Strategic partner financing the key to projects’ fortunes

Lack of access to capital is often the culprit for worthy projects going undeveloped. But this is not likely to be the fate of two Canadian projects being advanced by Fortune Minerals, which is pursuing a project financing strategy for both its Nico and Arctos projects that involves investment from strategic partners which require a reliable source of the commodities it produces.

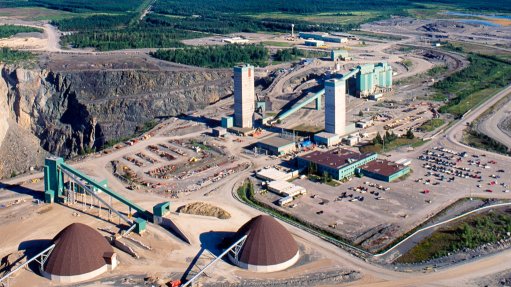

Fortune Minerals president and CEO Robin Goad tells Mining Weekly that detailed feasibility work has estimated the capital requirements for the development of its Nico gold/cobalt/bismuth/copper project at $440-million, and $788-million for the Arctos anthracite metallurgical coal project.

“Our financing plan was initiated a couple of years ago and successfully attracted Posco Canada, a subsidiary of South Korean steel producer Posco, as our first-stage partner for Arctos,” explains Goad.

Firm Financial Advice

He explains that Fortune has been working with Deloitte Corporate Finance Canada as its financial adviser, leveraging their significant Asian platform and existing relationships with the companies that it is targeting for investment.

“We have entered into confidentiality agreements with a number of qualified investors and discussions are continuing with a shortlist of potential partners toward our goal of securing all, or substantially all, of the required capital for both projects through strategic relationships. The process for both projects is advanced.”

The Posco transaction will provide for 20% of the capital required to develop the Arctos project and Fortune expects that the remainder of the project financing will be contributed by additional partners interested in securing a world-class high-quality source of anthracite coal that is required in many steelmaking and metal-processing technologies.

“If our plan is successful, Fortune will only be required to fund its corporate cash requirements and any unexpected shortfall from our strategic partnering process.”

Commenting on the deal with Posco, Goad explains that the South Korean company is the fourth-largest steel producer in the world and has received many awards and accolades as a lead innovator in the steel industry.

“Posco has been pursuing a strategy of minority investment in mines at the project level to vertically integrate and secure strategic sources of supply of the com- modities they need to operate. Their investment in Arctos is an important validation of the project as a key supplier of metal- lurgical coal for the global steel industry and of Fortune’s ability to successfully develop and operate it,” he says.

Goad says that China and other Asian governments recognise that they need to secure access to raw materials to maintain their growth and are supporting investment with encouragement from National Policy and provision of sovereign capital. Com-modities have also been demonstrated to be better investments than western currencies that are depreciating due to fiscal policies.

“Although Canada has concerns over sovereign government ownership of its important natural resources and com- panies, particularly in the oil and gas sector, Fortune’s model for minority equity investment from strategic partners in Asia is consistent with Canadian government foreign investment policies.”

Following the Posco transaction, Deloitte was re-engaged by Fortune.

“Deloitte is primarily an advisory firm and has a significant Asian platform with merger and acquisition personnel in all of the major global financial centres. It also has existing relationships with our potential strategic partners from their accounting and buy-side advisory work,” says Goad.

“Deloitte’s business philosophy is based on relationship-building with both buy-side and sell-side clients. This focus on relationships made them the right choice to help Fortune with our strategic partnering process. It is actively engaged in the process and is helping us advance toward our goal of securing additional partners for our Arctos and Nico projects.”

Project Progress

Goad reports that both projects are very advanced development opportunities that have proven and probable mineral reserves. Both have been successfully test mined, pilot-plant processed and assessed in positive bankable feasibility studies.

“We have advanced both of these projects to the permitting stage with collective expenditures totalling about $200-million, with the company successfully keeping control of both assets,” says Goad.

Nico is in the final stages of permitting for its mine and concentrator in the Northwest Territories and its refinery in Saskatchewan and the company expects to receive permits by midyear.

“Our goal is to have both projects in commercial operation by 2016, which if successfully executed, will materially benefit the nearby communities and jurisdictions and also leave significant off-site infrastructure as important lasting legacies from our developments. The most important future milestones are the receipt of material permits and securing the project financing,” explains Goad.

Market Demand

In terms of the market for its products, Goad says the company owns significant reliable Canadian sources of critical commodities that are required for basic industrial activity and for specialised products that need unique raw materials to manufacture.

“All of the commodities we will produce are experiencing substantial increases in demand as a result of emerging market growth and urbanisation. Supplies of most of our products are limited, or production is dominated by countries that are politically unstable, or might otherwise restrict supply due to resource nationalism,” he explains.

Anthracite is the highest quality of all coals, represents only 1% of global reserves, and is required in many steelmaking processes, such as for sinter, electric arc steel manufacturing and low volatile pulverised coal injection products. Its unique properties make it the most versatile coal and it is also used as a reductant in metals processing and to make high-purity carbon products for water purification filters, composites, urea fertilisers and synthetic fuels. Goad says that the traditional suppliers, namely China and Vietnam, are now net importers or have restricted exports to secure domestic use, respectively.

Cobalt is experiencing 8% yearly growth, primarily owing its use in high-performance lithium ion and nickel metal hydride batteries used in portable electronic devices and the pending proliferation of hybrid- electric automobiles. Demand is also increasing in alloys used in aerospace, cutting tools and magnets, as well as catalysts used in a number of industrial chemical processes such as petroleum refining. Goad reports that it is worth noting that 51% of current production is from the politically unstable Democratic Republic of Congo. Neighbouring Zambia accounts for another 12% of production, and globally about 15% of cobalt supply is sourced from higher-cost laterite deposits.

Bismuth is also experiencing significant demand growth owing to concerns over lead-toxicity. It is a nontoxic and environ- mentally safe replacement for lead in electronic and plumbing solders, other metal alloys, paint pigments, ceramic glazes and ammunition. Bismuth is also essential in a number of unique industrial applications. China accounts for 80% of world bismuth reserves and 73% of yearly production. “With Nico containing 15% of the global reserves, our project is a potential alternative source for manufacturers that have security of supply concerns. With 1.1-million ounces of gold, Nico also has an important highly liquid countercyclical hedge to the specialty metals contained in the deposit,” comments Goad.

Community Rules

Fortune Minerals supply chain manager Bill Shepard reports that the company has a First Nations first practice with respect to sourcing goods and services in the regions and communities of its projects.

“For example, 75% of the people that we have hired to work at our Nico camp since 2007 have been First Nations from the North. We seek to build unique relationships with the local Aboriginal economic development groups and businesses by designing our requirements to match local capacities. We introduce opportunities for employment and business contracts that help Aboriginal service providers participate competitively in the market place,” says Shepard.

He adds that a respect for Aboriginal culture is essential for a successful programme and the company’s relationship with the Canadian Council for Aboriginal Business (CCAB) demonstrates the steps it has taken in this regard.

By working within the CCAB’s Progressive Aboriginal Relations programme, the company has identified internal business practices that support its efforts. The process has also identified opportunities for improvement and, through mentorship provided by the CCAB and its membership, Fortune has been able to benchmark and adopt many world-class practices to enhance Aboriginal involvement.

Looking ahead, Goad says Fortune is a Canadian mineral development company pursuing its goal of becoming a successful mine operator and mineral processor.

“Our current focus is on the development of the Arctos and Nico projects and optimisation of these assets during operations. We are also focused on outstanding performance and growth of shareholder value through continued assembly and development of other high-quality mineral resource projects,” says Goad.

Visit Fortune Minerals at PDAC 2013 at booth #2837.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation