Kropz reveals restructuring plans to simplify debt, boost operational progress

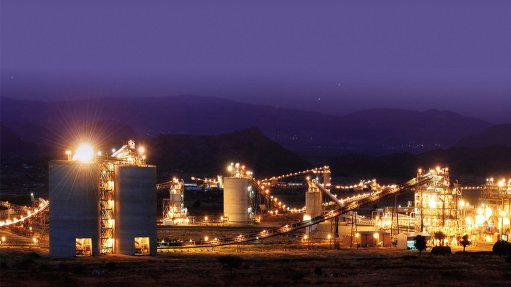

Aim-listed phosphate producer Kropz has announced plans to restructure its finances and raise additional funds to support its projects. This move is aimed at simplifying the company’s debt situation and boosting its operational progress at key projects, particularly the Elandsfontein phosphate project in South Africa and the Hinda project in Congo-Brazzaville.

In an announcement to shareholders on September 3, Kropz said it was simplifying the complex financial relationships within its group of companies and with its major investor ARC Fund.

This restructuring will involve converting substantial intercompany debt into equity and issuing new convertible loan notes (CLNs). Specifically, £28.2-million of debt held by ARC in Kropz’s South African subsidiaries will be converted to equity and £35.1-million of additional debt will be settled by issuing CLNs.

This process will eliminate the accumulated debt within Kropz’s subsidiaries, making the company’s financial structure simpler and more attractive to potential investors.

To support ongoing operations and growth, Kropz said it would be raising £8.9-million through a combination of a subscription and a retail offer. ARC Fund has committed to subscribing to at least 515-million new shares and has agreed to underwrite the entire fundraising effort.

This means ARC will cover any shortfall if other shareholders do not fully participate, ensuring that Kropz secures the full £8.9-million.

This fundraising is crucial for several reasons.

Firstly, the funds will help ramp up operations at the Elandsfontein phosphate project, which has faced challenges owing to unexpected ore variability and difficult mining conditions.

Recent heavy rains in the Western Cape also disrupted operations, but Kropz said it was working on solutions such as improved drainage and ore stockpiling to mitigate these issues.

Secondly, part of the funds will be directed to the Hinda project, where Kropz is progressing feasibility studies.

Thirdly, the funds will also be used to make the final repayment on a £2.8-million loan from BNP Paribas and to cover some of the accrued interest on the new CLNs.

The restructuring and fundraising efforts are subject to shareholder approval, which will be sought at a general meeting scheduled for September 20. Additionally, approval from the South African Reserve Bank is required owing to exchange control regulations.

If these approvals are obtained, Kropz plans to issue 643.9-million new shares, representing 41% of the company’s expanded share capital.

The company said the restructuring was vital for the company as it addressed its over-leveraged balance sheet, particularly at the subsidiary level.

Kropz Elandsfontein, which has been burdened with high levels of debt, will see a significant improvement in its financial position.

Moreover, the restructuring will help Kropz comply with broad-based black economic empowerment requirements by increasing ARC’s direct ownership in Kropz’s South African subsidiaries to at least 30%, aligning with the new Mining Charter.

The company said the restructuring and fundraising were necessary steps to stabilise Kropz’s financial situation, improve its operational performance and attract future investment.

Kropz said it was focused on overcoming the challenges at its Elandsfontein project and advancing its Hinda project, with the ultimate goal of securing long-term growth and profitability.

In addition to the restructuring, Kropz said on September 3 that it was offering its current UK retail investors the chance to buy up to £1.8-million worth of new shares. This offer is being made through the REX platform, which is a digital platform enabling individual investors to participate in company fundraising on equal terms with institutional investors.

This is in addition to the £8.9-million Kropz is planning to raise through the subscription and retail offer as part of its restructuring plans.

To participate in the REX retail offer, investors must already be Kropz shareholders and must go through participating financial intermediaries, such as AJ Bell, Hargreaves Lansdown, and interactive investor. The offer closes at 16:30 on September 9, but intermediaries might close earlier. The minimum investment is £50.

The offer depends on certain conditions, such as approval at the general meeting on September 20. If approved, the new shares will start trading on the LSE on September 27.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation