Partnership to shape future of coloured gemstone sector

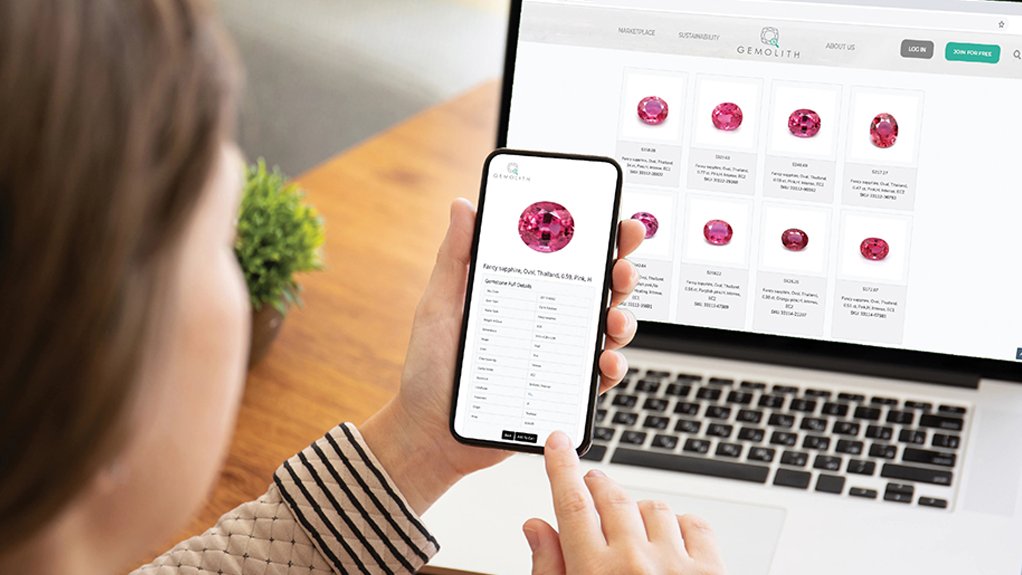

INDUSTRY SOLUTION GemCloud offers potential for gemstone vendors to organise, digitise and monetise their gemstone inventories

RECORD RESULTS Gemfields achieved record revenues following its most recent auction of predominantly commercial quality rough emeralds mined at its Kagem operation in Zambia

Photo by Gemfields

EXPANDING ETHICS GemCloud strives to help businesses of all sizes access and sell responsibly sourced coloured gemstones, such as Gemfields’ 7.5 ct ‘Chipembele’ discovered at the Kagem emerald mine

Photo by Gemfields

Technology gateway GemCloud, which has the potential to play a central role in shaping the future of the coloured gemstone sector, has gained a new, noncontrolling anchor investor through coloured gemstone miner Gemfields’ establishment of Gemdustry.

“Gemfields is delighted to support GemCloud, an exciting platform for the coloured gemstone industry, boosting access to and for buyers and sellers. Parties interested in joining Gemdustry can play a role in shaping and contributing to what we hope will become the pivotal marketplace for coloured gemstones,” says Gemfields new projects manager Algy Strutt.

Gemfields, which operates the Kagem emerald mine, in Zambia, invites “forward-thinking coloured gemstone industry participants of good standing” to join the company as partners in Gemdustry.

This structure allows GemCloud Group to retain its independence and neutrality while benefiting from industry backing, experience and input in shaping an online coloured gemstone platform and marketplace for cut-and-polished coloured gemstones, explains Gemfields.

The company believes that an independent, trusted online marketplace for cut and polished coloured gemstones, supported by a cross-section of coloured gemstone industry participants, is a logical step in the ongoing growth and development of the industry.

The coloured gemstone sector is still characterised by many vendors operating their own online sales platforms and offering their own inventory, notes Gemfields.

“This structure complicates the process for buyers who are forced to scour multiple websites. As many other industries have experienced, this ‘early stage’ structure inevitably morphs over time toward an ‘aggregator’ or ‘comparison’ model which offers far greater inventory in a single platform and facilitates a smoother, more efficient process for buyers and sellers, leading to further sector growth.”

GemCloud Group, founded in 2019, is a tech startup in the coloured gemstone digitalisation space that has developed a cloud-based inventory management platform and an online business-to-business (B2B) marketplace – Gemolith.com – transforming access for and to buyers and sellers, and “vastly improving the speed and convenience with which they can transact, all in a reliable and vetted environment”, highlights Gemfields.

On the Gemolith.com B2B marketplace, GemCloud acts as the counterparty to facilitate transactions and mitigate credit risk, allowing jewellers to buy in a vetted, secure environment.

The Gemolith.com B2B marketplace allows for the standardisation of imagery, videos and nomenclature for all gemstones, allowing gems to be directly compared onscreen using identical lighting conditions and scale settings.

“This is achieved through GemCloud’s partner laboratories, which use identical technology and the GemCloud grading system to digitalise, photograph, video, grade and certify the inventory. “GemCloud’s regional offices also provide supply chain and logistics facilitation, supporting buyers and sellers, and fulfilling gemstone sales (including shipping and logistics),” says Gemfields.

GemCloud.com offers users an inventory management system built specifically to solve the day-to-day challenges of the gemstone industry.

GemCloud has many features demanded from top-flight enterprise resource planning systems such as inventory management, consignments, billing, traceable manufacturing and stock audits, adds Gemfields.

GemCloud also offers various sales channels with which to better sell selected gemstone inventory including, for example, instant interactive quotations that enable a user’s customers to securely access data, imagery and certificates for the inventory, thereby facilitating privately concluded sales between the user and their customer. Users can further use GemCloud to power a feed of their own inventory on their own website or sales platform.

The Gemolith.com B2B marketplace also presents the option to offer selected inventory where buyers from around the world can find what they are looking for in one location.

“As such, GemCloud offers unparalleled potential for gemstone vendors to organise, digitalise and monetise their gemstone inventories,” says Gemfields.

For jewellery brands, designers and manufacturers, Gemolith.com offers a curated B2B marketplace, including for responsibly sourced coloured gemstones from some of the world’s most sought-after gemstone suppliers.

Multiple gemstone laboratory certificates can be uploaded for each gemstone. Additional tools allow gem buyers to filter for the parameters that matter most to them, such as their preferred gemstone laboratory, the country of origin (where known) or the mine of origin (where known).

Thereby, GemCloud facilitates integrity and confidence in the coloured gemstone sector, in turn, fostering industry growth, states Gemfields.

“In working closely with key industry participants, GemCloud will transform the way that coloured gemstones are bought and sold, spurring further growth for our industry. It is a natural evolution of innovation, and we strive to improve the industry and help businesses of all sizes to access and sell responsibly sourced coloured gemstones with competitive prices in a safe environment,” says GemCloud CEO and cofounder Veronica Favoroso.

Record Month

Gemfields achieved record revenues of $42.3-million following its auction of predominantly commercial quality rough emeralds from its Kagem mining operation, in Zambia. The auction ran from March 15 to April 1 this year in Jaipur, India.

Kagem is 75% owned by Gemfields and 25% by the Industrial Development Corporation of Zambia. The proceeds of this auction will be fully repatriated to Kagem, with all royalties due to the Zambian government being paid on the full sales prices achieved at the auction.

Fifty-six companies placed bids on the 32 lots offered, with all 32 sold at an average price of $9.37/ct – an all-time record for Kagem commercial quality auctions.

Gemfields product and sales MD Adrian Banks says this auction represents one of the most momentous outcomes he has experienced in his 23-year career.

“We’ve witnessed another breakthrough for Kagem emeralds, with an auction of predominantly commercial quality emeralds setting a new all-time revenue record for Kagem and surpassing even our higher-quality auctions,” he adds, noting that when Gemfields announced Kagem’s August 2021 auction results, the company pointed to a step change in market demand and in the prices bid by its customers, paving the way for an exhilarating cycle in the coloured gemstone sector.

This latest result underscores the significance of that step change, Banks states, highlighting that Gemfields is “delighted to see the coloured gemstone industry firing on all cylinders”.

Since July 2009, Gemfields has hosted 40 auctions of Kagem gemstones (emeralds and beryl), yielding a combined $792-million in revenues.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation