Gold Fields, AngloGold set out to create Africa's largest gold mine

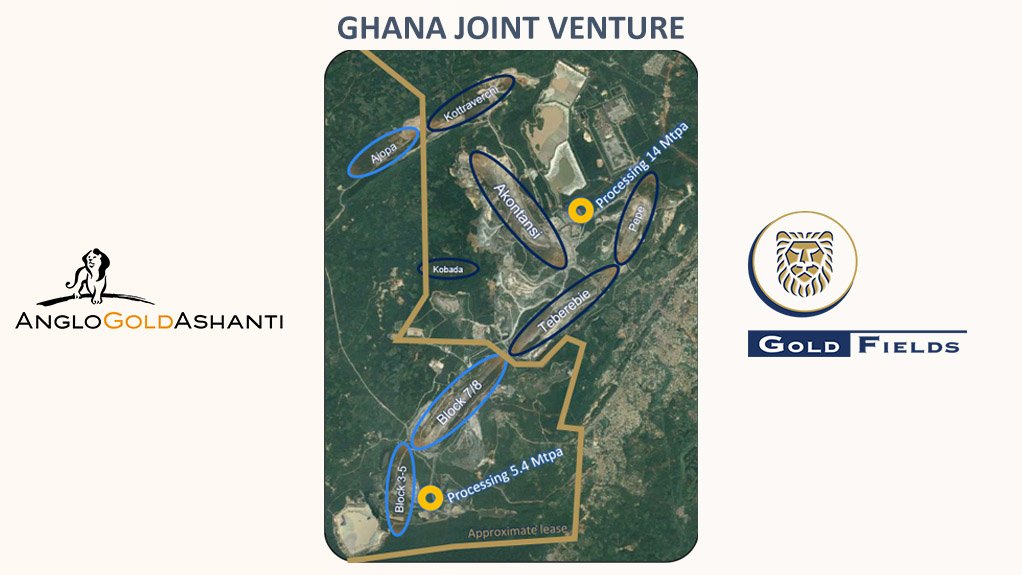

A map showing AngloGold's Iduapriem mine on the left and Gold Fields' Tarkwa mine on the right

AngloGold's Iduapriem mine

Gold miners Gold Fields and AngloGold Ashanti have announced plans to merge their neighbouring Tarkwa and Iduapriem mines, in Ghana, under a new joint venture (JV).

The companies have agreed, in principle, on the key terms of the proposed JV and have started with preliminary, high-level and constructive engagements with senior government officials in Ghana about the proposed JV, which is expected to lead to the creation of the largest gold mine in Africa and one of the largest in the world.

Gold Fields and AngloGold say the JV will result in a high-quality operation, supported by a substantial mineral endowment and an initial life spanning almost two decades.

AngloGold CEO Alberto Calderon describes the proposed JV as a "win-win" for both companies, saying it is an exciting deal for both AngloGold and Gold Fields and that the merged operation will provide scale.

Calderon points out that Tarkwa and Iduapriem currently produce a combined 780 000 oz/y of gold. The combined operation is expected to produce about 900 000 oz/y of gold over the first five years.

Thereafter, production will average about 600 000 oz/y over the remainder of the operations' life, which is currently estimated at at least 18 years, but with potential for further extensions.

Calderon states that the two mines should always have been one asset and says the combination of the two mines will bring together two parts of the same world-class orebody, allowing the companies to share skills and infrastructure to significantly enhance every aspect of this mining operation, from exploration and planning, to mining and processing.

Operational synergies will be achieved by optimising mining of the combined orebodies and consolidating the infrastructure of the immediately adjacent mines.

"By creating one of the world’s largest openpit gold operations, in a pre-eminent mining jurisdiction, we will create longer-term value not only for AngloGold Ashanti and Gold Fields but for the combined stakeholders in our local host communities and for all of Ghana,” he says.

Gold Fields interim CEO Martin Preece, meanwhile, describes Tarkwa and Iduapriem as "two of the African continent's most important mines".

“The proposed JV is an exciting opportunity to combine mining operations that are essentially part of the same mineral deposit and is something that Gold Fields and AngloGold Ashanti have discussed many times before over the years.

"The ability to optimise mining and the use of shared infrastructure across the combined operation will result in significant flexibility in mine planning, materially enhancing the economics of the mine and ensuring quality and scale of operation that will be world class. That unlocked value will underpin the proposed JV's continued contribution to our host communities and Ghana for decades to come. For Gold Fields, it will also significantly enhance the overall quality of our portfolio,” says Preece.

He notes that the proposed JV materially improves the quality of Gold Fields' portfolio.

The Tarkwa mine is held by Gold Fields Ghana, in which Gold Fields currently owns a 90% share and the government of Ghana 10%. The Iduapriem mine is fully owned by AngloGold.

The JV is intended to be an incorporated JV to be operated by Gold Fields. AngloGold Ashanti will contribute its 100% interest in Iduapriem to Gold Fields Ghana in return for a shareholding in that company.

Excluding the interest to be held by the government, Gold Fields will have an interest of 66.7%, or two-thirds, and AngloGold an interest of 33.3%, or one-third, in the proposed JV.

The finalisation of the proposed JV remains subject to approval by the Ghanaian government, as well as other conditions precedent.

Neither company would be drawn on when the JV might be finalised, saying only that initial discussions with government officials had gone well.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation