Heap leach option slashes Dubbo capex, speeds up rare earths delivery

Rare earths company Australian Strategic Materials (ASM) on Friday published the scoping study for its Dubbo project in New South Wales, outlining a new first-phase development plan that uses heap leach processing.

The new approach drastically reduces capital costs and provides a faster pathway to producing separated rare earth oxides (REO), including key magnet metals neodymium-praseodymium (NdPr), dysprosium and terbium.

The study proposes a phased implementation model, beginning with the processing of one-million tonnes a year of material. By focusing initially on REO production and eliminating complex early-stage processing steps, the plan reduces the forecast capital cost to A$740-million, down from the A$1.68-billion estimated in ASM’s 2021 optimisation feasibility study.

The company also expects the project to operate in the lowest quartile of costs among rare earth producers outside China.

Average yearly production during years three to 15 is estimated at 1 157 t of NdPr oxide, 72 t of dysprosium oxide, and 13 t of terbium oxide. Over the full 42-year mine life, average yearly production would be slightly lower but still commercially significant.

ASM projects a pretax net present value of A$967-million under a base case pricing scenario, and up to A$1.47-billion in a more optimistic pricing case provided by Adamas Intelligence. Pre-tax internal rates of return range from 18.3% to 22.9%, with a post-tax payback period of between 4.3 and 5.8 years, depending on the scenario.

The project’s economic case remains robust even at lower market prices. The company estimates breakeven prices of $87/kg for NdPr, $1 160/kg for terbium and $258/kg for dysprosium. For comparison, current Chinese spot prices inclusive of VAT are slightly below the breakeven level for NdPr and near parity for terbium and dysprosium.

The heap leach methodology represents a shift away from ASM’s previous capital-intensive all-in-one flowsheet. The company’s rare earth options assessment, launched last year, was designed to evaluate alternative development strategies that could lower up-front costs while accelerating market entry. Heap leaching was identified as the most promising path, offering lower operating and capital costs while leveraging existing metallurgical testwork and in-house separation and refining technologies.

Metallurgical testwork included scoping-level variability tank leach and bottle roll testing across different zones of the deposit. These studies indicated encouraging rare earth recoveries and highlighted the potential for optimisation. The heap leach option avoids the energy- and reagent-intensive acid bake process used in conventional flowsheets, further improving cost and process efficiencies.

ASM MD and CEO Rowena Smith said the strategy directly responded to market and funding conditions. “The work ASM has done as part of the rare earth options assessment directly responds to two critical needs: first, it offers a pathway to reduce upfront capital costs in the face of inflationary pressures and challenging market funding conditions; second, it accelerates the delivery of a viable source of REOs – particularly heavy rare earths – in a time of surging global demand.

"With China tightening export controls on dysprosium and terbium, concerns over secure supply are growing. ASM’s unique mine-to-metals strategy is now more crucial than ever in addressing supply chain vulnerabilities exposed by recent geopolitical shifts.”

She added that the heap leach scoping study represented a pivotal moment in ASM's evolution. "By prioritising rare earth production through this approach, we are derisking project execution, accelerating our pathway to production, and positioning the Dubbo project strongly to take advantage of the strategic opportunities before us in global rare earth markets.”

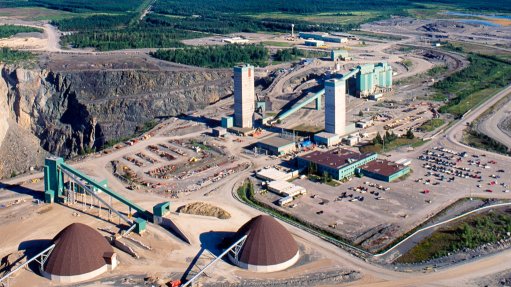

The Dubbo project is supported by a measured mineral resource estimate of 42.81-million tonnes and will retain the same openpit mining plan from the 2021 optimisation feasibility study. The new plan focuses exclusively on REO output in its first phase, streamlining the development and simplifying offtake agreements.

ASM has also indicated that the majority of activities planned for the next phase remain eligible under the A$5-million grant awarded by the Australian federal government in 2024 under its International Partnerships in Critical Minerals Programme.

Next steps include additional metallurgical drilling and testing, production of separated REO at the pilot plant in collaboration with ANSTO, and preparation of a prefeasibility study (PFS) that will further define the heap leach process and support future engineering and investment decisions. The company is targeting completion of the PFS in the first quarter of 2026, with a final investment decision and construction to follow.

“As such, ASM remains well-positioned to deliver a project that meets the strategic needs of both customers and allied supply chains,” said Smith

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation