Improved operational performance drives increase in Northam’s full-year refined output

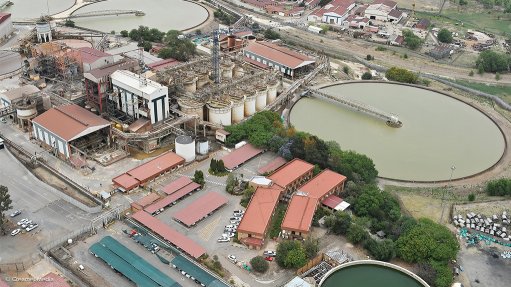

JSE-listed Northam Platinum achieved a 10.3% year-on-year increase in total equivalent refined platinum, palladium, rhodium and gold (4E) metal production from its own operations for the financial year ended June 30.

Including bought material, refined 4E metal production was 10.6% higher year-on-year.

The production increases arose from ongoing improved operational performance at all operations, underpinned by the group’s long-term growth and diversification strategy and a continued strong focus on pursuing and increasing operational efficiencies, Northam says in a voluntary update.

Concentrate production from own operations at Booysendal, total equivalent refined metal production from own operations, equivalent refined metal bought from third parties and total metal sold all exceeded guidance.

All other production metrics were within guidance.

Total equivalent refined metal production from own operations was 892 876 oz of 4E, compared with 809 775 oz of 4E in the prior financial year.

Equivalent refined metal bought from third parties was 135 409 oz of 4E, compared with 119 820 oz of 4E in the prior year.

Total equivalent refined metal production from own operations, including refined metal bought from third parties, was 1.02-million ounces of 4E, compared with 929 595 oz of 4E in the prior year.

Total refined metal produced increased to 891 721 oz of 4E, compared with 846 490 oz of 4E the year before, while refined metal sold reached 899 377 oz of 4E, compared with 832 602 8oz of 4E in the prior year.

Concentrate sold, disclosed as equivalent ounces, was 50 874 oz of 4E, compared with 52 745 oz of 4E the year before, while total metal sold was 950 251 oz of 4E, compared with 885 347 oz of 4E.

Further progress was made towards achieving the group’s strategic goals of growing safe production down the sector cost curve.

Northam says its capital investment programme remains on track, despite temporary pauses to project modules that can be delayed without a detrimental impact to the overall programme, as part of the group’s focus on cash conservation during the current pricing cycle.

Industry challenges remain, particularly in respect of metal prices and mining inflation, the group points out.

However, the combined effect of ongoing and consistent growth in production volumes and increased operational diversification, continues to underpin its defensive position and resilience in the face of the current soft metal price environment, Northam states.

It says this affirms the long-term contribution of the group’s counter-cyclical investments made over the past decade in pursuit of establishing a competitive production base which is able to withstand potential medium- to long-term cyclical downturns.

In light of the prevailing pricing weakness and uncertainty surrounding the platinum group metals (PGM) market, Northam says it remains fully internally focussed and management continues to pursue innovation and operational excellence, particularly regarding safe production, aimed at delivering efficient mining at the right cost.

Also cash conversion and cash preservation remain key focus areas, ensuring a strong balance sheet to further enhance investor confidence, the group says.

The current price environment may endure for some time, and this, combined with higher general inflation, continues to exert pressure on the entire PGM sector.

“Given our Upper Group 2-dominant resource base, well-capitalised mining assets and proactive balance sheet management, Northam remains well-positioned and fully prepared to face these industry headwinds, while continuing to deliver long-term, sustainable value to investors,” the group posits.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation