MMG to acquire Anglo American's nickel business for $500m

Diversified mining group Anglo American has agreed to sell its nickel business to midtier miner MMG for up to $500-million, the companies announced on Tuesday.

The transaction, which includes two ferronickel operations and two greenfield projects in Brazil, forms part of Anglo American’s broader strategy to streamline its portfolio and sharpen its focus on copper, premium iron-ore, and crop nutrients.

Anglo American CEO Duncan Wanblad stated that the agreement with MMG followed a “highly competitive process” and represented a strong outcome for shareholders, employees, and Brazilian stakeholders.

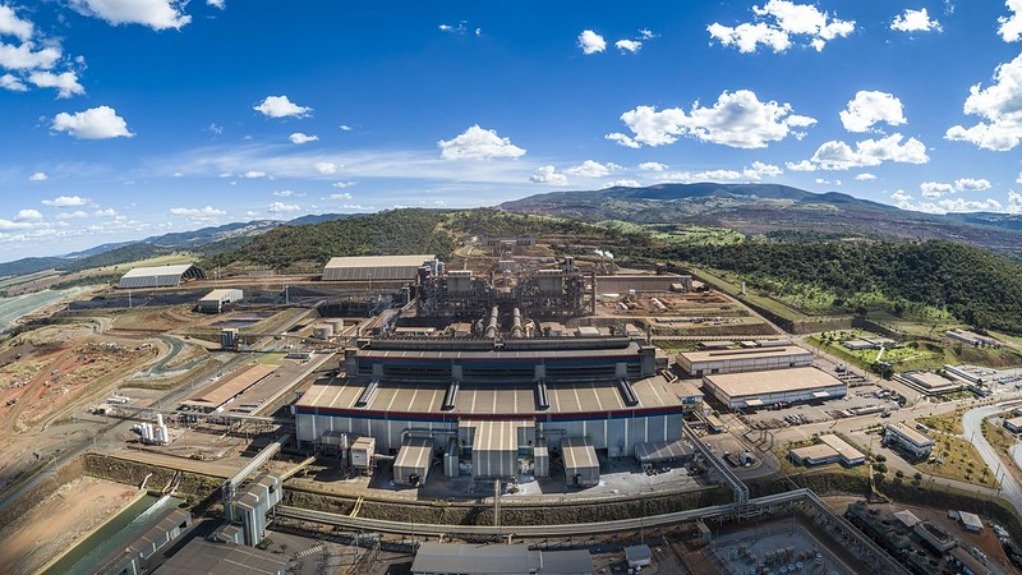

The nickel assets involved in the deal include the Barro Alto and Codemin ferronickel operations, as well as the Jacaré and Morro Sem Bone development projects.

MMG CEO Cao Liang said the acquisition would enhance MMG’s diversification strategy and strengthen its position in Latin America.

“Anglo American’s nickel business is well positioned to serve both the stainless steel and battery value chains,” the company stated. The operations include the Barro Alto and Niquelândia mines and the associated ferronickel processing plants, which collectively produced 39 400 t of nickel in 2024. Further, the two development projects offer significant resource potential, with Jacaré holding about 300-million tonnes of mineral resources and Morro Sem Bone estimated at 65-million tonnes of mineralisation.

Barro Alto is also notable as the only nickel mine in the world certified by the Initiative for Responsible Mining Assurance (IRMA), having achieved the IRMA 75 level of assurance last year.

The agreed consideration comprises an upfront cash payment of $350-million at completion, with a further $100-million contingent on a price-linked earnout and $50-million tied to a final investment decision for the development projects.

The transaction is subject to regulatory approvals and customary competition clearances. The deal is expected to close by the third quarter of 2025.

Wanblad said that the nickel sale agreement, together with those signed in November to sell Anglo American's steelmaking coal business, was expected to generate up to $5.3-billion of gross cash proceeds, reflecting the high quality of the group's steelmaking coal and nickel businesses.

"We are unlocking the inherent value of all of Anglo American as we create a much simpler, more resilient and agile business that will enable full value transparency in the market," he stated.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation