Evolution posts record ‘24 profit, sets sights on higher output

Australian gold mining company Evolution is ideally positioned for the 2025 financial year, said MD and CEO Lawrie Conway on Wednesday, reporting record 2024 profit and high margin cash flow.

The company posted net profit of A$422-million, up 158% on the previous year, with earnings a share surging by 147% to a record 22c a share.

The company also declared a final dividend of 5c a share, up from 2c a share in 2023, bringing the final dividend for 2024 to 6c a share.

"The record financial performance and excellent progress we have made on deleveraging the balance sheet and the more than doubling of the final dividend, while continuing to invest in our various project opportunities are testament to our strategy and capital allocation discipline,” said Conway.

The group’s earnings before interest, taxes, depreciation and amortisation margin increased from 38% to 47%, driving cash flow up from A$483.3-million to A$367.3-million, after investing A$739.6-million back into the business.

Gearing reduced from 33% to 25% during the year.

Evolution stated that its approach of “margin over ounces” and banking the cash from higher metal prices would allow it to build on strong deleveraging progress made in the 2024 financial year. Only 6% of the gold production for 2025 is hedged and copper is entirely unhedged.

For 2025, the group is forecasting gold production of 710 000 oz to 780 000 oz and copper output of 70 000 t to 80 000 t, at an all-in sustaining cost of A$1 475/oz to A$1 575/oz.

During 2024, Evolution produced 716 700 oz of gold and 67 862 t of copper.

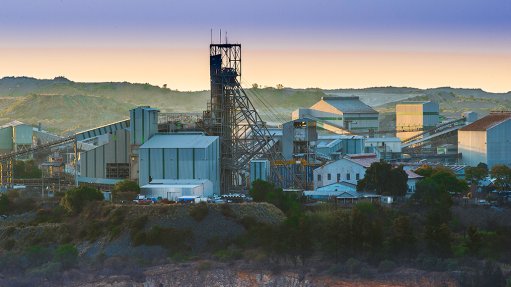

Reporting on the performance of its operations, Evolution stated that its Cowal underground mine, in New South Wales, had reached commercial production and that it had started to contribute to cash flow.

Cowal has also fully paid back all of its acquisition cost and subsequent capital expenditure, including the underground during the 2024 financial year, generating A$294.2-million in net mine cash flow. The next phase of the openpit is continuing through the regulatory approval process and remains subject to a final investment decision by the board. This is expected late in the 2025 financial year.

Ernest Henry, in Queensland, has recovered fully from the weather events of the 2023 financial year, and returned to its predictable and reliable performance. The extension feasibility study is progressing to plan and will take into account the ongoing drilling success. Ernest Henry also achieved fully paid back status in 2024 and generated net mine cash flow of A$334.1-million.

Northparkes, in New South Wales, Evolution described as “an excellent addition” to the portfolio, contributing A$74.2-million to net mine cash flow, after delivering on stream obligations to Triple Flag. Development on the E48 sub level cave started in July 2024, providing the mine with lower capital intensity over the near term, while the optionality of the large resource base is studied further.

The Mungari 4.2 expansion project, in Western Australia, was progressing well, being on budget and schedule. This project positions the operation to deliver strong cash flow from a larger and lower cost production base. Before major capital investment, it contributed A$66.5-million to cash flow in 2024.

Red Lake, in Canada, has started to show sustainable improvements to enable positive cash generation and reliable delivery in 2025, having achieved record mining tonnes under Evolution ownership in the June quarter.

Mt Rawdon is expected to deliver a valuable cash contribution in 2025, supplemented by stockpile processing as the operation reaches the end of its mine life in the financial year.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation