Vale weighs IPO of metals unit after sale of 10% stake

Vale is considering a spinoff or initial public offering of its sprawling base metals business after it completes the sale of a minority stake, according to people familiar with the situation.

The Brazilian mining giant is in talks to sell a 10% stake in the unit and expects final bids in that process to be submitted by mid-April, said one of the people, who asked not to be identified because the deliberations are private. Once the transaction is completed, Vale will likely list the unit or spin it off in 2024, the person said.

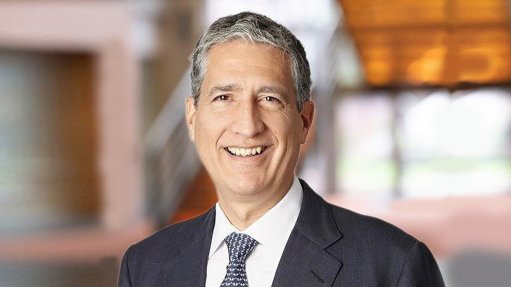

The company has approached Mark Cutifani, a former CEO of Anglo American, about becoming chair of the base metals business, the people said. Vale is also considering other options and there’s no guarantee Cutifani will be offered the job or accept it, according to the people. There is also no guarantee the listing or spinoff will go ahead, they said.

Vale declined to comment.

Vale, which makes most of its money from iron ore, has spent years trying to unlock what it sees as hidden value within its copper and nickel mines in Canada, Brazil and Indonesia. Demand for the battery metals is set to boom as the world moves away from fossil fuels.

General Motors, Mitsui & Co. and Saudi Arabia’s Public Investment Fund are weighing offers for the 10% stake, people with knowledge of the matter said earlier. Automakers are among Vale’s main clients as they try to secure access to strategically important metals amid a shift to electric vehicles. Vale is already a direct supplier for Tesla and GM, and it has signed Ford Motor Co. as one of its partners to jointly develop a nickel project in Indonesia.

Cutifani, who left Anglo last year after almost a decade in charge, led the mining company through one of the most tumultuous periods in its more than 100-year history. It was on the brink of collapse in 2015 due to high debt levels and a collapse in commodities prices. He then oversaw a dramatic recovery as prices for many of the products it mines rose to a record, and he positioned Anglo for growth.

Cutifani previously managed Vale’s Sudbury operations when he was chief operating officer of Inco, the Canadian miner acquired by Vale.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation