South Africa’s Hillside Aluminium continuing to go all out to decarbonise – South32

South Africa's aluminium needs to be decarbonised.

South32 aluminium and manganese in South Africa.

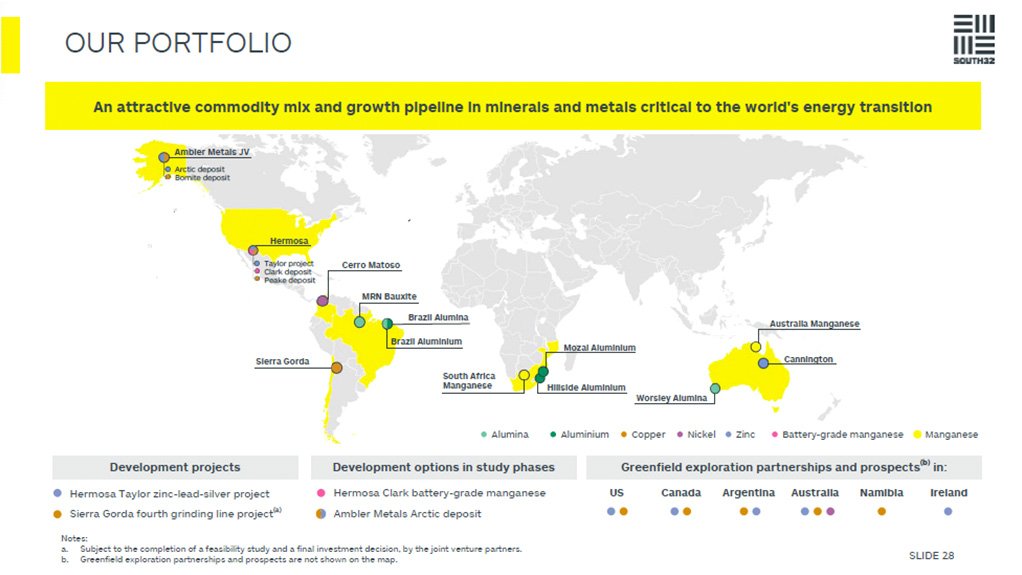

JOHANNESBURG (miningweekly.com) – While ‘high-carbon’ is the value-lowering label being put on aluminium from South Africa’s Hillside Aluminium in KwaZulu-Natal, the Sydney-, Johannesburg- and London-listed South32 benefits from the value-enhancing 'low-carbon' premium status of its other two aluminium producers, namely Brazil Aluminium and Mozal Aluminium.

The carbon-intensive description given to Hillside stems from its use of coal-fired electricity, but the good news is that competitive decarbonisation is continuing to be intensively investigated for Hillside, the largest aluminium smelter in the southern hemisphere and the producer of a good percentage of primary aluminium for South Africa’s value-adding secondary aluminium product producers.

As Hillside directly and indirectly supports more than 31 000 jobs and contributes nearly R10-billion to South Africa’s GDP, it would be a major advantage if optimum public-private attention could be given to ‘greening’ Hillside, which is responsible for a whopping 94% of South32’s total Scope 2 emissions, South32 CEO Graham Kerr spelt out in response to Mining Weekly questions following the company’s strong start to financial year 2025 (FY25), amid portfolio transformation to support the world’s clean energy transition.

“Engagement with government has been good,” Kerr revealed.

South32’s approach to climate change embraces operational and value chain decarbonisation.

“We’ve been studying this technically and commercially for many years to see what’s possible for the business,” South32 COO Noel Pillay emphasised.

“More recently that culminated in a request for information from the market, so we went to market to test what's possible, because our technical studies concluded that we could make Hillside work with solar PV and wind, obviously with backup investment.

“That process was actually over-subscribed, so lots of interest, and in isolation that was competitive. We are talking with Eskom, so there's various options we're looking at,” he said.

These include both nuclear and renewables, as well as investigating new renewables projects together with Eskom to establish the semblance of a one-stop shop.

“That's all work in progress with much more work to do to give us clarity on how we go forward,” Pillay pointed out.

Just energy transition considerations for Hillside require the switch to low-carbon energy to be planned in collaboration with a broad range of government and community stakeholders.

Meanwhile, investment has been made in the low-energy consumption AP3XLE technology.

“We’re trying to pull every lever that we can within what we can control and we’re halfway through converting all of our potcells to AP3XLE. But what we can control is very limited. The real issue here is the power source, which is what we’re working to find,” Pillay added.

FY25 production guidance for Hillside is 720 000 t, which on its own is considerably more than the combination of the 130 000 t expected from Brazil Aluminium and the 350 000 t from Mozal in Mozambique.

In the half-year, overall aluminium production increased by 5% and copper production by 16%, which enabled the group to capitalise on improved commodity prices, with underlying earnings increasing by 44% to $1-billion.

An interim ordinary dividend of $154-million was declared, with $171-million remaining to be returned to shareholders.

"We are focused on continuing our strong operating performance into the second half, unlocking value from our growth pipeline and continuing to reward shareholders as our financial performance improves," Kerr stated.

“Our second climate change action plan, to be released in August, will detail our approach and the actions we are taking to address the risks and opportunities that climate change presents for our business.”

Meanwhile, in the six months to the end of December, South32’s operational greenhouse-gas emissions declined by 9% to 9.5-million tonnes of CO2, reflecting last year’s sale of Illawarra Metallurgical Coal.

COPPER PLANS

Sierra Gorda continued to invest in studies and exploration to grow future copper production, including a feasibility study for the fourth grinding line project which has the potential to increase plant throughput by 20% to 58-million tonnes a year. The feasibility study and a final investment decision by the joint venture partners is expected in the first half of FY26.

Across the broader portfolio, $18-million was invested in greenfield exploration in pursuit of the next generation of base metals mines.

An alliance has been struck with Noronex to explore for copper in the Kalahari copper belt in Namibia and a 19.9% interest has been acquired in American Eagle, which holds an option to acquire a 100% interest in the Nakinilerak copper exploration prospect in British Columbia, Canada.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation