Construction imminent at large diamond project

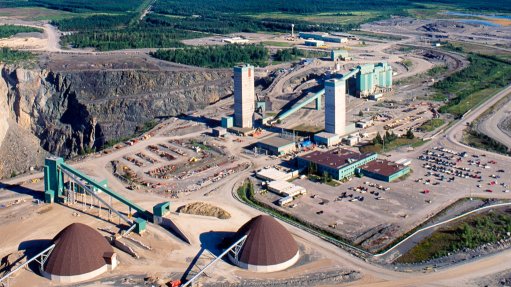

Construction activities at the C$650- million Gahcho Kué diamond project are expected to kick off by midyear following completion of the environmental review in December 2012.

Located at Kennady Lake in Canada’s Northwest Territories, Gahcho Kué is being developed by a partnership between Mountain Province Diamonds (49%) and De Beers Canada (51%).

Gahcho Kué is said to be the world’s largest and richest new diamond development project and Mountain Province Diamonds president and CEO Patrick Evans reports that production is expected to begin in the first half of 2015.

The project consists of a cluster of four diamondiferous kimberlites, three of which have a probable mineral reserve of 31.3- million tons grading 1.57 ct/t for total diamond content of 49-million carats. A 2010 feasibility study indicated that the project has an internal rate of return of 33.9%.

In January the Mackenzie Valley Environmental Impact Review Board closed the public record for the Gahcho Kué environmental-impact review, marking a significant milestone in the permitting of the diamond mine.

“Based on the high level of government and public support for the Gahcho Kué diamond mine, combined with the encouraging statement from the chairman of the Gahcho Kué panel, we are optimistic that we will receive an early and positive recommendation supporting the Gahcho Kué development plan. We are also hopeful that Canada’s Minister of Aboriginal Affairs and Northern Development will move swiftly to approve the development of Gahcho Kué once he has received the recommendation of the panel,” says Evans.

He reports that since the discovery of Gahcho Kué 20 years ago, more than C$200-million has been invested in explora- tion, social and environmental studies, engineering design, feasibility studies and consultation.

“This reflects an extraordinary commitment on the part of our shareholders to the people and diamond industry of Canada’s Northwest Territories. The successful permitting of Gahcho Kué will secure the Northwest Territories’ position as one of the world’s leading diamond-producing regions.”

He also notes that a decline in production from the existing Ekati and Diavik diamond mines, as they enter their sunset years, contributed to an estimated 5% drop in the gross domestic product of the Northwest Territories.

“Gahcho Kué is critical to the future of Canada’s diamond industry and will con- tribute important benefits to all the people of the Northwest Territories.”

He adds that the joint venture partners are currently negotiating impact benefit agreements with all the First Nations groups in the vicinity of Gahcho Kué.

“These agreements typically cover training, employment and procurement. The joint venture partners strive to offer economic opportunities to the First Nations impacted by the mine’s development,” says Evans.

“Our vision is to grow Gahcho Kué to a Tier 1 diamond asset with an on site value of greater than C$20-billion. We expect this to be achieved through our current mine-site exploration programmes,” says Evans.

Evans reports that the diamond recovery results from the Tuzo deep drill programme at Kennady Lake confirm the potential for Gahcho Kué to be even larger and richer.

“The microdiamond results indicate the potential for the grade to increase below 350 m, which, if confirmed, would place Gahcho Kué amongst the richest of all known diamond deposits.

“Our growth strategy is focused on the 5 000 m Tuzo deep drill programme and the 29 high-priority new drill targets identified,” says Evans. The company will begin drilling of 15 of the 29 new targets in February and expects to report an updated resource by the end of the first quarter of 2014.

Looking at market trends, Evans notes that rough diamond prices dropped, on average, about 12% last year.

“However, it appears the diamond market will be in balance in 2013, which should provide price support this year. We should see rough diamond prices increase in 2013, somewhere between 5% and 10%. However, all predictions indicate that there will be a supply shortage starting in 2014, which is likely to provide strong price support for rough diamonds as the company begins production in 2015,” he tells Mining Weekly.

Visit Mountain Province Diamonds at PDAC 2013 at booth #3318.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation