Triple Flag reports stable third-quarter performance

TSX- and NYSE-listed gold-focused, emerging senior streaming and royalty company Triple Flag Precious Metals sold 19 523 gold-equivalent ounces (GEO) in the third quarter, down slightly from the 20 746 GEO sold in the corresponding period in 2021.

Of this, gold comprised 11 918 GEOs and silver 6 134 GEOs.

This resulted in revenue of $33.8-million, down from the $37.1-million of the third quarter of 2021, while cash costs were $165/GEO – broadly in line with the same period in 2021.

As such, the company declared a quarterly dividend of $0.05 a share, payable on December 15.

However, Triple Flag’s third-quarter net earnings of $12.8-million were higher than the net earnings of $5.1-million from the corresponding 2021 period; equating to adjusted net earnings of $13.3-million, compared with $13.7-million in the third quarter of 2021.

As such, the company’s operating cash flow in the period was $25.4-million, down from the $29.5-million of the third quarter of 2021.

Adjusted earnings before interest, taxes, depreciation and amortisation in the period were $26.1-million, down from the $29.5-million of the corresponding 2021 period.

“Our results from the third quarter were broadly in line with expectations and we are expecting our full-year GEO sales to be towards the low end of our guidance range of 88 000 GEO to 92 000 GEO,” says CEO Shaun Usmar.

“Our portfolio has delivered year-on-year GEO increases in gold streams and royalties to date,” he adds.

However, Usmar notes that silver GEOs have lagged, primarily as a result of changes in delivery timing from Cerro Lindo, which is producing silver in concentrate in line with Triple Flag’s expectations for this year.

Nonetheless, he says a combination of a higher gold/silver ratio and changes in the quotational period associated with offtake contracts have impacted the timing of Triple Flag’s stream deliveries by several months on average.

“This points to a short-term timing impact in contrast to the robust underlying operational performance of the mine and portfolio as a whole.

“Our asset margins remain strong at 90%, our cash costs of $165/GEO remain low, and our production base is diversified across 15 producing assets,” says Usmar.

He explains that, with almost 90% of its assets situated in the lowest half of their respective industry cost curves, Triple Flag’s mining partners are well-positioned to weather inflationary pressures and the current volatile commodity price environment.

In terms of loan facilities, Triple Flag, on September 22, extended the maturity of the $500-million credit facility by three years to August 30, 2026, and increased the uncommitted accordion from $100-million to $200-million, for a total availability of up to $700-million.

Under the amendment, the London Inter-Bank Offered Rate benchmark interest rate was replaced by the Secured Overnight Financing Rate; while all other significant terms of the credit facility remain unchanged.

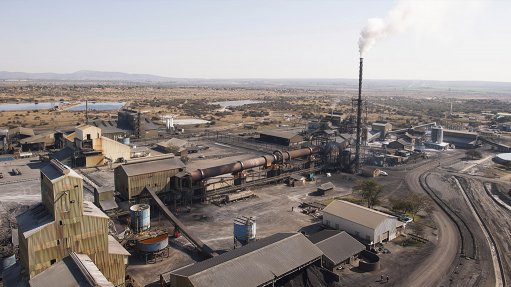

Triple Flag’s streaming assets are located in South Africa, Australia, the US, Canada, Mongolia, Colombia and Peru.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation