Green Sedibelo will use 82% less electricity to take PGMs all the way to end consumer

Pallinghurst managing partner and cofounder Arne Frandsen speaks to Mining Weekly’s Martin Creamer. Video: Darlene Creamer

Nouveau Monde’s Phase 1 graphite beneficiation plant.

Sedibelo's Pilanesberg Platinum Mines, in the North West province.

Photo by Creamer Media

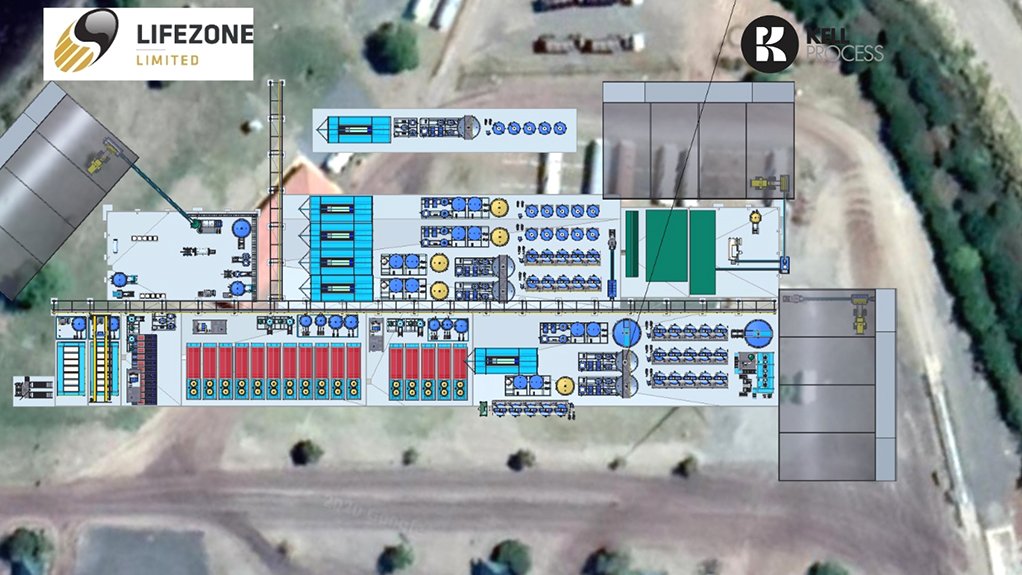

An impression of the Kell plant layout at Pilanesberg.

JOHANNESBURG (miningweekly) – Platinum group metals (PGMs) producer Sedibelo Platinum Mines is well on its way to becoming the lowest of low-energy PGM energy users and the highest of high on-site beneficiators of metals that are key in the global fight against climate change.

Sedibelo’s technology sensation is the remarkable Kell processing plant, now under construction at Pilanesberg Platinum Mines, in the North West province. (Also watch attached Creamer Media video.)

Requiring a mere 18% of the electricity used when conventional PGMs smelting takes place, Kell will eliminate associated carbon emissions, improve recoveries, lower operating costs, put an end to sulphur dioxide pollution – and, outstandingly, take PGMs all the way to the end consumer, at the very same site where the mining takes place. Kell uses standard, off-the-shelf PGMs refining technology that is deployed in PGM refineries.

“We now control the entire chain,” said Pallinghurst managing partner and cofounder Arne Frandsen in a Zoom interview with Mining Weekly.

Kell’s carbon dioxide (CO2) emissions from concentrate to final refined metals are only 19% of the CO2 emissions given off by conventional smelting and refining.

What is more, steps are being taken to make the 18% of electricity that is used as green as can be.

There is no half measure with Frandsen when it comes to greenness, a hue that he is also flying sky-high as chairperson of Nouveau Monde Graphite of Quebec in Canada. Nouveau Monde, which listed on the New York Stock Exchange in May, is on schedule and below budget with its project to bring graphite anodes to the new battery electric world.

Returning to Sedibelo, Mining Weekly can report that being maximised by Kell at the Pilanesberg operations is on-site value-addition, another massively sought-after but often evasive beneficial aspect needed in South Africa because of this country's very serious unemployment problem: “Beneficiation is the big issue because for hundreds of years, people have come to Africa to take the resources and basically add the value to them back home, somewhere else. Value adding was kept to a minimum.

“What we are changing now is that we can actually take everything up out of the ground in Pilanesberg, and we can deliver the final product to the end consumer,” Frandsen, who is the chairperson of Sedibelo Platinum Mines Limited, reiterated.

Sedibelo shares an interest in Kell South Africa with the State-owned Industrial Development Corporation and founder Keith Liddell, the developer of the revolutionary Kell technology, which comes at a third of the capital cost of smelting/refining, and at half of its operating cost.

End products will be customised by Sedibelo’s Kell plant, which will be producing refined 99.95% PGM metal products.

Kell lowers locked-up ‘work in progress’ inventory by 90%, and in doing so releases working capital and shortens payment pipelines from several months for smelters down to a month or so for what will be the case for Sedibelo.

In fact, for a mining company that is currently selling concentrate, the release of locked-up working capital can pay for more than half of a Kell plant and by producing refined metals on-site, Kell generates more skilled jobs.

The first ounces from Sedibelo's Triple Crown expansion project under way at Pilanesberg are expected in 2023, with the predominantly shallow deposits enabling safe and sustainable mining activities for potentially more than 60 years.

The existing Pilanesberg Platinum Mines’ concentrator plant has the capacity to be used to process the Triple Crown ore as well as ore from the openpits. With minimal reconfiguration, the Triple Crown upper group two and Merensky ore will be blended and processed through the existing Merensky plant, thereby reducing capital expenditure as well as lowering operating cost significantly.

BATTERY-GRADE GRAPHITE

Mining Weekly can report that the Phase 1 graphite beneficiation plant construction, which coincided with Nouveau Monde Graphite’s listing on the New York Stock Exchange, will begin producing “shaped, purified and coated” battery-grade graphite in Quebec early next year.

It is key that the graphite particles are correctly shaped, free of impurities and coated so that they can be correctly stacked.

“It sounds very fancy, but what it really means is that we are producing the final products that can be put into the anode part of the battery – and remember, no anode, no battery,” said Frandsen.

True to form, Nouveau Monde Graphite will be producing this graphite with a zero carbon footprint, with an electrified mine fleet powered by hydroelectricity.

Estimates indicate the Nouveau Monde’s Matawinie graphite mine, located about 150 km north of Montréal, has 120.3-million tonnes of resources in the combined measured and indicated categories, with a 4.26% grade.

In addition to trading on the New York Stock Exchange in US dollars, Nouveau Monde’s common shares continue to be traded on the TSX-V in Canadian dollars and Nouveau Monde’s common shares on the Frankfurt Stock Exchange.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation