Local automakers know they need to decarbonise but lack understanding of how to manage emissions

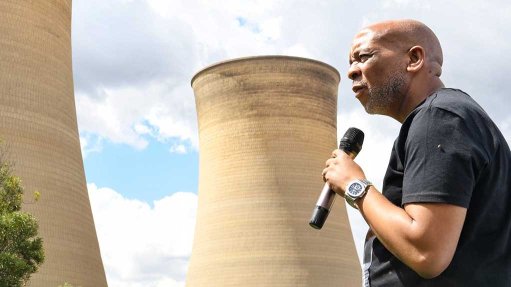

in this video, Nedbank Commercial Banking relationship head Coillard Ford discusses the reality of CBAM and its impact on local manufacturing.

A recent study conducted by naamsa | The Automotive Business Council and Nedbank revealed that 60% of respondents were aware of the need to decarbonise, especially in light of the EU’s Carbon Border Adjustment Mechanism (CBAM), but faced challenges in understanding and managing Scope 1, 2, and 3 emissions, National Association of Automotive Component and Allied Manufacturers policy and regulatory affairs head Beth Dealtry has pointed out.

Additional challenges identified by respondents included access to technology and the costs associated with compliance.

The carbon-readiness study focused on the automotive sector. Its aim was to understand the sector’s current state of carbon-emissions awareness, the challenges faced in the decarbonisation process, and readiness for emerging sustainability requirements such as CBAM.

Dealtry stated during Nedbank Commercial Banking’s Manufacturing Roundtable discussion, held on June 10, in Sandton, that “. . . the reality is, at the moment, it’s not the most pressing challenge that’s facing our membership base, and they have much bigger opportunities and challenges to be dealing with in the short term”.

She clarified that CBAM was often misunderstood in terms of its applicability.

“What is sometimes misunderstood is that CBAM doesn’t hit most of our manufacturers. It is a much smaller subset of them that are directly impacted by CBAM. That doesn’t mean to say sustainability doesn’t matter. That doesn’t mean to say that other subsectors aren’t going to be impacted and required to decarbonise,” she said.

Dealtry also highlighted the lack of understanding around Scope 3 emissions.

“You start to see when you look through the scopes – everyone’s got a fairish idea what their Scope 1 emissions are. Scope 2, it gets a bit fuzzier. Scope 3, that is a whole other language. If you are talking Scope 3 emissions, it’s not just the component sector. It’s the entire supply chain,” she said.

She elaborated on the difficulty, noting that “. . . that’s where it becomes tricky, because you need everyone working together. We’re a very globalised supply chain, and so there are a lot more moving parts to it. So I understand where the lack of understanding comes from.”

The panel of experts who participated in the roundtable discussion collectively emphasised the importance of collaboration. They highlighted the need for localised solutions and the potential for regional value chains to enhance carbon readiness.

Nedbank Commercial Banking relationship head Coillard Ford stated that South Africa exported nearly 30% of its manufactured goods to the EU.

He noted that, in the automotive sector, the figure was closer to 62%. He pointed out that a significant portion of the country’s industrial base was now competing not only on price and quality, but also on emissions transparency and carbon performance. He added that these trends were not limited to Europe.

“Globally, we are seeing [environmental, social and governance] being procurement standards, Scope 3, emission tracking and carbon pricing mechanisms, all being written into trade, lending and investment criteria.

“This is no longer a compliance issue. It’s a market access issue, and it’s happening faster than most of us have expected. We are already seeing cases where local manufacturers are being asked to submit carbon disclosures to their global buyers, and not being ready will cost contracts. This isn’t hypothetical. It’s real, and it’s happening,” he said.

Ford warned that the pressure to decarbonise was spreading across all sectors.

“Whether you are in packaging, steel, chemicals, textiles or consumer goods, the pressure to decarbonise is spreading across the entire value chain. Because what’s happening is structural carbon is becoming a cost, a risk, a strategic differentiator, and readiness is no longer optional,” he said.

Ford warned that industry was heading into a future where carbon data would be as important to a company as its financials, and readiness would mean being able to speak that new language with credibility.

“If you’re in a boardroom today and you can’t answer how carbon risk is being managed in your supply chain, that is no longer a niche gap. It’s a strategic red flag,” he said.

Ford acknowledged that most businesses understood the need to decarbonise and that many had taken initial steps, but there were significant constraints. These included limited access to affordable technology, insufficient capacity to measure emissions, uncertainty around reporting frameworks and the high costs of compliance.

He further observed that progress was not limited by company size.

“What is clear is that readiness isn’t about size. Some of the most agile progress is coming from mid-corporate-sized businesses, the ones closest to the operational detail, the ones able to adapt without being burdened by bureaucracy,” he said.

Ford further emphasised the need to ensure that carbon readiness did not become another divide between large corporations and midtier businesses. He stressed that readiness needed to be scalable, tangible and bankable.

“Carbon readiness isn’t about doing what is fashionable. It’s about doing what is necessary to stay relevant in this fast changing world.”

Nedbank Commercial Banking manufacturing head Amith Singh agreed that the issue was already at hand.

“This is not something that’s coming. This is not something that’s ahead. This is something that’s right at our doorstep. It’s been measured from next year. How do we aid and assist our market in navigating these challenges? How do we control the controllables?

“How do we take back some power and empower clients to navigate this from now being seen as a challenge to potentially a differentiating factor and opportunity, from developing ourselves our readiness level to other developing countries?” he said.

Nedbank Corporate and Investment Banking senior strategic analyst Greg Howard commented on the broader geopolitical implications of CBAM. He said he believed the mechanism would further widen the gap between developed and developing nations, arguing that CBAM essentially served to protect European industry through the imposition of tariffs.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation