Understanding the Role of Precious Metals in Investment Portfolios

When markets get shaky, a lot of investors look for something solid, literally! That’s where precious metals come in. Gold, silver, platinum... they’ve been used to store value for centuries, and that hasn’t changed. While the economy evolves and new asset classes emerge, these metals still hold a firm place in modern investment strategies.

But why do precious metals hold such a special place in portfolios? How do they perform in different market conditions? And is there still a strong case for holding them in 2025 and beyond?

Why Investors Still Turn to Precious Metals

Precious metals aren’t just about nostalgia or tradition. They play a very specific role in a well-balanced portfolio. Here's why they continue to attract serious attention from both individual and institutional investors.

1. Hedge Against Inflation

When inflation rises, currencies lose purchasing power. Precious metals, particularly gold, tend to hold their value. That makes them an effective hedge when other asset classes are under pressure.

2. Portfolio Diversification

Metals often move independently of stocks and bonds. When markets fall, gold and silver may rise or at least remain steady, providing balance and reducing overall portfolio risk.

3. Safe Haven During Volatility

Geopolitical tension, economic uncertainty, or sudden market shocks usually trigger a flight to safety. Investors often move capital into precious metals during these times, boosting their value.

4. Tangible Value

Unlike shares or digital assets, metals are physical commodities. You can hold them, store them, and trade them worldwide without counterparty risk.

5. Liquidity and Accessibility

Thanks to technology and modern commodities trading, investors no longer need to buy physical gold bars or silver coins. You can gain exposure to precious metals through futures, ETFs, CFDs, or even digital representations, making it quicker and more efficient than ever.

Gold - The Flagship Metal

Gold is the most well-known and widely held precious metal. It has a long history as a store of value and plays a critical role in central bank reserves. But its relevance goes beyond symbolism.

Price behaviour

Gold usually rises during economic instability and dips when the global economy is stable and interest rates are high.

Use case in portfolios

It’s often used as a long-term store of value and a tool for hedging inflation or currency depreciation.

Modern access

Through trading platforms, investors can now go long or short on gold using derivatives, with no vault required.

Silver - The Dual-Purpose Metal

Silver is both a precious metal and an industrial one. It’s used in electronics, solar panels, and medical equipment, so its price reflects both market sentiment and real-world demand.

Price behaviour

More volatile than gold due to its industrial link, but this also presents opportunities for short-term traders.

Use case in portfolios

A way to diversify within the metals category, silver offers exposure to both investment demand and economic growth trends.

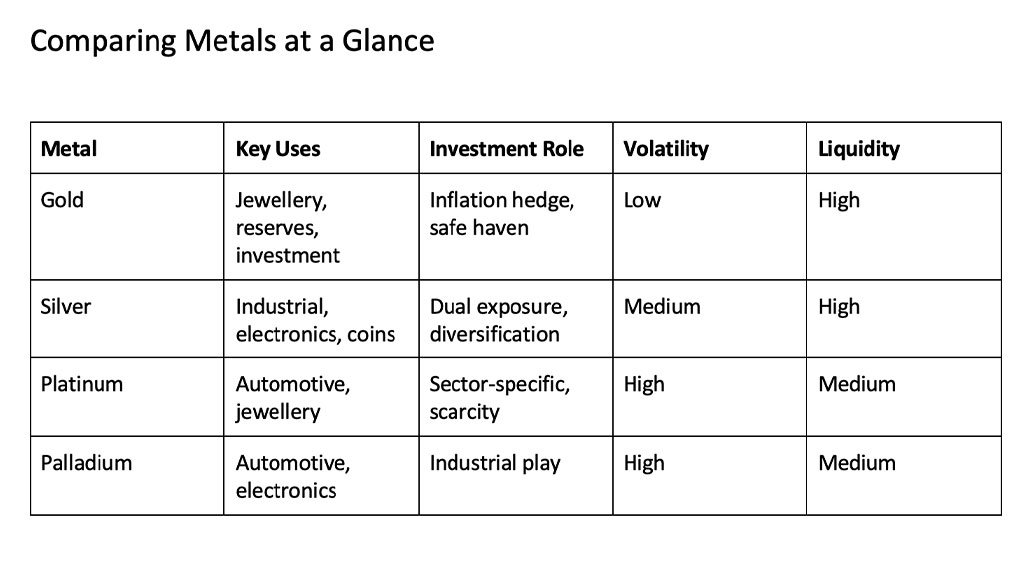

Platinum and Palladium - The Specialists

While not as commonly discussed, platinum and palladium are increasingly seen as smart plays for those looking to diversify further within commodities.

Both are heavily used in the automotive industry, particularly in catalytic converters, as well as in some green technologies. This makes them sensitive to supply chain dynamics and the pace of technological shifts.

Price behaviour

They’re more niche, so liquidity can be lower, but price movements can be sharp and rewarding for active traders.

Use case in portfolios

Useful for sector-specific exposure or as tactical trades in response to supply shortages or industrial growth.

How Precious Metals Perform in Different Markets

One of the most compelling arguments for precious metals is how they behave across different market cycles.

- During inflationary periods, gold and silver tend to outperform, especially when fiat currencies weaken.

- During market crashes, metals often hold their ground or rise slightly, helping cushion overall portfolio losses.

- In stable, high-growth environments, equities usually take the lead, and metals may lag but they still serve as insurance.

- When interest rates rise, metals might dip temporarily, as fixed-income investments look more attractive, but long-term demand often rebounds.

No asset class performs perfectly all the time, but precious metals tend to thrive when you need them most.

Including Metals in a Modern Portfolio

You don’t need to store physical gold bars or silver coins to invest in precious metals today. There are several practical ways to gain exposure:

Many investors use ETFs or index funds that track the price of metals like gold or silver. These funds allow you to participate in price movements without dealing with storage or security concerns.

Others prefer trading futures contracts, which offer leveraged exposure to metal prices, though these are typically suited to more experienced investors due to their complexity and risk.

Contracts for Difference (CFDs) are also widely used for short-term trading. They let you speculate on price changes without owning the actual metal, making them a flexible option for active traders.

Some choose to invest in mining stocks, gaining indirect exposure through companies that produce precious metals. This route carries additional risk, as it ties your investment to the performance of a business rather than just the commodity price.

For those who want easy access to multiple asset classes, including metals, forex, and indices, trading platforms like Eurotrader offer a centralised way to manage and diversify investments without juggling multiple accounts.

Still Worth Their Weight?

In a world where markets are more connected and more fragile than ever, precious metals remain a strong contender for portfolio inclusion. When inflation bites, markets wobble, or currencies slide, they’re often the anchor that keeps a portfolio grounded.

Used wisely, precious metals can act as both a shield and a springboard, protecting against risk while offering opportunities when the timing’s right. Whether you’re trading short-term moves or building a long-term hedge, they’ve earned their place.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation