Minerals Council VP spells out platinum production decline expectation to Shanghai

Graph showing projected downward path of platinum.

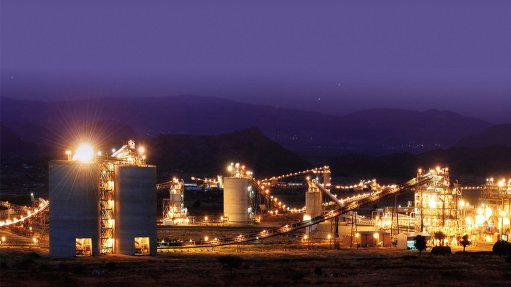

The many aspects of PGM mining that have far-reaching economic value.

Northam CEO Paul Dunne

Shanghai Platinum Week in-person audience with tens of thousands online.

At Shanghai Platinum Week.

JOHANNESBURG (miningweekly.com) – Under current market conditions, many platinum mines will close prematurely owing to a lack of financial resources – and even without financial constraint, closure of depleting mines will result in platinum availability being considerably below the level that has prevailed for the past quarter century, Minerals Council South Africa VP Paul Dunne informed last week’s Shanghai Platinum Week audience.

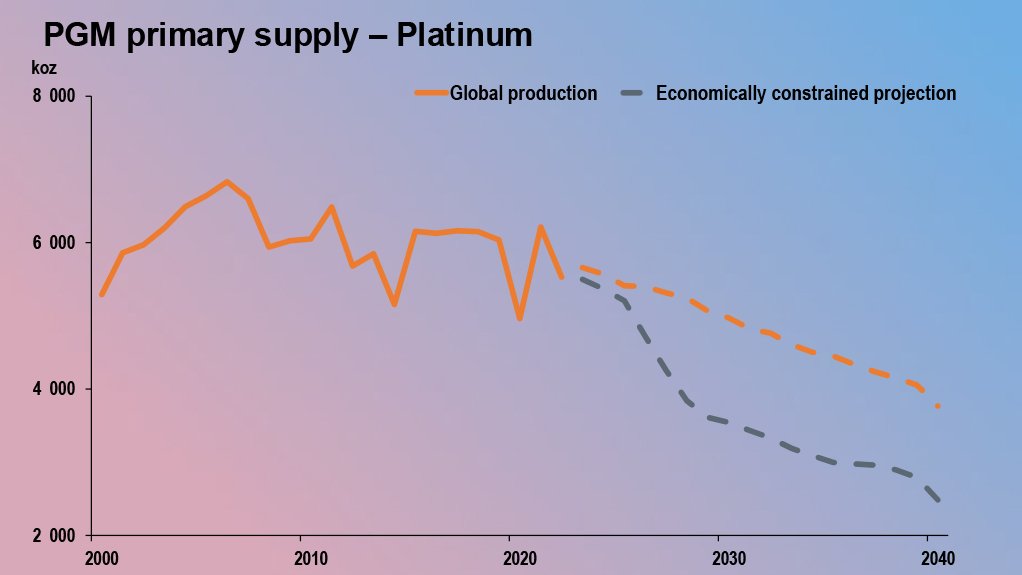

Displaying a graph projecting two global platinum scenarios, Dunne said the lower declining darker dotted line shown in the image above would be platinum’s downfall should current platinum group metals (PGM) pricing persist.

The slide depicts the mined platinum production over the last 24 years in the solid line, as well as two scenarios of future milled platinum production depicted with the use of declining dotted orange and darker lines.

The declining orange dotted line scenario depicts the view of milled platinum production when there are no financial constraints and naturally depleting mines cease to produce.

“This is the maximum production, in our view, without new projects,” Dunne said of the dotted orange line, which includes supply projection from mines that have been announced and started, as well as those in production now.

But even as can be seen from the dotted orange line projection, current mining investment will not be able to offset the loss of production from the old mines passing on, Dunne spelt out as CEO of Northam Platinum, which has grown by more than 300% since 2014.

The second scenario, shown by the darkish dotted line, illustrates the projected production collapse on the way if the current uneconomic PGM prices persist.

Anticipated is that many mines will be closed prematurely owing to a lack of financial resources.

“Under current market conditions, the blue line can be so,” Dunne reiterated, while conceding that the eventual outcome may be somewhere in between, but still worryingly down.

Two scenarios were also shown for palladium production across the world, albeit with the palladium PGM declining at a slower pace than forecast for platinum over the next 20 years, owing to the relatively smaller exposure palladium production has to Southern Africa’s economics.

But, in an economically constrained scenario, the closure of high-cost palladium mines is foreseen.

The rhodium graph displayed resembled the platinum graph, amid significant rhodium volumes arising from the upper group two, or UG2, mines on the western limb of South Africa’s Bushveld Complex. “These mines are now nearing the end of their lives and are anticipated to become less competitive as production starts to fall,” Dunne added, while emphasising the major loss to planet earth of less PGM availability.

“PGMs are very, very special metals. They're very rare and are only found in a few places around the world. Their unique catalytic chemical properties are used to make the world a better place,” Dunne noted, while displaying a slide with an iridium chloride background.

Iridium, another member of the PGM family of six and one of the rarest elements on earth, was named after Iris, the Greek goddess of the rainbow.

“Iridium, together with the ruthenium, were historically considered the minor PGM metals, but their importance is growing, in particular, in the hydrogen economy,” Dunne pointed out.

MANY VALUE-ADDING STAGES

Producing pure PGM metal begins with the mining of ore deposits that typically contain a low concentration of the metals, two to five parts per million, two to five grams per ton.

Following this, the mined ore passes through five stages of physical and chemical beneficiation, ultimately producing high-purity, stable, and saleable PGMs.

To do this, tens of thousands of Southern Africans are employed and very many terawatts of electricity are deployed.

Along with the PGMs often comes valuable base metals and millions of tons of chroma.

Operations have multiple concentrators, smelters, and are linked to local and international refineries.

Mining methods are often mechanised, taking mineworkers away from potentially harmful areas through the use of machines.

Many mining companies invest in local communities and take care of the environment in and around mining operations and mine closure results in far-reaching socioeconomic disruption, which the PGMs industry is clearly seeking to avoid.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation