 2024.

PLATINUM PROGRESSION

International Precious Metals Institute reports on LinkedIn that the changed vehicle emission testing rules have resulted in a 17% increase in the PGM loadings in order to meet compliance levels and sufficient hybrid vehicle production would as a result provide enough upside to lift PGM demand beyond the previous highs.

In Australia, A$432-million funding from the Australian government has been earmarked for Sydney-listed mining, infrastructure and manufacturing company Orica in support of the operation of the Hunter Valley Hydrogen Hub. Orica’s Hunter Valley Hydrogen Hub also has the endorsement of the federal and New South Wales governments to establish the hub at Kooragang Island. This has resulted in Orica receiving interest from a range of potential project partners in the last few months, including those interested in developing markets for green-hydrogen-derived green ammonia.

In Europe, three energy companies – Enagás, Engie group company Natran, and Teréga – are setting out to jointly build the BarMar hydrogen pipeline, which is on its way to becoming the first subsea pipeline made solely for transporting renewable hydrogen, Hydrogen Fuel News reports.

Stretching more than 400 km under the Mediterranean, BarMar will link Barcelona in Spain with Marseille in France and have a capacity of two-million tonnes of hydrogen a year, some 10% of the EU’s estimated hydrogen demand by 2030.

Platinum-catalysed hydrogen fuel cell trucks and buses have already covered well over 15-million kilometres of use in Europe.

In Slovakia, the country’s hydrogen-powered truck was officially registered with a Slovak licence plate, marking another advancement in Europe’s transition to zero-emission heavy-duty vehicles. The certification complies with Europe's alternative drive system standards and is being highlighted as a pivotal development in the hydrogen mobility sector. The truck uses four hydrogen cylinders that store 12.4 kg of hydrogen at a pressure of 700 bar.

In Nordic countries, it is reported by Renewables Now that the project companies of the Nordic Baltic Hydrogen Corridor (NBHC), the planned hydrogen pipeline network in the Baltic region, have secured a EU grant of $8-million for feasibility studies. The feasibility study started earlier this year and is to be completed in the first quarter of 2027, laying the groundwork for subsequent project development phases. NBHC commissioning is planned around 2033.

Germany has reached the halfway point in its plan to expand solar energy by 2030, the German Solar Industry Association (BSW-Solar) reported. "In the past 25 years, photovoltaics have developed from an expensive satellite technology into the cheapest form of electricity generation on earth," BSW-Solar's chief executive Carsten Körnig enthused. Germany now has 107.5 GW of capacity installed of the targeted 215 GW. The 5.3-million systems installed on rooftops, balconies, over car parks and even on water now cover 15% of Germany's electricity needs.

In South Africa, the final stage of development for the Coega Green Ammonia at Nelson Mandela Bay in the Eastern Cape has begun with the release of the request for proposals to 15 shortlisted engineering, procurement and construction EPC entities from the 48 responses received from the Hive Hydrogen request for information process earlier this year.

Requests have been invited for proposals for a plant with a production capacity of more than one-million tons of green ammonia a year; plants for seawater abstraction, desalination and demineralisation; storage facilities with two 7 km pipelines for 70 000 t of green ammonia piping; a 1 430 MW solar photovoltaic cluster of nine solar farms; and 1 879 MW of wind power in two clusters of five wind farms.

Also in South Africa, the coal-mining-linked Seriti Green last week erected the first wind turbine at its Ummbila Emoyeni wind energy facility in Mpumalanga, which hosts most of South Africa’s coal mines.

The 221-m-high turbine has 130 m tower and 91 m blades. This is inextricably linked to the province’s Just Energy Transition commitment to the coal-rooted province’s supportive community.

Seriti Green involves local communities in the energy transition through job creation, supplier opportunities, and delivering long-term socio-economic benefits. “This is just the beginning, and we look forward to continuing this journey together,” Seriti Green CEO Peter Venn stated on LinkedIn.

Renewables, PGMs, seawater and grey water, and land go hand-in-glove with the development of green hydrogen, which then paves the way for the expansion of the use of fuel cells for clean transport and green manufacturing.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation