De Beers investor Botswana says serious buyers showing interest

Botswana’s government said it’s optimistic that Anglo American will find a buyer for its diamond unit De Beers this year.

“We are very confident that partners are coming forward,” Botswana Vice President Ndaba Gaolathe said in an interview in Washington, without identifying prospective investors. “Some are countries, some are funds, some are companies that have a deep interest. I’m comfortable, I’m confident that we are on the right track.”

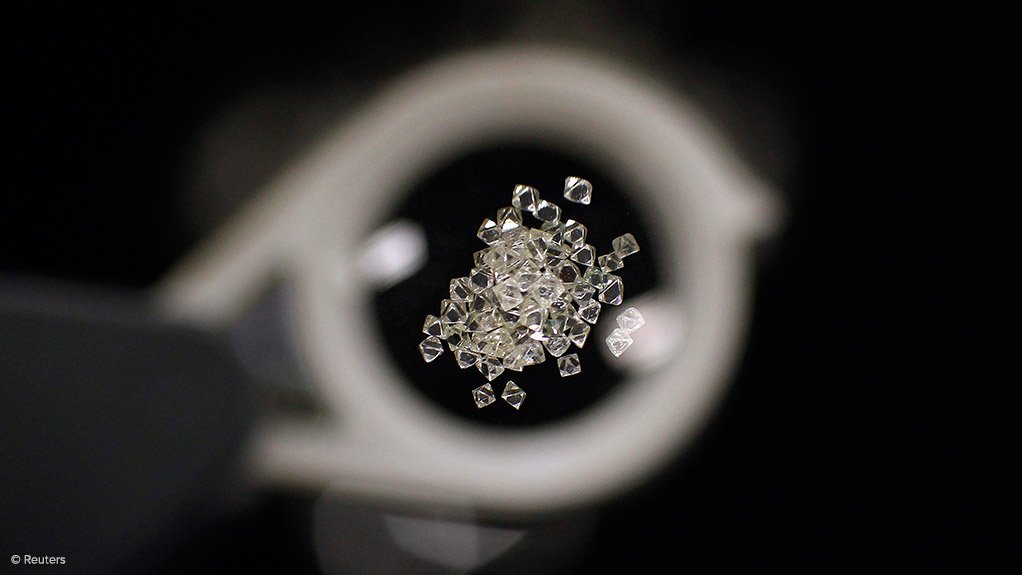

Botswana owns 15% of De Beers, which sources the bulk of its diamonds from the southern African nation. Anglo owns the rest and is looking to offload the stake following a slump in prices for natural diamonds, partly a result of the rising popularity of lab-grown stones.

Anglo wrote down the value of De Beers for a second time in February, to about $4.1-billion. The London-listed company said it aims to exit De Beers — either via a trade sale or a listing — in the second half of 2025.

Botswana, which depends on diamonds for the majority of its exports and about one-third of government revenue, has a decades-long partnership with De Beers. They signed a ten-year deal in February to fund a marketing campaign to resuscitate demand for natural diamonds.

Gaolathe, who also serves as Botswana’s finance minister, said the country should have a say over whoever takes on Anglo’s 85% stake. The country, he said, wanted them to have “deep pockets” and be in the diamond industry for the long haul.

“We are looking for partners that are not coming into it for the quick buck,” he said. “Whoever wants to take over the Anglo shares, it’s not just the takeover of shares. It’s actually the consummation of a relationship with the government of Botswana. And I want to impress upon you, we take relationships very seriously.”

It’s possible, he said, that Botswana looks to increase its De Beers stake to as much as 50%. “We’re definitely not going lower than 15%,” he said.

The vice president, who was in the US attending the International Monetary Fund-World Bank Spring Meetings, also said higher American tariffs on diamond imports would backfire.

“The US does not have diamonds,” he said. “But the US has been able to create an entire diamond sector, a jewelry sector. It’s large, it creates jobs for Americans. So the US has benefited from Botswana diamonds and a sudden pushback on Botswana diamonds will and can hurt the US more than it imagines.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation