Manna lithium project, Australia – update

Photo by Global Lithium Resources

Name of the Project

Manna lithium project.

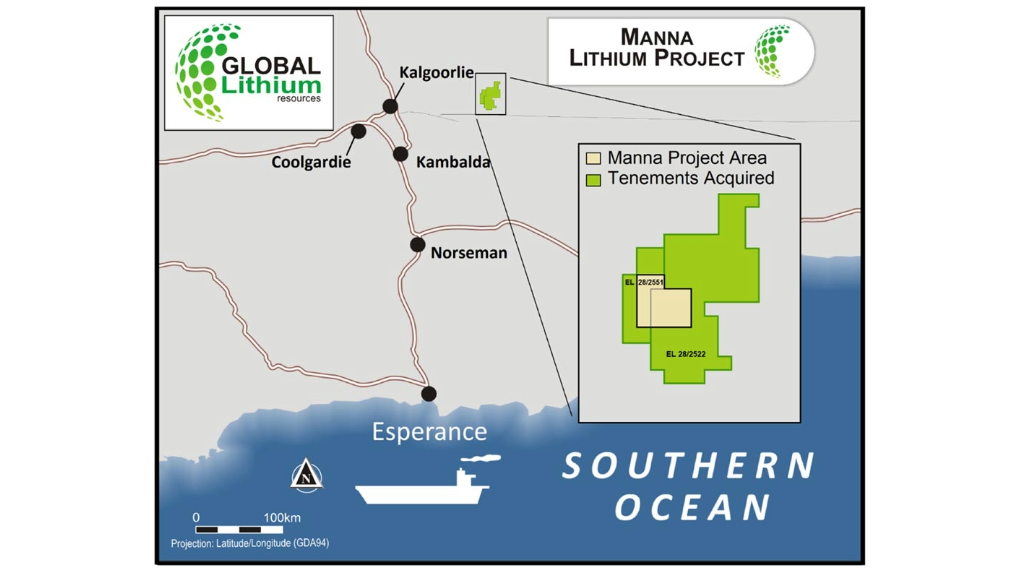

Location

Goldfields region of Western Australia.

Project Owner/s

Diversified lithium exploration and development company Global Lithium Resources (GL1).

Project Description

A scoping study has confirmed the potential for a globally competitive lithium project.

The scoping study envisages an operation with a life-of-mine of ten years, with an estimated total production of 2.2-million tonnes of spodumene concentrate, based on mineral resources of 32.7-million tonnes at 1% lithium.

The concentrator will have a nameplate capacity of two-million tonnes a year of run-of-mine ore.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an estimated pretax net present value, at an 8% discount rate, of A$2.8-billion and an internal rate of return of 103%, with a payback of 15 months after first production.

Capital Expenditure

Direct capital costs are estimated at A$299.4-million.

Planned Start/End Date

First spodumene concentrate targeted for production in 2026.

Latest Developments

Global Lithium Resources (GL1) shareholders have approved a new board that wants to go ahead with developing the project.

Former executive chairperson Ron Mitchell had turned to regulators to try to stop what he alleged was an undisclosed association among China-linked shareholders unlawfully seeking to take control of the company and the Manna lithium project. He alleged that shareholders might have violated Australia's takeover laws and the foreign takeovers act in reports to Australia's Treasury in 2024, as well as in filings to the Australian Securities Exchange, the Western Australian Supreme Court and Australia's Takeovers Panel.

Management froze development of the project in late 2024 amid a protracted downturn in the battery raw material market, but some of Global Lithium's biggest shareholders opposed the company's strategy.

Following the board’s overhaul, the company has said it will prioritise finalising a native title mining agreement with the Kakarra Part B Native title group, ahead of seeking a mining lease and completing a financial feasibility study on the project.

Global Lithium is also seeking a new chairperson as it looks to "rebuild trust" with potential project partners.

The Takeovers Panel twice declined to review the allegations, but Australia's Treasurer was still keeping a close eye on the situation, newspaper The Australian reported.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Global Lithium Resources, email info@globallithium.com.au

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation