Theta changes funding strategy for South Africa project

Theta’s project is located next to the historical mining town of Pilgrim’s Rest, in Mpumalanga.

Junior miner Theta Gold Mines has changed its strategy on the project funding structure for its South African gold project, chairperson Bill Guy said on Monday.

The ASX-listed company has opted to fully redeem its A$6-million secured bonds with 2Invest, freeing up its project interest to be available as collateral for future potential project funders.

Theta will use funds from a $8-million private placement to redeem the bonds. The company has received $6-million from the first tranche of a two-tranche, $10-million placement to Hong Kong Ruihua Investment (HRIM), along with a firm commitment for an additional $2-million from institutional investors.

Theta said that HRIM remained committed to the second tranche of the placement for $4-million.

Theta has also decided not to proceed with the streaming transaction initially proposed with Sprott Streaming and Royalty. Instead, the company is now concentrating on negotiations with Yellow River, a subsidiary of Power Construction Corporation of China (PowerChina). The discussions revolve around a proposed engineering, procurement and construction (EPC) agreement, which includes 70% deferred payment terms for the construction of Stage 1 of its TGME gold plant and tailings storage facility.

In addition to the EPC negotiations, Theta is engaged in advanced talks with multiple project financiers. These discussions are aimed at securing the additional funding necessary to complete the capital expenditure required for the TGME gold project.

“The current gold price environment has changed the board’s strategy on the project funding structure. Our July 2022 definitive feasibility study was done based on gold price assumption of $1 642/oz and we have witnessed a significant rally in gold prices since that time,” said Guy.

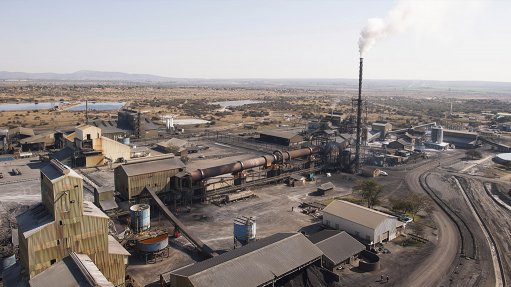

Theta’s project is located next to the historical mining town of Pilgrim’s Rest, in Mpumalanga.

Following small-scale production from 2011 to 2015, the company is currently focusing on the construction and financing of a new gold processing plant within its approved footprint at the TGME plant.

The company has completed a feasibility study released to the ASX two years ago, for the first four mines - Beta, CDM, Frankfort and Rietfontein. The base case comprises a 12.9-year mining operation and delivering 1.24-million ounces of contained gold.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation