Lynas flags uncertainty over Texas rare earths plant, posts profit slump

Amanda Lacaze says Lynas is a big supporter of continued investment in development of outside-China's supply chains.

MELBOURNE - Australia's Lynas Rare Earths warned of considerable uncertainty over the future of its heavy rare-earths processing plant in Texas and also reported a steeper-than-expected drop in its annual profit on Thursday.

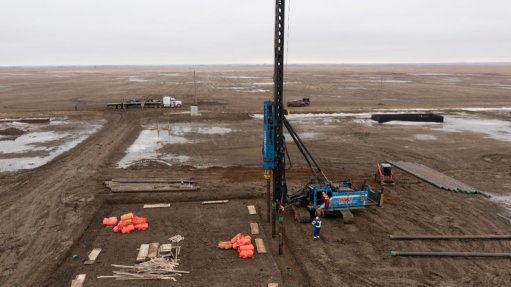

Lynas, the world's largest rare-earths producer outside China, said it is in negotiations with the US Department of Defence (DoD) to reach a mutually acceptable offtake agreement for production from the Texas-based Seadrift facility.

"While there can be no certainty that offtake agreements will be agreed, any offtake agreements would need to be on commercial terms acceptable to Lynas," the miner said.

Lynas has been developing the facility under a contract with the US DoD, with plans to begin operations in fiscal 2026. However, the company indicated that construction of the plant may not move forward.

"We are big supporters of continued investment in development of outside-China's supply chains," CEO Amanda Lacaze told an investor call.

"But just remember ... Lynas is the lynchpin of (the) outside-China supply chain, and it is important that policy development is done in such a way that continues to protect that, because, as I said before, development of new plants can be long and uncertain," she said.

Her comments came after the US government last month agreed a multibillion dollar deal to become the top shareholder in Lynas' biggest rival outside China, MP Materials, provide a floor price for its key rare earth product, and lend it $150-million to expand in heavy rare earths separation.

Lynas also wants to be involved with new rare earth magnet makers in the US and other countries outside China and is open to taking an equity stake.

"There are seven magnet projects coming to market in the US, many of which actually have some form of government funding, which de-risks them," Lacaze said, adding there are probably more magnet projects in the US than in the rest of the world combined.

"We want to be able to participate either on an operational or a supply or an equity basis in this part of the supply chain," she said.

The miner last month signed an agreement with Korea's JS Link to develop a magnet facility in Malaysia where it has processing operations.

Lynas' net profit after tax came in at A$8-million for the year ended June 30, a sharp decline from an A$84.5-million reported a year earlier.

The annual figure also missed the Visible Alpha consensus estimate of A$30.4-million.

Lynas attributed the drop in profit to depreciation costs from its Kalgoorlie and Mt. Weld facility expansion, noting that production at Kalgoorlie fell short of nameplate capacity.

It expects its fiscal 2026 capital expenditure to be around A$160-million.

The miner announced an A$750-million equity raising to "pursue new growth opportunities". The new shares will be issued at A$13.25-apiece, a discount of 10% to Lynas' close on August 27.

Its shares were placed on a trading halt ahead of the equity raising.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation