Phalaborwa Rare Earths Project, South Africa – update

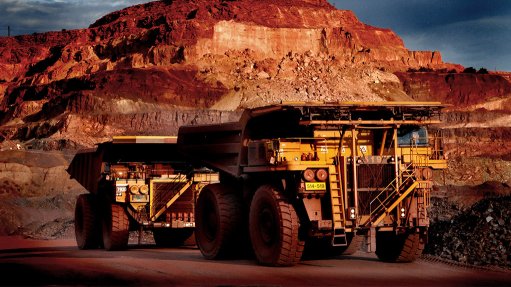

Photo by Rainbow Rare Earths

Name of the Project

Phalaborwa Rare Earths Project.

Location

Limpopo, South Africa.

Project Owner/s

London-listed Rainbow Rare Earths (85%).

Rainbow Rare Earths signed an agreement with phosphate mining company Bosveld Phosphates in June 2023 to ensure it obtains 100% ownership of the Phalaborwa project.

Upon completion of a definitive feasibility study (DFS), the unincorporated joint venture (JV) will be transferred into an incorporated JV company and, at Rainbow’s election, Bosveld will transfer all assets required for the project into that company.

Project Description

An interim economic study released in December 2024 proposed a project life of 16 years – two years longer than the one envisaged in the October 2022 preliminary economic assessment (PEA) – processing an average of 2.2-million tonnes of phosphogypsum a year.

The overall recovery rate of magnet rare-earth elements remains the same as that of the PEA, at 65%, based on the pilot campaign undertaken from 2023 to 2024, with about 1 900 t/y magnet rare earth oxide (REO) production.

The interim economic study represents a much higher level of confidence in the processing flowsheet prior to separation, and capital and operating cost estimates, than those of the PEA.

In addition to confirming the robust economics of Phalaborwa, the interim economic study has highlighted several areas for further operating and capital cost optimisation, which will be done in parallel with the ongoing rare earth separation testwork.

Potential Job Creation

Not disclosed in the interim study.

Net Present Value/Internal Rate of Return

When calculated on the same basis as the October 2022 PEA, the interim economic study delivers an after-tax net present value (NPV), at a 10% discount rate, of $611-million, in line with the comparable PEA NPV of $627-million.

Capital Expenditure

The interim economic study provides an updated, upfront capital cost of $326.1-million, which is lower than the PEA capital cost of $295.5-million, adjusted for inflation.

Planned Start/End Date

Production is expected to start in 2026.

Latest Developments

Rainbow has reported that after being in operation for about three months, its laboratory, in Johannesburg, is progressing well.

The laboratory is equipped with “state-of-the-art” technology that allows for the performance of leaching, ion-exchange, precipitation and separation testwork across the full Phalaborwa processing flowsheet.

Additionally, the laboratory features a “cutting-edge” inductively coupled plasma - mass spectrometer for analysis of samples taken from testwork, which enables the immediate assay of grades ranging from low parts per billion to high purity, to be reported internally.

Rainbow has said that this level of accuracy is vital for the evaluation of its separation testwork, noting that the laboratory is equipped to automate testwork where possible to ensure accurate and rapid results.

Turnaround times for these tests are, therefore, considerably faster than the typical 72 hours to three weeks experienced when using external providers.

This rapid turnaround ensures that testwork can be continuously advanced in a targeted and informed manner, based on previous test results.

By conducting the test- and assay work at in-house facilities, Rainbow has delivered significant savings, compared with using third-party providers and expects to pay back the modest cost of building the laboratory within a few months.

Testwork and associated work in recent months has been focused on undertaking trade-off studies for the leaching circuit to minimise operating and capital costs; maximising rare-earth recovery and impurity rejection through continuous ion exchange (CIX); and defining the optimal path to purification of the mixed rare-earth feed ahead of final separation.

The leach circuit is estimated to represent about 80% of the Phalaborwa flowsheet and therefore offers the best opportunities for cost optimisation.

While Phalaborwa's capital and operating costs are already considerably lower than the majority of the rare earth peer group, the work done during the project's interim study has identified areas where further testwork and trade-off studies have potential to reduce costs, making Phalaborwa even more resilient in terms of its economics, the company has said.

The key optimisation opportunities identified, which are expected to deliver savings in power, reagent, labour and capital costs, include replacing the three-stage 30 ˚C leaching circuit with a two-stage higher temperature leach circuit with reduced residence times; mechanical versus hydraulic reclamation of the phosphogypsum; on-site sulphuric acid plant as opposed to acid supplied from a third party; and the cost and supply resilience of third-party green energy versus Eskom power supply.

The company has indicated that it intends to use the results of the trade-off studies to provide the market with an update as to the potential impact on capital and operating costs for the project ahead of the DFS publication.

Further, Rainbow has said that the extensive piloting work conducted to date has established that the production of a high-grade, low-impurity feed stream to the separation process is key to achieving separated rare-earth oxides of the desired purity level.

The company has noted that the development of the leaching process has successfully managed impurity build-up in the leach solution to prevent the impact of impurities on the extraction of rare earths from the phosphogypsum.

The company has seen the benefits in using CIX as the primary process to recover the rare earths from the leach solution, which is expected to successfully reduce impurities in an efficient and cost-effective way, producing a low-impurity feed stream for separation.

Several resins and eluants have been tested at bench scale to select the configurations of the primary ion-exchange rare earth recovery circuit to be used for pilot-scale testwork.

Meanwhile, early testing is under way considering key impurity levels from the primary CIX and proven rejection techniques ahead of separation.

For the separation testwork, Rainbow has said that it is important that the leaching and recovery options are finalised to ensure a representative feed.

Ahead of the final purification results, early ion chromatography separation tests are under way to establish rare earth performance under various configurations.

These tests are expected to accelerate the development of the final formulation once the purification steps are complete.

Key Contracts, Suppliers and Consultants

ANSTO Minerals (plant processing testwork); K-Tech Inc (REO separation technology and partner in developing plant processing flowsheet, managing the back-end of the pilot plant at its US facility); Mintek (managing plant front-end in South Africa); and METC Engineering (production of the PEA and engineering work for the DFS).

Contact Details for Project Information

Tavistock Communications, on behalf of Rainbow Rare Earths, tel +44 20 7920 3150 or email rainbowrareearths@tavistock.co.uk.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation