Formal launch of South Africa’s first green ammonia project on Tuesday

BuiltAfrica chairperson Thulani Gcabashe interviewed by Mining Weekly’s Martin Creamer. Video: Darlene Creamer

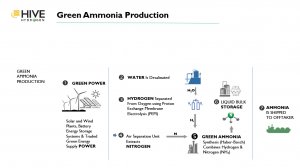

Green ammonia production process.

Coega in Nelson Mandela Bay local authority.

JOHANNESBURG (miningweekly.com) – The formal launch of South Africa’s first green ammonia project takes place on Tuesday, against the background of the initiative having already secured an in-principle offtake agreement from a global player – a clear indication of the world’s ‘go green’ momentum.

Hive Energy and BuiltAfrica – together as Hive Hydrogen – as well as Linde plc, through its wholly owned South African subsidiary Afrox, have teamed up to establish this R75-billion green ammonia export plant in Nelson Mandela Bay, Eastern Cape, which is expected to generate in the region of 10 000 direct and indirect jobs. (Also watch attached Creamer Media video.)

The arrangement for a bankable offtake of the entire green ammonia output has been concluded well ahead of the first phase going live in 2025 and full operation getting under way by the end of 2026.

The plan is for a combined 3 200 MW of renewable sun and wind energy to electrolyse 3.4 megalitres of seawater a day as part of a desalination and hydrogen extraction process. Proton exchange membrane, or PEM, electrolysers, which generally make use of South Africa’s platinum and iridium metals, will separate the hydrogen from the oxygen. The project will be working closely with salt-making company Cerebos, which has an adjacent Coega desalination works in need of switching to green hydrogen.

Nitrogen will be simultaneously extracted from the air utilising an air separation unit. The hydrogen and nitrogen will be combined through ammonia synthesis to produce green ammonia, which will then be cooled, liquified and stored for export.

Planned is the export of 780 000 t/y of green ammonia a year from the Coega Special Economic Zone (CSEZ) in ships that will likely be driven by green ammonia themselves at that stage, given the fast pace of change.

As chairperson of Hive Hydrogen and executive chairperson of BuiltAfrica, former Eskom CEO Thulani Gcabashe expressed Hive's delight at bringing what he described as a landmark green ammonia project to South Africa.

In an exclusive Zoom interview with Engineering News & Mining Weekly, Gcabashe spoke with enthusiasm about the positive response the project is already receiving from banks, corporates and investment houses willing to invest in it.

He was also full of praise for the Coega Development Corporation (CDC), which he described as an excellent partner, as well as Transnet, which he said had indicated the availability of space at the port for the export of a commodity already showing strong global demand.

Gcabashe described green hydrogen and green ammonia projects as having the potential to become game-changing growth generators of the South African economy and spoke of the need for South Africa Inc to revive its long-held megaproject capability and renowned track record in carrying out big projects on time and on budget.

The project certainly heralds a new era in its commitments to greener solutions for industry and is being driven by companies with strong green credentials. BuiltAfrica is a company with significant renewable energy operations in place and Hive Energy UK, under CEO Giles Redpath, has been working on renewable energy-powered green hydrogen and green ammonia projects since 2019.

Following the completion of the project’s prefeasibility study, all concerned have been confident in announcing their collective aspiration to move forward to the final investment decision and the commencement of the development of this leading project.

Engineering News & Mining Weekly: What motivated your decision to take steps to produce and export green ammonia?

Gcabashe: BuiltAfrica, from the outset, has been a company that has only worked in renewable energy. We have a couple of solar plants that are in operation, and Hive Energy similarly – most of their portfolio is in renewable energy. They are quite big internationally. As players in that space, we always had a concern about the intermittency of renewable energy sources, and hydrogen has always had the potential to be a zero-carbon energy carrier that can also be stored and transported. When this opportunity came, we really latched on to it to try and produce green ammonia initially, for the global market.

Who will buy the 780 000 t of green ammonia that you will be producing a year – and at what price do you intend selling it?

There is a growing market globally for green ammonia and our approach was to find a global offtaker who could offer us a long-term agreement. In this way, it helps us to ensure the investment and attract good investors but also it means that for the life of the plant we can secure quite a bit of the offtake. We have an in-principle agreement with one such offtaker, a global player in this space, and everything is signed, but we will not be announcing that until such time as the commercial agreements are far more advanced.

When will your final investment decision be made – and how do you intend raising the $4.6-billion required for the project?

We’ve just concluded the prefeasibility stage and we’re very pleased with the outcome. We finally think that all of the building blocks are in place and we’re confident that we should move on to the next stage. We would expect that within 18 months, we should be in a position to make an investment decision. This will, of course, depend on how all the pieces come together, but we’re very comfortable that we’ve got a workable project. We are receiving support from stakeholders. Our own government is quite interested in seeing this happen. It has been identified as one of the important sectors that needs to be grown. The Coega Development Corporation’s an excellent partner. They’ve also worked with us in ensuring that we can access the kind of facilities that we need. Similarly, Transnet has also indicated that there will be space available at the port for our activity

Is it this support that helped to prompt your selection of the Eastern Cape as a solar power and production location, along with the Coega special economic zone as the export base?

Absolutely. It’s a coincidence of the right kind of ingredients. It's a deep-water port accommodating vessels of the nature that we’ll be using. At the same time, the Eastern Cape is known for wind, particularly in that area, so there's enough wind potential to supply power. Similarly, there’s good enough solar resource to make it possible. We’ve actually made sure that our project is focused on green ammonia, which would in fact command a premium over other ammonia but also it would mean that it's a bigger contributor to combating climate change if it’s totally green.

The visit of the European Union and European Investment Bank green hydrogen delegations to the Coega SEZ coincided with your announcement. Are these entities linked to your project in any way?

Not at this stage. It really was coincidental. Our project has been going on for about 24 months and we reached conclusion of prefeasibility stage and felt we should make the announcement. It’s a very positive announcement. It has been well received and it gives confidence that South Africa is still an investment destination and that it can attract megaprojects like this. Any future collaboration with the European Union (EU) will be welcome but at this stage it was really quite coincidental.

How much renewable power will your project require and how much water will that renewable energy electrolyse into green hydrogen and oxygen?

In terms of power itself, we’re looking at a solar plant on site, which will provide most of the power during the day. We’re looking at battery storage on site, which will be available for any bridging, and then we’re looking at a wind plant off site, which will provide power outside of the time when the solar is on. Altogether we think 3 200 MW will be required. In terms of water, we’re looking at 3.4 megalitres a day, which is not a lot of water when it comes to this kind of project. In the first phase, we’re hoping to get water from Cerebos, who are the salt-making company. They already have a desalination plant right next door to us so we’d in a way be taking their wastewater but that will really only suffice in the first phase. As we ramp up production, we’ll be having our own desalination and that’s all in the plan.

Where will you source the water that is required beyond the Cerebos phase – and what will be done with the salt produced during the processing of that sea water, for instance?

It will be sea water and will continue to then supply Cerebos with the salt that will come off that. But there are other industrial players in the region who could also use it. Salt will be a waste product in our production but useable by other players fairly close to the site.

Will the oxygen released during the electrolysis process be put to any use?

We’re working with Afrox to see if this is both commercially viable and possible. Clearly, it would have to be refined to be pharmaceutically ready for use, so a little bit more work. But all indications at the moment are that the demand for oxygen is well supplied in the country. So, if anything, it will be released into the atmosphere, which in itself is a helpful process.

What is the envisaged operational period of the plants that will be constructed – and how many jobs will be generated?

We’re looking at a 25-year lifespan. Of course, we believe that there will always be extension of life possibilities. But our current modelling is on a 25-year lifespan. In terms of jobs, it’s very difficult to pin it down but we’ve said we think it could be in the region of 10 000 jobs both direct and indirect, but that will be something we will define much better in the feasibility phase. But it will be significant. This is a R75-billion investment, and it will produce jobs directly and indirectly and we’re quite hopeful that that kind of number will be reached.

Will you be training personnel in the new technologies that are required to make green hydrogen and green ammonia?

We think some training will be necessary but South Africa has a good resource of scientists and engineers and we think that as much as training will be needed, we won’t be starting from scratch. But it will offer training opportunities and upskilling, specifically for this kind of operation.

What has been the response of South Africa Inc to your project announcement?

We’ve had a fairly good response from some international press but mainly local press and generally there is excitement. In fact, we’re planning a formal launch next week down at the site. Our view is that there is enough that has happened in South Africa to make us all a little gloomy about the prospects of our country. We’re still in junk status but we’ve taken the view that we’ve got to keep doing what we’ve always done. We’ve got to get back on the horse and get going. So, we welcome the positive feedback that we’re getting and we’re hoping we can grow the number of stakeholders who feel that they would like to support this. We’re hoping it will be an investment booster for South Africa and show once again that we can do megaprojects, on time and on budget, without too much distraction.

Is there much red tape in the way of getting your project off the ground?

We don’t see it in a negative way as red tape but, of course, regulatory permissions are required for quite a few things. We are dealing with electricity and hydrogen gas so a number of regulations will affect us. Discussions so far have not been discouraging. We think we can get over all of the regulatory hurdles but then this project is also the first of its kind and we may find as we go on that policy makers feel there needs to be more regulation of one thing or another. But being in a special economic zone and being part of a hydrogen economy programme that is nationally driven from the Presidency and involving the Department of Trade, Industry and Competition (DTIC) and other government departments, we think that we’ll be able to work with partners to make this happen and hopefully open the way for other projects of this nature. The world needs a lot more of this, so our view is that if this clears the way for planners, we welcome it.

In that context, what is your comment on the government of Namibia selecting Hyphen Hydrogen Energy as the preferred bidder for a $9.4-billion green hydrogen project in Lüderitz, which is also expected to come on stream around 2026?

We wish them well. The world is going to need a lot more of this and our total region has fantastic potential. If they succeed, we will all get more confident and we’ll see more investment coming into this, so we’re quite happy with that.

How exactly will you and your partners produce green hydrogen and green ammonia – and will ships have to be modified to transport the green ammonia?

It all starts with electricity because you have to do electrolysis to separate the hydrogen. We’ve got solar and wind available for that and we’re starting off with green energy that is being brought into the equation. Once the hydrogen is split, there is then an air separation process. This involves taking air from the atmosphere and separating out the nitrogen. These are then combined in a Haber-Bosch process, which is technology that is well known and commercially accepted. It will then combine the hydrogen and the nitrogen, cool it and liquify it. Once liquified, it will go into storage and from storage it will be piped directly into vessels that will dock into the port. That makes it sound very simple but you are dealing with something that has to be maintained at very high pressure and low temperature and be exportable at very specific temperatures and pressure. We already import about 130 000 megalitres of this gas through Richards Bay. So, we already have ships of this nature coming in and out of our area. The modifications we’re hoping for are that the ships themselves will be driven by ammonia so that even the transportation process remains fairly green. As things stand, there are vessels ready for this kind of export but hopefully in the future they will also be green. There is also a great move towards using ammonia as aviation fuel, so the transport sector holds a lot of potential.

Global demand for green hydrogen and green ammonia is building up very strongly. Is supply matching this demand build-up?

I think from where we stand now, supply is not keeping up with demand, but clearly there is investment all over the world in ammonia projects, so we hoping we’ll see an improvement in that. An exciting aspect from where we stand as power people is Japan doing a demonstration project at the moment where they are mixing 20% ammonia into the fuel they are using in their coal-fired generation. The project is just one unit at this stage but they are going to run that demonstration project till about 2025 and indications are good at the moment. If that were to be the general case, I think you’re looking at demand also coming from the power sector where it becomes a transition fuel. Just by converting the burners and the boilers, introduce ammonia and in that way fuel power too. So that’s an exciting prospect as well.

What, in your view, will the world look like in 2050 from a point of view of green hydrogen and green ammonia?

I’m convinced that they will be an important part of our energy mix at that stage and that’s because the potential is there on the transportation side. Ammonia is already being used for fertiliser and that will continue but the power generation aspects and car transportation gives it big potential and I think it will rank among the main sources of energy for a lot of activities by the year 2050. The challenge is to keep it green and that’s where I think our region has an advantage and if it is green, it will contribute immensely to being at net zero by 2050. In my mind, I think it is going to be a very significant part of the arsenal we need to keep our climate change impacts at a minimum.

What else is important for readers and viewers to know about this project?

We’d like their support because it is a first of its kind in South Africa so we’re working with all stakeholders at the moment to make sure that we share as much information as we can and we elicit their support. I’d like to emphasise that we need to grow our economy. We need to put our minds to giving all we can towards growing this economy and I believe this could be an important part of such growth. Indications we’re getting are that banks, corporates, investment houses are willing to invest in this. Some of the reaction we got to the announcement actually came from those quarters to say, look, we’ve raised money for renewable energy and we’re ready and looking very interested. I think South Africa Inc should be looking at how we get back to being an area of direct investment and showing our capability, which we’ve always had, of doing big projects and doing them properly. I hope that’s a message that will go through the investment community and will also go through our entrepreneurs, our corporates, that here is an area of potential that we think can grow and be a game-changer for South Africa.

FAVOURABLE CONDITIONS

In an earlier media release, Afrox CEO Schalk Venter drew attention to Southern Africa being one of the few regions in the world with favourable conditions for green hydrogen and ammonia production and export.

“We’re excited to be working on this transformative project in Nelson Mandela Bay with Hive Hydrogen South Africa. Through our parent company’s engineering division, proven global expertise and technology, we’ll support this project’s feasibility, engineering design and development phases,” said Venter.

Nelson Mandela Bay Mayor Eugene Johnson hailed the project as being a breakthrough for South Africa and Nelson Mandela Bay in the global drive for sustainable green industry and expressed the city’s pride to be leading the way and working closely with Hive Hydrogen and Afrox to establish the ammonia plant and its green power requirements.

“The investment in job creation, training, new and clean industry, and the significant community benefits that this brings will be a great boost to the transformation programme we are planning for the region,” Johnson added.

Hive Hydrogen is being supported by InvestSA, a branch of the South African DTIC, with specific investment facilitation through the InvestSA one-stop-shop mechanism.

InvestSA head Yunus Hoosen emphasised the recognition of the DTIC of the importance of the green hydrogen sector in contributing to increased investment and industrial development opportunities.

The department’s work in this regard, Hoosen said, was coordinated through the High Level Panel on Hydrogen, established by Trade, Industry and Competition Minister Ebrahim Patel.

Hive Hydrogen described the 9 003 ha CSEZ as being a foreign direct investment destination of choice and a leading such zone on the continent.

In line with its strategy, the CSEZ is building a platform for sustainable investments in South Africa. Its focus on sustainability strengthens the value proposition for investors of the future.

All sustainable investments benefit from the zone’s modern infrastructure, government incentives, certified systems and processes, one-stop-shop systems supported by InvestSA, and proximity to two seaports, including the deep-water Port of Ngqura.

PARTNERING GROUPS

Hive Energy, headquartered in Hampshire, UK, was founded by Redpath in 2010 and Midrand-based BuiltAfrica by Gcabashe in 2008.

Hive has developed more than 2 000 MW of grid connected solar plants and BuiltAfrica participated in South Africa's Renewable Energy Independent Power Producer Programme with two large operational solar plants.

Gas manufacturer Afrox employs more than 3 000 people on more than 40 sites throughout Southern Africa and its owner, the German Linde, a leading global hydrogen, ammonia and oxygen producer, employs 80 000 people in more than 100 countries.

EUROPEAN DELEGATION

Representatives from the trade and economics section of the delegation of the EU to South Africa and the European Investment Bank in December set out to learn more about the work of the special economic zone at Coega, current investors – with a focus on European investors – and shared their priorities in South Africa with the zone’s management.

EU delegation to South Africa trade and economics head Roberto Cecutti stated in a media release that the EU was impressed by the operations and opportunities for investors at Coega.

He described the visit as being primarily focused on understanding the economic zone’s operations and opportunities and noted the proximity to the port and impressive infrastructure within the zone.

"We look forward to exploring further areas of collaboration with Coega Development Corporation in the future, specifically around green hydrogen,” Cecutti added.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation