Mazars

Carrot or stick? Perhaps the healthy equilibrium is to explore the strategic imperative of an integrated sustain-ability strategy. While firmer regulation is aimed at addressing climate change, it threatens at least half of the value of coal, oilfield and gas reserves. The transition to a low-carbon economy, limiting global warming to under 2 ˚C of pre-industrial levels, could mean leaving about 80% of known coal, 33% of oil and nearly half of all gas reserves in the ground. The result being $4-trillion in equity and $1.27-trillion in debt at risk from the transition and physical impacts of climate change.

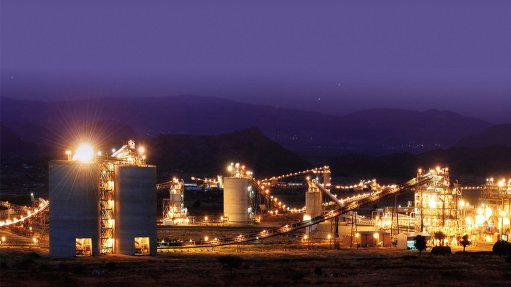

The transition is drawing attention to the sustainability of the mining industry in more ways than one. The International Energy Agency expects demand to increase for raw materials required to make rechargeable batteries and power renewable energy technologies.

The mining industry has a love-hate relationship with Environmental, Social and Governance (ESG). The effort to meet net-zero emissions by mid-century could lead to six times the increase in overall mineral requirements for clean energy technologies by 2040. We will need more aluminium, cobalt, copper, graphite, lithium and nickel and the industry will need a partner that understands the potential consequences of developing mines on communities, ecosystems and scarce resources. This transition needs the government, regulators and investors to strike the careful balance of achieving our energy transition while transforming the industry.

The S of ESG remains complex. Mining in South Africa tends to improve wage levels, but often triggers indirect negative social impacts. Our approach includes finding innovative ways of communicating impact, and social responsibility strategies with shared value. Mining is important to our development and to our transition to a low carbon economy, it contributed over R400-billion to GDP in 2020.

As the mining industry continues at pace to dig up minerals required for the decarbonisation of the world’s energy needs, alongside traditional demand, we aim to help the industry take a more holistic approach to ESG as core part of the business and the investment case.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation