Metallica raises cash to advance Cape Flattery

PERTH (miningweekly.com) – ASX-listed Metallica Minerals will raise A$9.6-million through a fully underwritten share placement and a fully underwritten non-renounceable pro-rata entitlement offer to progress its Cape Flattery silica sands project, in the Cape York Peninsula.

The company is aiming to raise just under A$5.1-million in the share placement, which will be priced at 3.5c each, welcoming new shareholder Sibelco Asia Pacific, which will be subscribing for A$3-million, while existing shareholders Ilwella and SPARTA AG will acquire a combined A$1-million in new shares.

Under the fully underwritten non-renounceable pro-rata entitlement offer, Metallica is hoping to raise a further A$4.5-million, with the offer to be priced at 3.2c a share.

“We are delighted this placement has enabled existing shareholders including Sibelco, Ilwella and SPARTA AG, to show their continued support for Metallica. It has also provided the company with the opportunity to welcome new institutional investors to the register,” said Metallica executive chairperson Theo Psaros.

“This show of support represents a significant endorsement of Metallica’s ambitions to provide high-quality silica to global markets and sends a strong positive signal to potential future customers that Metallica is well positioned to progress the development of the Cape Flattery silica sand project.”

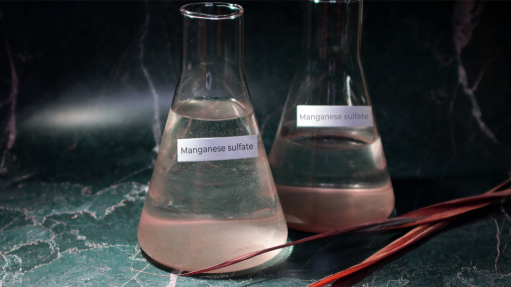

“The commercial environment for silica sand remains buoyant given ongoing strong demand from Asia-Pacific glass manufacturers supplying the solar panel industry. Our recent prefeasibility study (PFS) has highlighted the world-class potential of our Cape Flattery silica sand project and we are looking forward to the opportunity to be a valuable contributor to the global energy transition. This placement and entitlement offer will enable us to strengthen our cash reserves for the continuation of the definitive feasibility study that is underway.”

The March PFS estimated that the project would require a capital investment of A$79.4-million and could produce 1.35-million tonnes a year of saleable production over a project life of 25 years, based on a maiden ore reserve of 46-million tonnes at 99.18% silicon dioxide.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation