Valterra’s third-quarter volumes dip but it expects these will recover soon

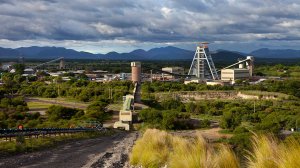

London- and Johannesburg-listed Valterra Platinum has successfully reached steady-state production at the Tumela Lower section of the Amandelbult mine, in Limpopo, marking the completion of the mine’s recovery to full production after flooding occurred in February.

The Tumela Lower ramp-up resulted in a 118% quarter-on-quarter increase in Amandelbult’s production to 153 100 oz; however, production lagged 3% on a year-on-year basis owing to lower tonnes milled and a lower head grade.

The company has set the mine’s full-year production guidance at between 450 000 oz and 480 000 oz of platinum group metals (PGMs) as the mine enters its last production quarter for the financial year ending December 31.

Valterra advises in a production report for the third quarter ended September 30 that its own-managed mines’ PGM production decreased by 2% year-on-year to 539 600 oz in the quarter owing to lower output from the Mototolo, Amandelbult and Unki mines.

Mototolo’s PGM production decreased by 11% year-on-year to 66 200 oz owing to lower tonnes milled and reduced grades. Valterra says production was impacted by anticipated complex geological features encountered at the Borwa and Lebowa shafts, which temporarily affected crew efficiencies and mining grades.

At Unki, production declined by 8% year-on-year to 57 500 oz, mainly owing to lower grades in the current mining area.

At the company’s 50% own-mined Modikwa PGM operation, production decreased by 7% year-on-year to 37 000 oz. This was owing to lower concentrator recoveries following the introduction of openpit material, which replaced volumes from South 1 shaft infrastructure that was closed in the first half of the year.

Refined PGM production also decreased by 5% year-on-year to 981 500 oz owing to lower metal-in-concentrate (M&C) production and a larger drawdown of excess work-in-progress inventory in the prior period.

Including tolling, refined production decreased by 5% year-on-year to 981 500 oz. Excluding tolling, refined production decreased by 11% year-on-year.

Valterra’s M&C production decreased by 7% year-on-year to 855 100 oz in the reporting quarter, mostly owing to the Kroondal operation’s transition to a tolling arrangement from September 2024.

The group’s PGM sales volumes decreased by 9% year-on-year to 936 800 oz in the quarter under review, when excluding Kroondal, but decreased by 15% including Kroondal.

Meanwhile, the company’s nickel production decreased by 15% year-on-year to 6 226 t, while copper production decreased by 9% to 4 201 t. Valterra says the prior comparable quarter included a larger release of work-in-progress inventory.

Total chrome production increased, however, by 10% year-on-year to 271 000 t owing to higher volumes at Mototolo and improvements in yields across other operations.

Valterra benefited from a higher average realised basket price of $1 916/oz in the reporting quarter, which was 30% higher year-on-year and the highest average realised basket price since the first quarter of 2023.

CEO Craig Miller says the PGM price rally reflects a confluence of bullish macro-, micro- and sectoral drivers, including a weaker US dollar, robust precious metals investment amid rising inflationary fears and heightened geopolitical tensions, buoyant Chinese demand and concerns over metal availability in key trading centres.

Valterra remains on track to deliver full-year M&C production of between three-million and 3.2-million ounces, with its own operations accounting for about two-million ounces of the volume.

The company expects its refined production and sales volumes to be about 3.4-million ounces for the full-year.

Miller comments the company is satisfied with the continued recovery in the group’s quarterly M&C production volumes following some significant weather-related incidents earlier in the year.

“We have identified opportunities to optimise our work-in-progress inventory, which, combined with the benefits of our stable and efficient processing assets, will allow us to supplement M&C production. This should result in higher refined production and sales volumes.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation