Nothing like negative interest rate, fear to drive gold price – Bristow

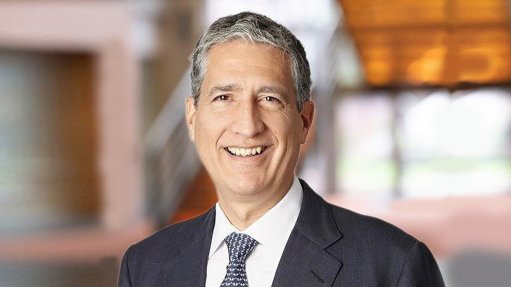

JOHANNESBURG (miningweekly.com) – “There’s nothing like a negative real interest rate and a fear to drive the gold price,” says Barrick Gold Corporation CEO Dr Mark Bristow, who also puts money printing firmly on the list of gold price drivers.

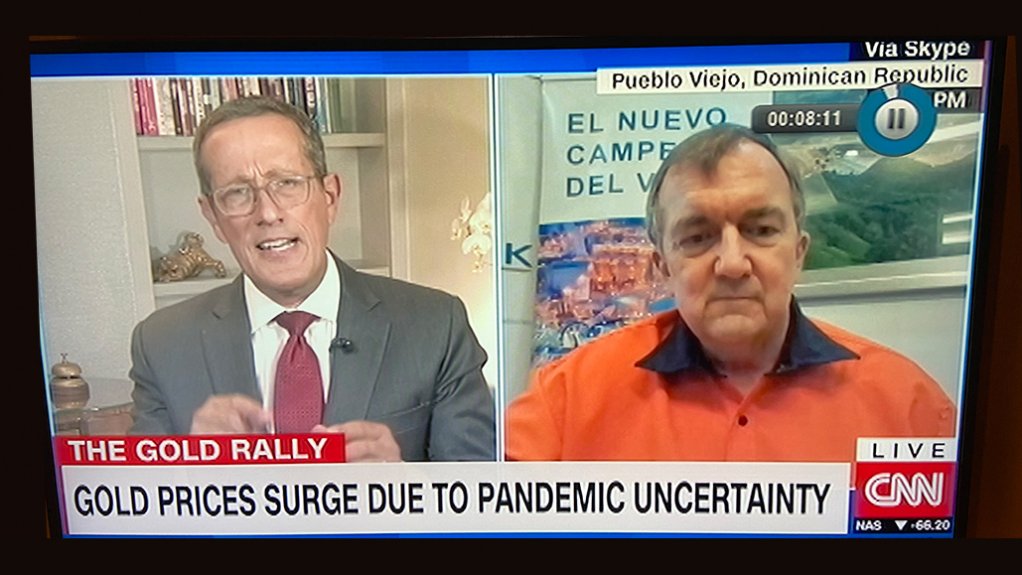

Bristow was responding via Skype to Richard Quest on CNN’s Quest Means Business from Barrick Gold’s Pueblo Viejo gold mine, in the Dominican Republic, on the factors driving up gold equities and the gold price during this period of pandemic uncertainty.

With a graphic of the gold price rise to $1 850/oz flashed up on the TV screen and $2 000/oz being the next target, Quest put it to Bristow that gold had been rising extremely sharply on the international exchanges, giving rise to investment opportunity.

“Gold, once again, becoming exceptionally popular, whilst the pandemic has been raging. I look at Barrick’s gold share price, which I have a graph of here, and I see the way it has risen so sharply, is that simply that we all fear what’s going to come next?” asked Quest, to which Bristow responded: “There’s nothing like a negative real interest rate and a fear to drive the gold price.”

“In a time of pandemic, when people are truly catastrophising, does gold become something that you need under the bed?” Quest asked further.

“Exactly, and the important thing, as you have seen, everyone is printing now, the money printing presses are rolling, and the impact of that is negative interest rates, devaluation of paper money, and that very process drives up the value of gold because you can’t print it, and you should have some in your portfolio, and, by the way, if you look back all the way to Bretton Woods in the Seventies, whether you go back to the turn of the century, or just the last two years or five years or ten years, gold has performed at the top end of all asset classes.

“From the late Nineties to 2001, gold wasn’t in favour, but then it’s the only time we’ve seen perfect harmony across the globe, economically and socially, and I’m sad to say that we don’t see any signs of that today,” Bristow responded.

Bristow launched Randgold Resources in Johannesburg in the mid-Nineties and close on two years ago, both he and Randgold were absorbed into the 40 000-employee, 14-country Barrick, which is listed in New York and Toronto.

As reported by Mining Weekly last week, Barrick expects to meet its production guidance for 2020, despite the negative impact of Covid-19.

The group reported preliminary second-quarter gold production of 1.15-million ounces and copper production of 120-million pounds. Gold production for the first six months of 2020 was 2.4-million ounces, which is at the midpoint of the 4.6-million- to 5-million-ounce guided range set for the year.

According to Wikipedia, Pueblo Viejo, the mine from which Bristow was speaking to London-locked-down Quest, is the largest gold mine in the Americas and eighth largest in the world.

South African-born and Estcourt High School-educated Bristow, who graduated from the University of Natal with BSc and PhD degrees in geology, is in on record as expressing his belief that Africa could be the next China. When he was based in Johannesburg in the Nineties, interviewers found his in-depth geological knowledge of the continent unbelievably widespread.

He has held many fundraising motorbike safaris across Africa raising millions of dollars for Africa’s people, notably the women and children deprived of a decent life by strife and poverty.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation