SPR to invest in Bushveld to progress Vanchem, provide financial stability

Aim-listed Bushveld Minerals has entered into a binding term sheet with investment fund Southern Point Resources (SPR) for a cumulative proposed investment of between $69.5-million and $77.5-million.

The binding term sheet describes the in-principal agreements between SPR and the group and the key provisions to be contained in the comprehensive legal agreements to be entered into.

The proposed package of inter-conditional transactions, if concluded successfully, will provide immediate working capital, the opportunity to retire (either entirely or partially) certain existing financing instruments, an equity investment from SPR into Bushveld Minerals, a marketing and working capital solution to replace the group’s existing arrangements as and when they expire over the coming 5 to 17 months, and the opportunity to recommission Vanchem’s Kiln 1.

The key terms of the investment entail, firstly, an interim working capital facility secured against production at the Vanchem plant, which is designed to provide Bushveld with additional working capital to fund the ongoing expansion of production at Vanchem while the transactions contemplated below are under way, totalling R150-million (about $8.1-million).

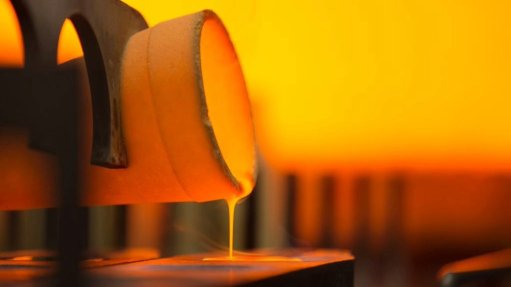

Secondly, there is the proposed purchase by SPR of 50% of the shares in Bushveld’s subsidiary that owns its Vanchem vanadium plant, and its 64% equity interest in its subsidiary that owns its Mokopane project, for about $25-million.

Thirdly, there is an equity investment by SPR of about $12.5-million into the company, at the same equity price as Orion Mine Finance.

Fourthly, there is a new marketing and sales arrangement under which SPR will be appointed to carry out all marketing and sales of products for Bushveld.

In line with this arrangement, SPR will provide a medium-term trade finance working capital facility to the company, totalling about $25-million to $30-million.

Fifthly, there is a potential future commitment by SPR of an investment of about $7-million to $10-million in Vanchem for the recommissioning of Kiln 1.

The rationale for this undertaking is to provide near-term additional working capital for the company at a time when production inputs have risen significantly, in light of the increased production at Vanchem, which will take time to translate into increased cash flows.

Moreover, it is for sufficient overall funding to enable Bushveld to strengthen its balance sheet by reducing gearing and generating free cash flow to fund its operations on a sustainable basis.

Vanchem will be managed by Bushveld Minerals with the support of SPR.

SPR has committed to invest between $7-million and $10-million in Vanchem for the recommissioning of Kiln 1 to increase output and reduce overall unit costs, providing a pathway for the group to further increase production beyond the base case and it will, therefore, be value accretive.

SPR also holds an interest in Highveld Robust Steel, a company that is in the final stages of acquiring and planning the resuscitation of the Highveld Steel complex, which would provide significant synergistic benefits for both SPR and Vanchem, the company says.

SPR envisages supplying vanadium-rich slag to Vanchem for processing at much lower and more efficient costs and higher outputs compared with run-of-mine ore.

Bushveld will share in the benefit of such optimisation.

SPR is also undertaking to develop Mokopane in the near term, reducing the company’s feedstock risk and input costs through an irrevocable life-of-mine supply agreement.

“I am pleased to announce this comprehensive transaction which will place the company in a much stronger financial position once complete – by providing necessary near-term working capital, reducing overall debt and assisting the business in meeting its short- to longer-term capital expenditure and optimisation requirements,” says CEO Craig Coltman.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation