US has lost three-quarters of its aluminium smelters, Bank of America reports

South Africa's expansive Hillside Aluminium in Richards Bay.

US's aluminium smelter loss.

China's cap on aluminium smelting.

Global power generation, transmission, consumption outline.

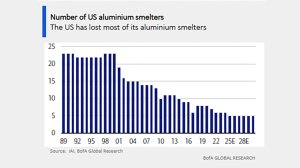

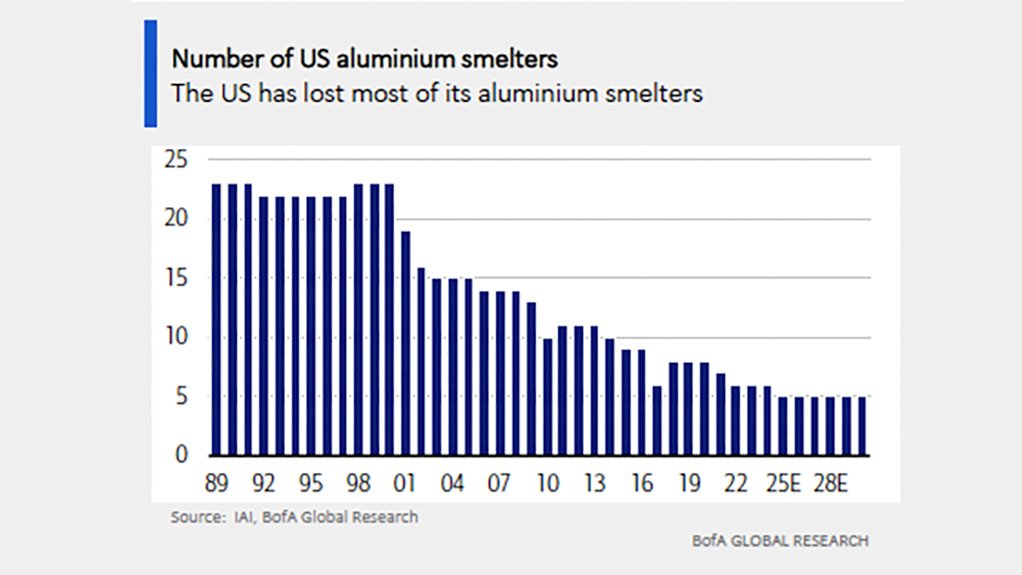

JOHANNESBURG (miningweekly.com) – Bank of America Global Research yesterday reported that the US has lost three-quarters of its aluminium smelters, China has capped its aluminium production, US consumers are now having to pay the full 50% tariff, there is uncertainty about what is happening with the aluminium smelter in Mozambique, and the biggest aluminium production increases are coming out of Indonesia, where, in many instances, it is Chinese operators who are doing the additional smelting.

In South Africa, the electricity pricing agreement for South32’s Hillside Aluminium in KwaZulu-Natal struck in May reflects the South African government’s policy to support strategic industries that create value for the nation. The Hillside smelter’s international competitiveness is enabling it to continue to deliver significant benefits to South Africa, but in the US, Bank of America metals research head Michael Widmer reported that it has been a one-way road downwards for aluminium smelters in the US.

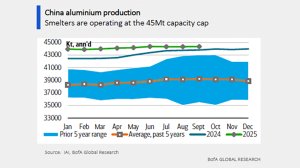

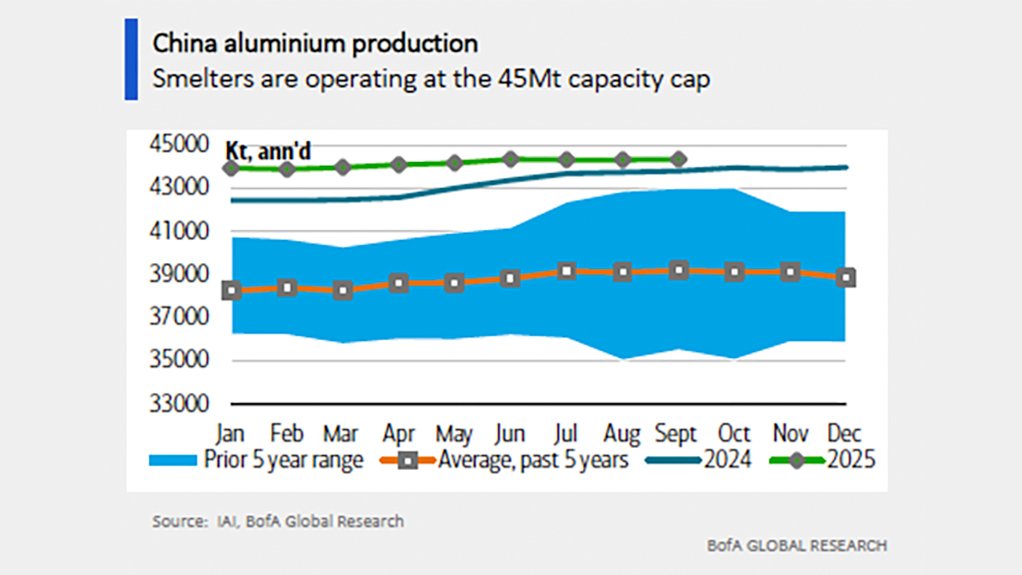

China's imposition of a 45-million-ton capacity cap also means that new smelters would have to take up the capacity of existing ones, which is not viewed as being likely, Widmer outlined during his report on the bank’s 2026 metals market outlook, covered by Mining Weekly.

While the US administration is trying to build new aluminium smelters, Widmer displayed a chart indicating that there is no silver bullet.

Highlighted was the demand for power from data centres, which will incidentally also need aluminium for cooling systems, and these data hubs are reportedly prepared to pay considerably more for the electricity that the aluminium smelters need.

‘With all the discussion on tariffs and who is going to invest, it often comes down to just one metric, which is the power cost, and the unfortunate reality is that, anecdotally, I think data centres and AI can pay more than three times as much for power than a smelter would want to pay, so there’s a lot of competition, and that really puts the US aluminium industry in a very difficult position,” Widmer noted, while another slide displayed showed that the US is now down to only five aluminium smelters from the more than 20 it had in 1998.

Provided by Bank of America Global Research was an outlook for metals, particularly copper and aluminium, in relation to global economic trends and defence spending, and those participating in the webinar heard that the Chinese government has repeatedly been called on by the Chinese aluminium industry in the past decade to effectively bail the smelters out.

“What happened is that every time there was a positive margin, the Chinese smelters came in, built a lot of capacity, increased production, competed away those positive margins, and ultimately came under pressure of the government.

“But it reached the stage where government said no more of this, we want to have a capacity cap and a 45-million-ton capacity cap was instituted, and that's where we are now.

“A little bit of supply growth is now coming through in Indonesia. Again, in many instances, it's the Chinese operators who can no longer invest in China, and now it's spilling over into the international market.

“But I think that the aluminium market should be able to absorb those. A lot of it potentially goes to China in the end as well,” Widmer reported during the webinar covered by Mining Weekly.

“In Europe in July, we saw the first months where every single sector made a positive contribution to aluminium demand in Europe for the first time in almost three years.

“There is a risk that premia in Europe go higher, and force US consumers to also pay up, because some of the Canadian units could, for instance, then end up in Europe.

“I think this competition is why we are starting to see aluminium prices also pushing higher. An additional issue that you have in Europe at the moment is there's a lot of uncertainty about what is happening with the South32 smelter in Mozambique. That's 500 000 t, about 10% of the European use. It doesn't have a power drive, so there’s still a risk of losing that supply.

“The other issue is that we have an aluminium smelter in Iceland that needs to be partly rebuilt, and so you're losing supply there as well and other regions that are short of aluminium having to increasingly compete for supply.

“We're not quite as bullish on aluminium as we are for copper, but we still have prices going above $3 000/t next year,” forecast Widmer, who expressed the view that it would be data centres and AI that would snatch the main focus over the coming years, with China likely eclipsing the US.

Regarding South Africa’s Hillside Aluminium, Eskom outlined its rationale for the pricing agreement in a publicly available submission to National Energy Regulator of South Africa (Nersa) in February 2021.

In its submission, Eskom noted Hillside’s role in supporting stability of the electricity grid.

When it publicly outlined its rationale for supporting the agreement, Nersa stated there was a “net benefit to the rest of the customer base in putting this agreement in place”.

South Africa’s Hillside Aluminium in Richards Bay is a significant contributor to South Africa’s national economy and a major employer.

Meanwhile, key metals that are essential for the functioning of data centres and AI technologies are steel for structural components, copper for electrical conductors, and aluminium for cooling systems, with gold and silver used in electronic components for their conductivity and corrosion resistance.

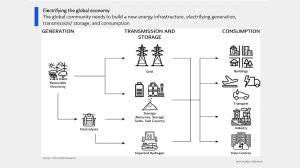

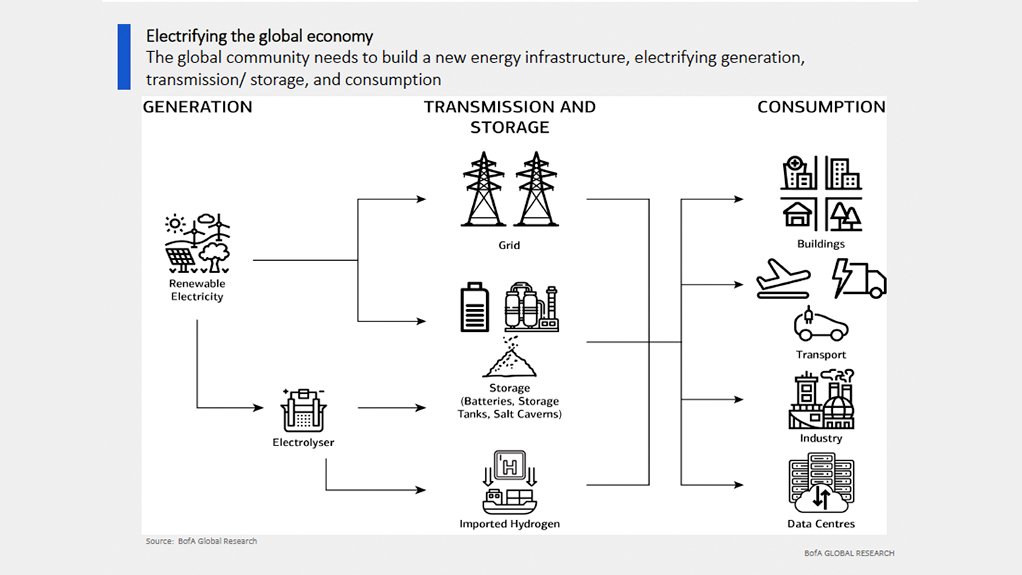

He reported that the global community was focusing on building a new energy infrastructure to support electrification across various sectors, involving investment in electrifying generation, in which hydrogen electrolysis is also depicted, transmission, storage, and consumption.

Noted was that copper demand is experiencing a soft patch, particularly in China, affecting global prices.

China's copper demand growth has shown a decline, with significant drops in sectors such as construction and consumer products.

The year-on-year change in copper demand from various sectors indicates a slowdown, particularly in grid and transport sectors.

Increased defence spending in Europe is driving demand for metals such as copper and aluminium. Defence spending as a percentage of GDP is trending higher in regions such as the US and China. By 2030, global demand for copper and aluminium from defence is projected to reach 550 000 t and 1.6-million tons, respectively.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation