MinRes plans $700m bond offering to refinance debt

Australian iron-ore and lithium miner Mineral Resources (MinRes) is preparing to tap debt markets with a proposed $700-million bond sale, aiming to refinance notes maturing in 2027 as the company seeks to shore up its balance sheet after a year of heavy spending and weak lithium markets.

The Perth-based miner said on Monday it would offer senior unsecured notes due 2031, subject to market conditions, with proceeds earmarked to retire its existing $700-million bond. The securities would be guaranteed by certain subsidiaries and sold to qualified institutional buyers under Rule 144A and to offshore investors under Regulation S.

Fitch Ratings assigned a ‘BB-’ rating to the proposed notes, in line with MinRes’ long-term issuer default rating. The agency said the refinancing would be leverage-neutral and said debt metrics should improve from the 2026 financial year as its flagship Onslow iron-ore project ramped up.

“Ebitda [earnings before interest, taxes, depreciation and amortisation] net leverage increased to 7.4 times in the 2025 financial year from 4.9 times the prior year, but we expect the company to stabilise leverage below 4.0 times by 2026/27, provided there are no new significant investments,” Fitch analysts wrote.

MinRes has faced a sharp drop in lithium earnings, with segment Ebitda falling to A$23-million in 2025 from A$384-million a year earlier as spodumene prices tumbled. Fitch said weak lithium prices and lower production volumes at the Wodgina and Mt. Marion mines were unlikely to provide meaningful upside next year.

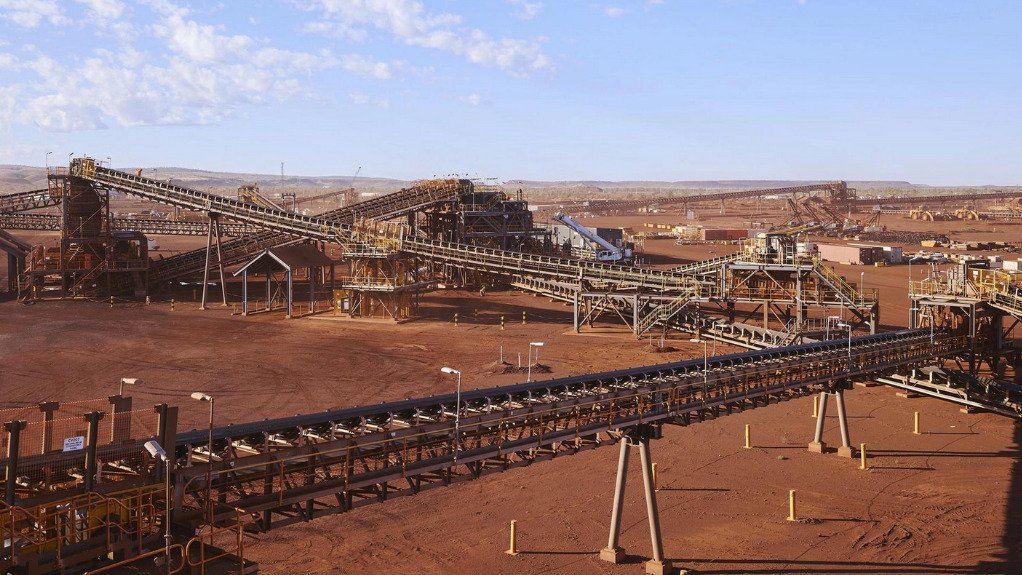

The company is counting on Onslow to drive deleveraging. The iron-ore project reached nameplate capacity in August and is forecast to contribute about A$1-billion in Ebitda in 2026, with attributable output of as much as 18.8-million tonnes. Growth capital expenditure is expected to ease after peaking at A$1.4-billion in 2025.

Fitch highlighted governance issues as a lingering risk but noted improvements including a refreshed board and stronger oversight of related-party transactions. The agency maintained a negative outlook on the company’s rating, citing execution risks across organic and inorganic growth plans that could keep leverage above expectations.

MinRes held A$412-million in cash and A$705-million in undrawn revolving credit facilities as of June 2025. Aside from the 2027 bond, its debt maturities are spread out, though Fitch treats a $400-million iron-ore prepayment agreement as debt rather than operating cash flow.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation