Cobalt Holdings drops plans for London IPO

Metals investor Cobalt Holdings said on Wednesday it would not proceed with its planned initial public offering on the London Stock Exchange, ending hopes for what could have been the largest listing in the UK capital since early 2024.

The company declined to specify the reasons for dropping its plans days after the listing was priced at $2.56 a share.

However, one person with knowledge of the process said the process was halted as a result of lack of investor demand. Management continues to believe in the business model and the market for cobalt, a second person with knowledge of the situation said, adding that the company is planning to explore options including funding the business privately.

The market debut, valued at around $230-million, would have been London's largest since Air Astana's listing in February 2024.

London has struggled to attract new listings, prompting reforms last year to make it more competitive with New York and the European Union after Brexit.

Several London-listed firms in recent years have also moved their primary listing to New York or picked Europe for IPOs, where they believe they can fetch better valuations.

Last month, Reuters reported that fast-fashion retailer Shein was working toward a listing in Hong Kong after its proposed London IPO stalled.

Unilever chose Amsterdam as the primary listing for its ice cream business Ben & Jerry's in February.

Glencore and affiliates of investment firm Anchorage Structured Commodities Advisor had agreed to buy about 20.5% of the shares to be offered in Cobalt's IPO when it was first announced in early May.

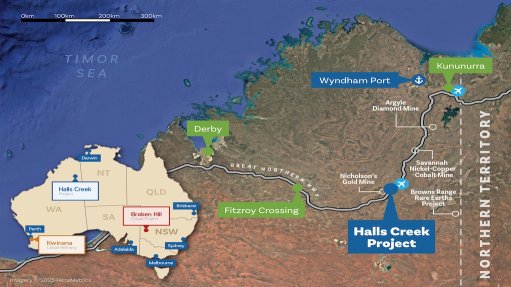

Cobalt, which holds physical cobalt and has a contract to buy from Glencore, had plans to use the majority of the IPO proceeds to buy an initial 6 000 metric tons of the key battery metal, worth around $200-million, from the global miner.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation