Top gold miner Newmont plans job cuts in sweeping cost drive

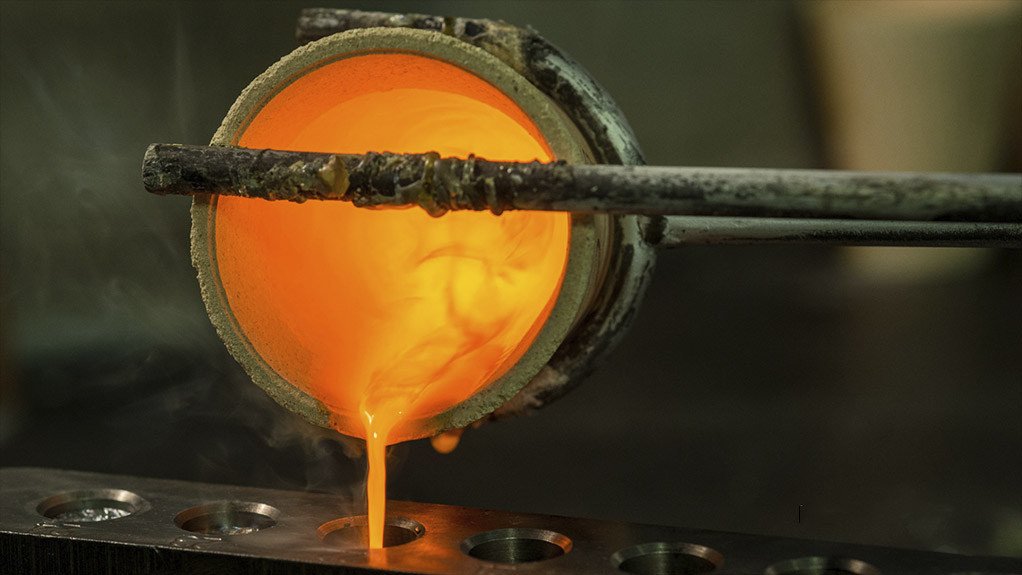

Newmont, the world’s largest gold miner, is studying plans to drive down costs that could lead to deep job cuts, following its $15-billion acquisition of Newcrest Mining in 2023.

The company’s costs jumped after the purchase took its portfolio of mines to about 20 and it expanded into copper mining. Newmont’s all-in sustaining costs per ounce — a key metric for gold miners — hit an all-time high earlier in 2025, eroding the earnings generated by record bullion prices.

Newmont has told managers it wants to be closer in line with its lowest-cost peers, according to people familiar with the matter. That would mean lowering costs by as by as much as $300 per ounce, or around 20%, the people said, asking not to be identified as the plans have not been made public.

While the company has not specified the number of jobs it intends to cut, that target could require Newmont to reduce its headcount by thousands, some of the people said. At the end of December, the company employed about 22 000 people, a figure that doesn’t include contractors.

Newmont has already started informing some staff about redundancies, the people said. Over the past few weeks, calls were held between executives and division managers on job cuts and other cost-cutting plants, including potentially curbing long-term incentives.

The company is still finalizing the cost-reduction plan and there is no certainty on how it will be implemented, some of the people said.

A spokesperson for Newmont said the company announced a cost and productivity improvement program in February. Moves to reshape its structure are one of several steps the firm is taking this year to reduce its cost base, the person added.

The biggest gold miners have cashed in on record bullion prices. The metal hit an all time high of about $3 500 an ounce in April and has mostly traded above $3 300 since then. That’s seen gold equities rally, with Newmont surging 95% this year.

Newmont’s all-in sustaining costs have risen more than 50% in the past five years, driven by higher energy, labor and material prices. In the second quarter, they were almost 25% higher than Agnico Eagle Mines, a rival which has established itself as one of the lowest-cost producers.

Newmont said last month that costs are within its guidance range this year, though it does expect them to increase in the second half of the year. CEO Tom Palmer told investors that the company was looking to make further improvements to its cost structure.

The worst of Newmont’s cost issues stem from its purchase of Newcrest two years ago, the people familiar said. Its Lihir operation in Papua New Guinea and Cadia mine in Australia have faced ongoing cost issues.

“The bigger challenge for Newmont was that all the Newcrest assets were at a tough part of their life-cycle,” said Bloomberg Intelligence analyst Grant Sporre. “They were and are still under-producing vs their employee base and need a lot of sustaining capex to catch up for the long period where Newcrest under-invested.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation