Gold steadies before US inflation data as recession fears linger

Gold steadied ahead of key US data prints this week, with traders focused on whether they will reinforce bets the Federal Reserve will soon pivot to monetary easing.

Bullion was trading near $2 430 an ounce in Asia after falling 0.5% last week, as markets braced for the release of the consumer price index report due Wednesday. The figure is expected to have risen 0.2% from June.

Such a modest move would be unlikely to derail the central bank from a widely anticipated pivot to lower rates next month, as it also contemplates the need to avoid recessionary risks.

Fed Governor Michelle Bowman on Saturday said she still sees upside risks for inflation and continued strength in the labor market. Higher borrowing costs are typically negative for the precious metal, as it doesn’t pay interest.

Hedge funds trading Comex futures cut bullish bets on gold to a five-week low in the week ending August 6, according to the latest data from the Commodity Futures Trading Commission.

The precious metal has risen about 18% this year and remains in touching distance of last month’s record high. Along with rate-cut expectations, it’s also been supported by srong central bank purchases and robust demand from Chinese consumers, and increased haven buying due to conflicts in the Middle East and Ukraine.

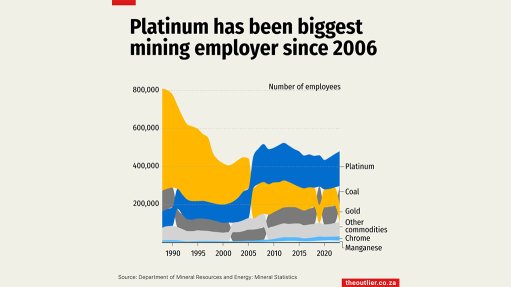

Spot gold was little changed at $2429.41 at 9:11 a.m. in Singapore. The Bloomberg Dollar Spot Index was flat. Silver fell, while palladium and platinum were steady.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation