Petra lowers price projections, starts retrenchment process

Amid continued weakness in the global diamond industry, London-listed Petra Diamonds has lowered its price expectations for 2025 and initiated a Section 189 retrenchment process affecting the group and its South African Operations support functions, as it works to save costs and generate additional cash.

It has appointed Vivek Gadodia chief restructuring officer to lead this work.

"Refinancing discussions have been deferred to 2025 to enable these cash generation initiatives to take effect and to benefit from greater certainty in respect of market conditions. We remain confident of a successful refinancing of the 2026 2L Notes and a further update will be provided at the time of our interim results in February,” says CEO Richard Duffy.

Petra's third sales cycle of the year yielded $71-million from the sale of 700 803 ct, taking full-year sales revenues to $146-million from the sale of 1.3-million carats.

"Like-for-like prices reduced by 7% from the previous tender cycle held in October, reflecting a continued weak market across most size ranges, although we were encouraged by the 3% increase in the 5 ct to 10.8 ct category.

"As a result of the prevailing market weakness, we have revised our price assumptions for the 2025 financial year. Despite the market backdrop, we are encouraged by the majors’ ongoing discipline around restricting the volume of rough diamonds to support the market and initiatives by upstream, midstream and retail sectors to collaborate in the category marketing of diamonds," says Duffy.

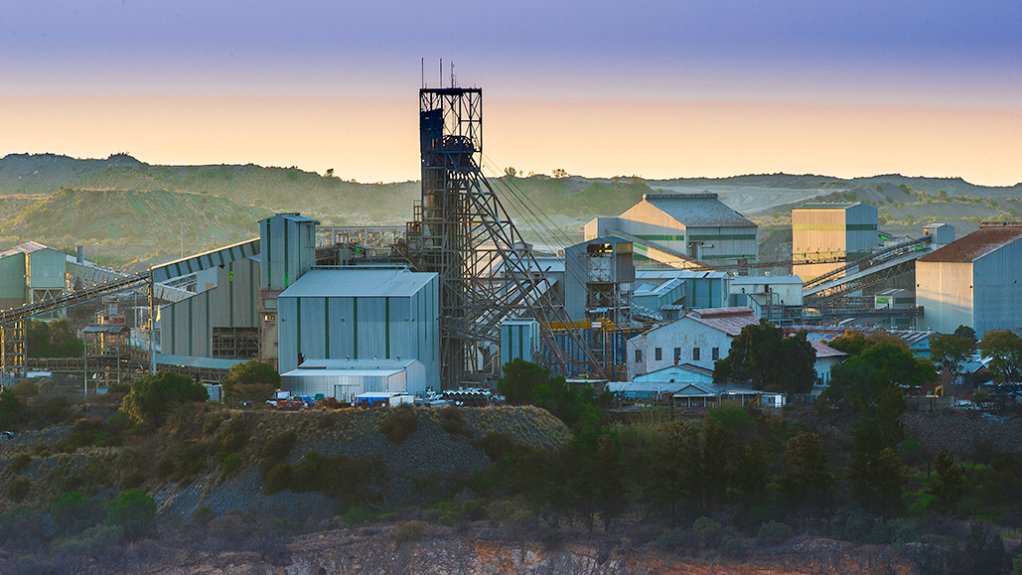

The group initially expected diamonds from the Cullinan mine, in South Africa, to be between $125/ct and $135/ct, but has lowered its forecast to $120/ct to $130/ct.

The price projections for the Finsch mine, also in South Africa, has been lowered to between $80/ct and $90/ct, compared with previous estimates of $98/ct to $105/ct.

Diamonds from the Williamson mine, in Tanzania, are now expected to attract prices of between $170/ct and $200/ct, compared with previous estimates of $200/ct to $225/ct.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation