Simandou iron-ore project, Guinea – update

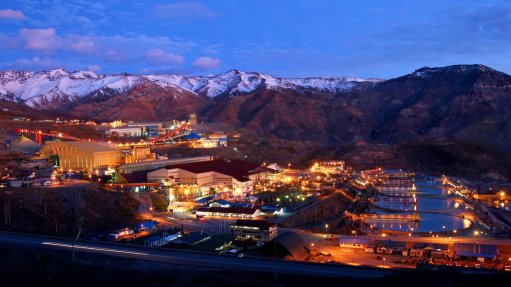

Photo by ©Bloomberg

Name of the Project

Simandou iron-ore project.

Location

Guinea.

Project Owner/s

Simandou’s mining concession is divided into four blocks.

The project is a partnership between Rio Tinto, Chalco Iron Ore Holdings (CIOH), and a Chinalco-led consortium, Winning Consortium Simandou (WCS), Baowu and the Guinea government.

SimFer Jersey Limited is a joint venture (JV) between the Rio Tinto Group (53%) and CIOH (47%). CIOH is a Chinalco-led JV of leading Chinese State-owned enterprises: Chinalco (75%), Baowu (20%), China Rail Construction Corporation (2.5%) and China Harbour Engineering Company (2.5%).

SimFer is the holder of the mining concession covering Simandou blocks 3 and 4, and is owned by the Guinean State (15%) and SimFer Jersey Limited (85%). SimFer Infraco Guinée will deliver SimFer’s scope of the co-developed rail and port infrastructure, and is a wholly owned subsidiary of SimFer Jersey Limited, but will be co-owned by the Guinean State (15%) after closing of the co-development arrangements.

WCS is a consortium of Singaporean company Winning International Group (50%), Weiqiao Aluminium (50%, part of the China Hongqiao Group) and United Mining Supply Group (nominal shareholding). WCS is the holder of Simandou North blocks 1 and 2 (with the government of Guinea holding a 15% interest in the mining vehicle and WCS holding 85%) and associated infrastructure. Baowu Resources has entered into an agreement to acquire a 49% share of WCS mine and infrastructure projects through a Baowu-led consortium, subject to conditions, including regulatory approvals. In the case of the mine, Baowu has an option to increase its shareholding to 51% during operations.

Project Description

The Simandou mine will be the biggest integrated mine-and-infrastructure project ever developed in Africa. It comprises three core elements: a mine, railway and port, as well as associated infrastructure.

The SimFer JV’s mine concession holds an estimated 2.8-billion-tonne mineral resource, of which 1.5-billion tonnes were converted to ore reserves that support a mine life of 26 years, with an average grade of 65.3%.

There will be an openpit iron-ore operation in the Simandou range, in south-eastern Guinea, with an expected peak production of between 95-million and 100-million tonnes a year.

WCS’s blocks 1 and 2 are expected to produce 40-million tonnes a year, and Rio's blocks 3 and 4 about 60-million tonnes a year.

WCS will build the project's estimated 536 km shared dual-track main line, a 16 km spur connecting its mine to the mainline and the WCS barge port, while SimFer will build the estimated 70 km spur line connecting its mining concession to the main rail line and the transshipment vessel port.

Associated developments to provide utilities and supporting infrastructure for the project include construction facilities, and access to materials, power generation, water, access roads and accommodation.

New infrastructure will become State property upon completion.

Construction of the project will be undertaken in two stages.

During the first stage, the southern Ouelaba mine site will be developed, which will include the construction of the railway and port to a capacity of about 60-million tonnes a year.

The second stage will result in the northern Pic de Fon mine site being brought on line and the capacity of rail and port facilities being expanded, increasing production to between 95-million and 100-million tonnes a year.

Potential Job Creation

Rio Tinto reported in October 2025 that the workforce across the SimFer scope of mine, rail and port had reached 25 200 with 82% Guinean participation.

Present Value/Internal Rate of Return

Not stated.

Capital Expenditure

At $23-billion, it is Africa’s biggest-ever mining project and could make Guinea the continent’s number-two exporter of minerals and metals by value.

SimFer's capital funding requirement for the Simandou project is estimated at $11.6-billion, of which Rio Tinto's share is $6.2-billion.

Planned Start/End Date

Operations at the project started in November 2025.

Latest Developments

Rio Tinto reported on December 8 that the first shipment from the Simandou project has set sail from Guinea.

Supply from Australia and Brazil, the two major iron-ore suppliers, accounts for 80% of China's iron-ore imports.

The share will likely fall with more supply from Guinea, analysts have said.

The near-month contract will face further pressure amid high supply, swelling inventory and diminishing demand, analysts at broker Xinhu Futures said in a note.

Key Contracts, Suppliers and Consultants

Fluor (construction contractor); NRW Holdings (earthworks contract); Komatsu and its regional distributor BIA Group (critical heavy mobile equipment, or HME, parts and maintenance services for the Simandou project, including five large production excavators, four production loaders and more than 30 ancillary HME vehicles, including dozers, water trucks and small excavators).

Contact Details for Project Information

Rio Tinto, tel +44 20 7781 2000 or email media.enquiries@riotinto.com.

SimFer media enquiries, email Abdourahama.Diallo@riotinto.com.

Chalco, tel +86 10 8229 8103.

WCS, tel +224 613 55 55 55 or email info@winningafrica.net.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation