Coal subsidies, policy instability threaten Asia's energy transition

SINGAPORE - Asia's clean energy push will stall unless governments curb fossil fuel subsidies, offer stable policy direction and invest in upgrading grids, industry executives said on Wednesday.

The executives flagged the cancellation of renewables auctions and subsidies to the fossil fuel industry as the biggest impediments of growth in green investments at a time when data centres are driving growth in power demand.

"Coal continues to be subsidised and power and energy in general continue to be used as a political tool to win votes. And I think that's the biggest stumbling block," Lawrence Wu, CFO for Asia of Portugal-based renewable power firm EDP Renewables, told the APPEC conference in Singapore.

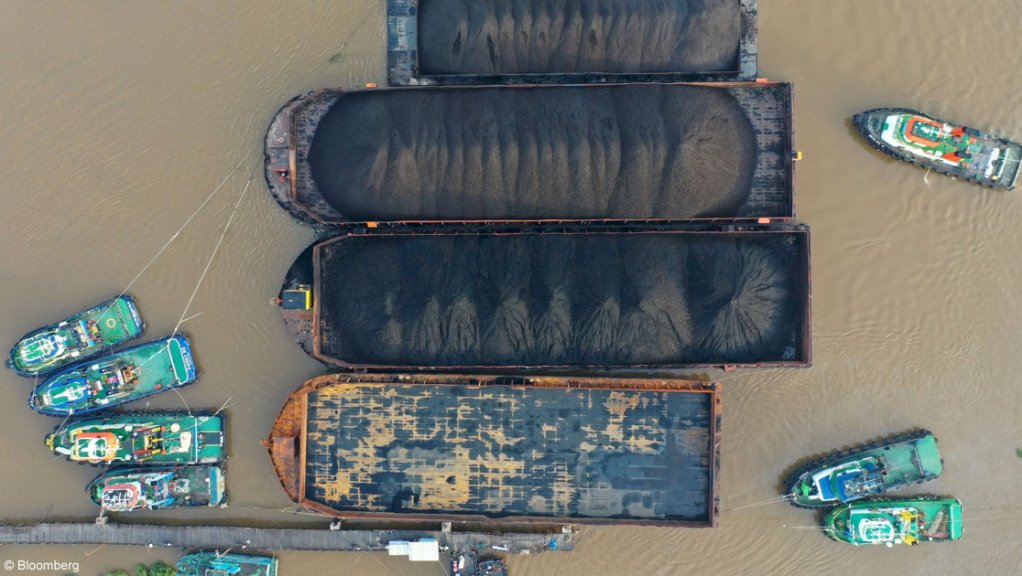

Major Asian economies including Indonesia and India continue to incentivise coal use, saying it helps keep retail power tariffs in check, and cite lower per capita emissions to defend dependence on the fossil fuel.

Nitin Apte, CEO of General Infrastructure Partners-owned, Singapore-based Vena Group, said the company is quadrupling construction of renewable energy projects in Asia to meet surging loads but said policy, not technology, is the main limitation.

"If we know a permit takes four years and the steps are clear, we can price that risk. The concerns come when you run an auction and then cancel it or the power purchase agreement is not bankable," Apte said.

Taiwan revoked two offshore wind generation licenses after review this year, while India has cancelled 11.4 gigawatts (GW) of renewable energy tenders in the last two years for reasons including high tariffs quoted.

Data centres have caused a surge in power demand across the region, and not necessarily for renewable energy, he said.

"I don't think they (data centres) really care what carbon intensity they have. They just want energy," Apte said.

Malaysia, one of Southeast Asia's hottest data centre markets, is boosting coal-fired power output and importing the fuel at record levels, taking advantage of low prices.

Both executives said challenges such as permitting delays were inflating financing costs and called for predictable long-term policy and timelines.

Wu said EDPR is "doubling down" on Japan and Australia, which had "sustainable" risks that the company was "prepared to take".

"It takes a few years to develop a project fully, but we know with a huge level of certainty in terms of what's going to come," adding that the predictability helped drive down financing and capital costs.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation