Kalahari manganese field ripe for consolidation, says Jupiter MD

Jupiter Mines MD Brad Rodgers speaking at the Diggers and Dealers conference in Kalgoorlie, Australia.

The Kalahari manganese field holds 73% of the world’s manganese (in an area less than the distance between Kalgoorlie and Coolgardie).

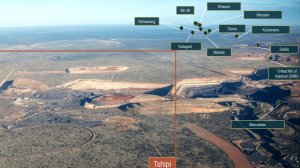

The Tshipi mine in South Africa's Northern Cape

ASX-listed Jupiter Mines is eyeing consolidation opportunities in South Africa’s Kalahari manganese field, one of the richest manganese-bearing regions globally, to unlock further value from its cornerstone asset – the Tshipi mine.

Speaking at the Diggers and Dealers conference in Kalgoorlie, Australia, MD Brad Rogers said on Monday that the Kalahari presented a “really unique” opportunity for consolidation, given the proximity of several of the world’s top-producing manganese mines.

“You’ve got five of the top ten producing assets in the world today, and all of the top remaining mine lives of already-producing assets in that photo,” said Rogers, referring to an aerial image of the region during his presentation. “Obviously, when you have that situation, there is an opportunity to combine ownership and drive consolidation value. Everyone who's familiar with this situation can see that. It has been challenging for various reasons, but that is part of Jupiter's strategy.”

Tshipi, which Jupiter holds a 49.9% stake in, is one of the largest and lowest-cost manganese mines globally. Located in the Northern Cape, the mine produced 3.6-million tonnes in the financial year ended June 30, slightly ahead of its 3.4-million-tonne average. Tshipi is expected to be the third-largest producer globally this year.

With more than 100 years of mine life remaining and a track record of consistent production, low operating costs, and healthy safety outcomes, Rogers said that Tshipi offered an “established, successful story” that Jupiter aimed to build on.

He highlighted a recent development that aligned directly with Jupiter’s consolidation strategy – the entrance of South African diversified miner Exxaro Resources into the manganese space. Exxaro is acquiring the 50.1% of Tshipi not owned by Jupiter, as well as a 20% stake in Jupiter itself, at a premium to the company’s trading price.

“Exxaro’s coming into this situation with a strategy aligned to Jupiter’s own, and so we are very supportive of and excited by this development,” Rogers said.

Beyond consolidation, Jupiter’s broader growth strategy includes improving Tshipi’s logistics to cut costs further, growing exposure to the commodity and exploring opportunities in the battery-grade manganese space.

Tshipi already produces a high-grade ore suitable for beneficiation into battery-grade material, and Jupiter has access to stockpiled ore under its marketing agreement. The company is evaluating ways to position itself as a future supplier to the fast-growing energy storage and electric vehicle sectors.

Despite sideways demand from China’s steel sector, Jupiter remains cash-positive and dividend-paying, owing to Tshipi’s cost competitiveness. The mine generates free cash even at the bottom of the manganese price cycle.

“There are five manganese mines in the world that make up 44% of global supply. If there is any issue in the interruption of supply. . . it immediately moves the price,” said Rogers, adding that Jupiter’s share price tended to respond strongly to price moves, offering clear upside exposure.

Since listing, Jupiter has returned nearly A$410-million to shareholders in dividends – an amount equivalent to its market capitalisation – with another dividend set to be declared on August 29.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation