Iron-ore battered to 2022 low as China’s steel crisis hits home

Iron-ore headed for a brutal weekly loss, hitting the lowest level since 2022, on concern that a steel-industry crisis rippling across China will sap demand, while supplies from miners remain robust.

Futures traded below $93 a ton in Singapore, after hitting an intraday low of $92.20. The steel-making staple — one of this year’s worst performing commodities — has shed almost 9% this week, the most since March.

Steel mills in China, the biggest iron ore importer, have suffered from lackluster demand and sinking product prices, and many of them are cutting back on output. Earlier this week, leading producer China Baowu Steel Group Corp. said the industry was facing a downturn more severe than major slumps seen in 2008 and 2015. The country has been wracked by slower growth and a drawn-out property crisis, which has eroded steel consumption.

Market watchers including Macquarie Group Ltd. expect iron ore to remain under pressure given that global supplies appear to be running ahead of demand, creating a glut. If weak prices persist, that’ll be a challenge for the highest-cost producers as their operations risk becoming unprofitable.

“The market is oversupplied when demand is falling cyclically, I would expect it’s not going to stop at marginal cost,” said Marcus Garvey, head of commodities strategy at Macquarie. “You probably would see prices at high $80s, $85, clearly taking out all the top portion of the cost curve.”

A survey of China’s steel industry from Macquarie pointed to difficult conditions. Among the findings, 50% of mills were said to be losing money, with a further 23% just breaking even, while almost half of mills planned to cut output either slightly or a lot. Property remained the “main drag,” it said.

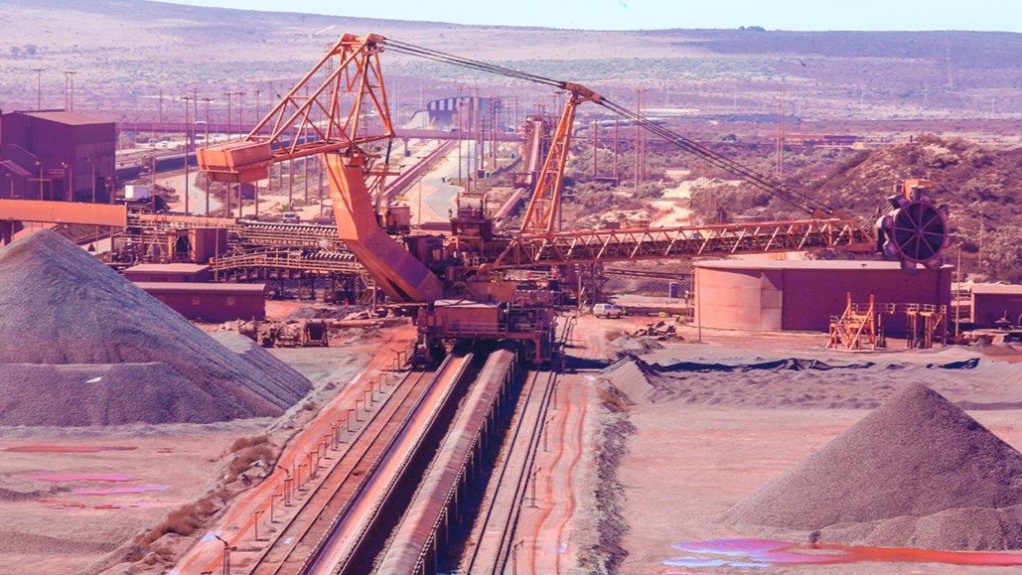

On the supply side, major miners in Australia and Brazil — which enjoy very low costs per ton given their scale — have been boosting cargoes. Shipments of iron ore from Port Hedland — Australia’s largest bulk-export terminal — expanded to more than 330 million tons over the first seven months of the year, ahead of the pace set last year and in 2022.

Iron ore futures traded 1.2% lower at $92.25 a ton in Singapore at 4:15 p.m. local time, with yuan-priced contracts in Dalian capping a weekly decline.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation