South Africa uses more recycled plastics as recycling rates continue to improve

Plastics SA, the umbrella body representing the South African plastics industry, has released its latest annual plastics consumption and recycling figures for the year ending December 2024. According to Anton Hanekom, Executive Director of Plastics SA, the results show encouraging growth in the use of recycled plastics, despite persistent challenges within South Africa’s waste management system.

“The purpose of Plastics SA is to collectively enhance the South African plastics industry’s long-term growth and sustainability. Each year, we compile this report by conducting in-person interviews with raw material producers and plastic preprocessors (recyclers) across the country, ensuring that the data is accurate, verified and truly reflective of what is happening on the ground,” Hanekom says.

South Africa in the Global Context

In global terms, South Africa’s virgin plastics consumption represents approximately 0.4% of total global plastics consumption. However, South Africa remains the largest plastics industry in Sub-Saharan Africa, supplying products to neighbouring countries both directly and indirectly through local manufacturers.

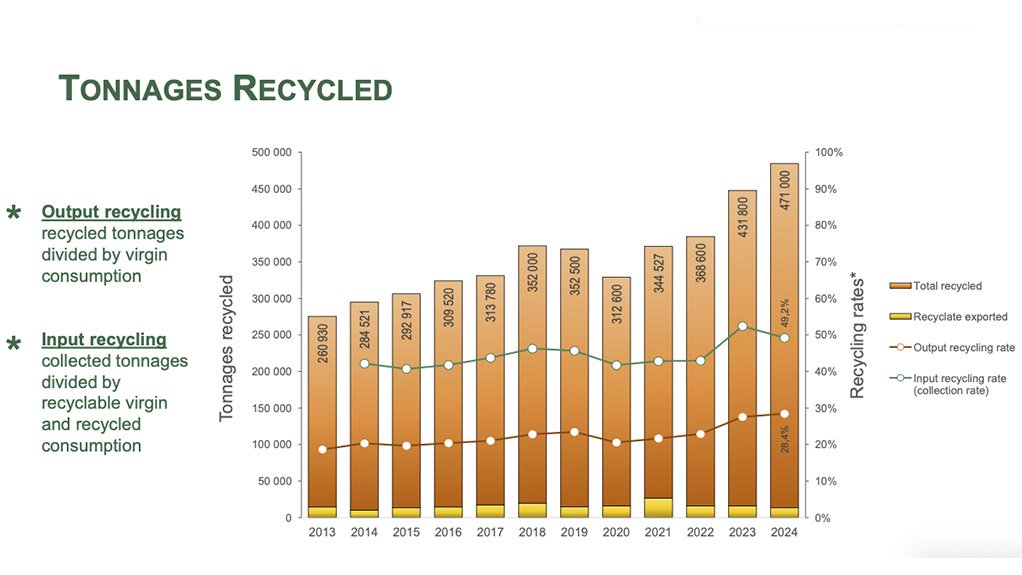

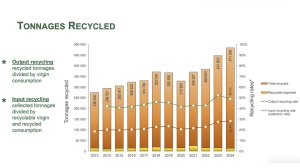

One of the most significant findings from the 2024 data is the continued shift towards recycled content. While virgin polymer consumption has grown steadily over the past decade, recyclate consumption has grown at a much faster rate, demonstrating the industry’s commitment to circularity.

“Over the last ten years, virgin plastics consumption grew by 18%, while recyclate consumption increased by an impressive 67%. This clearly shows that local reprocessors and manufacturers are actively supporting the transition towards a more circular plastics economy,” Hanekom explains.

Where Plastics Are Used in South Africa

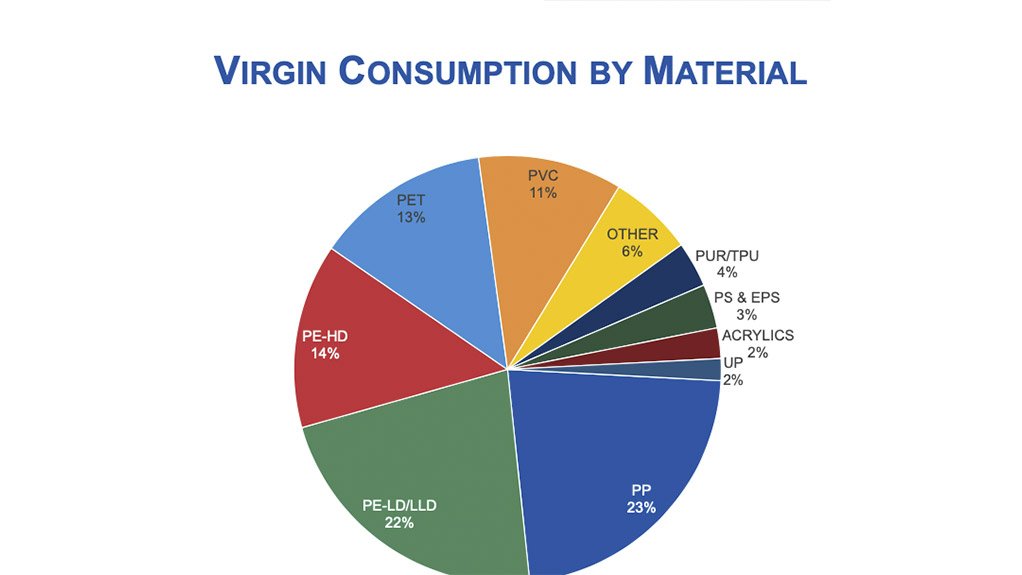

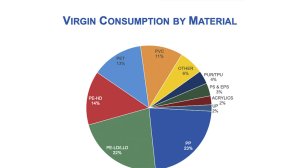

The packaging sector remains the largest consumer of plastics in South Africa, accounting for 49.4% of total plastics use, across both flexible and rigid applications. This is followed by building and construction (13.2%) and agriculture (10%).

“South Africa lacks a strong non-packaging plastics sector. Engineering, industrial and customised plastic products have the potential to generate higher margins and greater economic value. Yet we continue to import large volumes of finished plastic goods – including floor, wall and ceiling coverings, sheets, films, boxes, crates and builders’ ware – that could be manufactured locally to stimulate employment and local procurement,” he notes.

Key Recycling Highlights for 2024

- South Africa’s mechanical plastics recycling rate reached 28.4%, placing the country well above the global average and ahead of many developed economies when it comes to mechanical recycling.

- Total plastics recycled increased to 471 000 tonnes in 2024, continuing a steady upward trend over the past five years.

- Circular plastics content in new products rose to 22%, compared to just 16% a decade ago.

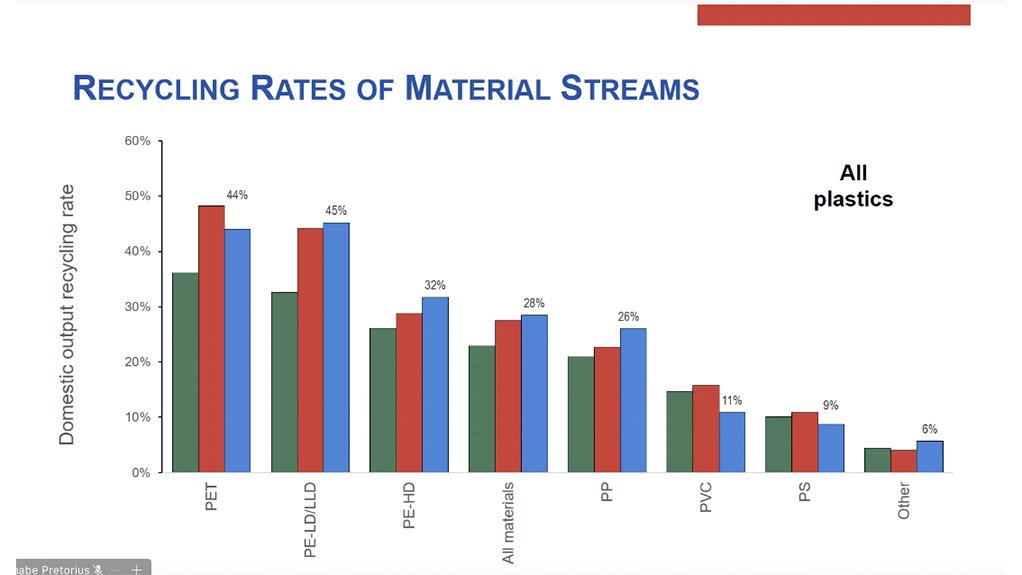

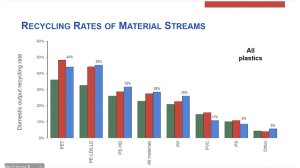

- Recycling volumes increased for most polymers, notably:

Low and Linear Low Density Polyethylene (LD / LLDPE): 166,692 tonnes

Polypropylene (PP): 96,838 tonnes

PET: 96,635 tonnes

High-Density Polyethylene (HDPE): 73,442 tonnes

- Post-industrially sourced recyclable waste increased from 17% in 2023 to 24% in 2024, reflecting greater recovery of cleaner waste directly from generators such as farms, contractors and distribution centres, rather than from landfill.

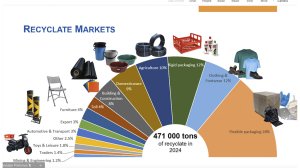

- End-markets for recycled plastics are becoming increasingly diverse. Key sectors include flexible packaging (28%), clothing and footwear (12%), and agriculture (10%), alongside applications in building and construction, furniture, toys and leisure products. No single market sector relies on only one material. Instead, recycled polymers are used across a wide range of end-markets, each selected to meet specific performance and fit-for-purpose requirements.

A System Under Pressure

Internationally, recycling is under pressure due to increasing collection and processing costs whilst virgin polymer prices plummet. Hanekom highlights that over the years, South African reprocessors have showed incredible tenacity and endurance to tough times and continued to grow despite the challenges they face.

“While South Africa’s recycling performance compares favourably with many countries, it remains highly dependent on manual collection and sorting, largely driven by waste pickers and small-to-medium recycling businesses. The recycling value chain in South Africa is long, fragmented and costly, largely due to inefficiencies in waste collection and sorting. Although this model delivers impressive recovery rates, it is also highly vulnerable,” he explains.

Furthermore, recycling growth is increasingly constrained by South Africa’s failing municipal waste management system, with an estimated 36% of households still lacking regular waste removal services.

“Recyclers cannot recycle what they do not receive. Contaminated waste, poor collection systems and a lack of separation at source result in valuable recyclable material ending up in landfills. In many cases, material that has already been collected is ultimately sent back to landfill due to sorting inefficiencies or contamination,” Hanekom explains.

Unlocking Further Growth

To enable further growth in recycling and strengthen South Africa’s circular economy, Plastics SA stresses the urgent need to:

- Fix municipal waste collection and sorting infrastructure

- Invest in and support local recyclers, particularly small and medium enterprises.

- Develop new end-markets for recycled plastics, especially beyond packaging

- Stimulate demand for recycled content through intentional product design and responsible procurement practices.

A Call for Collaboration

Plastics SA emphasises that no single stakeholder can address South Africa’s waste and recycling challenges alone. Meaningful progress will require stronger collaboration between government, industry, Producer Responsibility Organisations (PROs), recyclers and consumers.

“Recycling is not the problem – it is part of the solution. South Africa has proven that it can recycle. What we now need is a waste management system that works, markets that value recyclate, and policies that enable long-term investment in the circular economy so that this vital industry can continue to grow,” Hanekom concludes.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation