Shuka’s secondary listing on JSE approved

Aim-listed Shuka Minerals has received formal approval from the JSE and the South African Reserve Bank (SARB) for a secondary listing of its ordinary shares on the JSE, with trading expected to start on May 22.

Shuka retains its primary listing on the Aim market of the LSE.

The JSE has granted approval to Shuka for a secondary listing, by way of introduction under the fast-track listing process, of its issued and fully paid ordinary shares of 1p each in the company on the AltX of the JSE.

Shuka will join the FTSE – Industrial Metals and Mining sector, sub-sector General Mining, under the abbreviated name Shuka and with JSE share code SKA.

Approval has also been received from the SARB for the secondary listing and classified the secondary inward listed ordinary shares as domestic for exchange control purposes.

South African resident shareholders must hold their ordinary shares on the JSE register subsequent to the secondary listing and may trade the ordinary shares on the JSE without having recourse to their foreign portfolio allowance.

The JSE has 50 listed mining companies, of which 33 are dual listed.

“We are delighted with the approval of our secondary listing in South Africa, which will facilitate direct investment in Shuka by South African residents.

“The listing will increase the potential investor pool and will enable improved liquidity and marketability of Shuka shares. It provides a platform for Shuka to market itself and become more visible in Southern and Eastern Africa, thereby providing Shuka with more access to institutions and funds within the region,” highlights CEO Richard Lloyd.

“Shuka is excited to be joining the JSE, the pre-eminent African stock exchange. The listing aligns with Shuka's focus on the African continent and we hope to attract a new investor group to the shareholder register as we progress development of operations in Southern and Eastern Africa,” he adds.

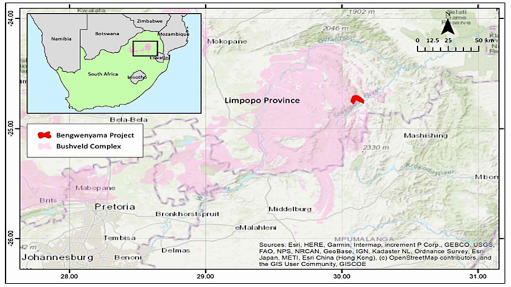

The company is focused on the discovery and development of copper, lead and zinc projects in Tanzania, Zambia, South Africa and other African countries.

Meanwhile, in a separate statement, Shuka sayid it had issued 1.63-million new ordinary shares to Gathoni Muchai Investments (GMI).

The new ordinary shares, which are being issued under existing share authorities at a 146% premium to the latest closing share price of 3.25p on May 6, is in lieu of £130 000 in fees owed to GMI under a consultancy agreement.

This issuance forms part of preparations for Shuka’s secondary listing on the JSE and supports liquidity by conserving cash resources.

Following admission, GMI will hold 20.04% of the company’s enlarged issued share capital.

“I am grateful for GMI's continued support and their continued faith in the future of Shuka, reflected in the premium at which they are willing to accept these shares in lieu of fees,” Lloyd says.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation