Endeavour Mining delivers strong full year performance

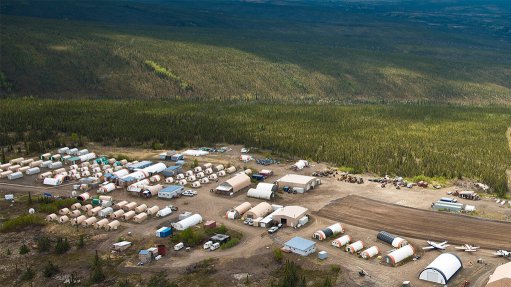

London-listed Endeavour Mining, which has a portfolio of gold mining assets in West Africa, reported strong results for the 2024 financial year, with record fourth-quarter free cash flow of $268-million, an improved leverage ratio of 0.55x and a 32% increase in proven and probable reserves.

Fourth-quarter production was 363 000 oz at an all-in sustaining cost (AISC) of $1 141/oz. This contributed to full-year production of 1.10-million ounces at an AISC of $1 218/oz.

Adjusted earnings before interest, taxes, depreciation and amortisation (Ebitda) of $546-million for the fourth quarter was a 72% increase over the previous quarter, while full-year Ebitda was $1.33-billion.

Adjusted net earnings of $110-million for the fourth quarter was a 49% increase over the previous quarter, with the full year’s earnings being $227-million.

The company declared a record full-year 2024 dividend of $240-million, supplemented by share buybacks of $37-million. Total shareholder returns amounted to $277-million, or $251/oz produced – 32% above the minimum commitment at a 5.9% indicative yield.

Share buybacks of $22-million were completed in the year to date for 2025, 69% higher than the prior year.

The definitive feasibility study for the Tier 1 Assafou project, in Côte d'Ivoire, is on track for late this year or early 2026. Aggressive exploration is ongoing around the project, the company says.

Group reserves increased by 32%, or 4.5-million ounces, during 2024, net of depletion, to 18.4-million ounces with additions at Assafou.

A group measured and indicated discovery target of 12-million ounces to 17-million ounces was achieved with 12.2-million ounces discovered since 2021 for less than $25/oz, Endeavour highlights.

CEO Ian Cockerill informs that the company further strengthened its portfolio, adding two high-margin growth projects in Senegal and Côte d’Ivoire, both of which were delivered on budget and on time.

“These will help to grow our production profile, improve costs and extend mine-life visibility, increasing both the quality and diversification of our portfolio,” he avers.

“Looking ahead, we will carry the strong momentum from the second half of 2024 into 2025, as we focus on operational delivery to maximise cash flow and support enhanced returns for our shareholders,” Cockerill highlights.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation