Well-endowed South Africa has huge opportunity ‘right now’ to grow mining sector

Minerals Council South Africa CEO Mzila Mthenjane.

Photo by Creamer Media

State of Mining In South Africa presentation to Parliamentary Committee.

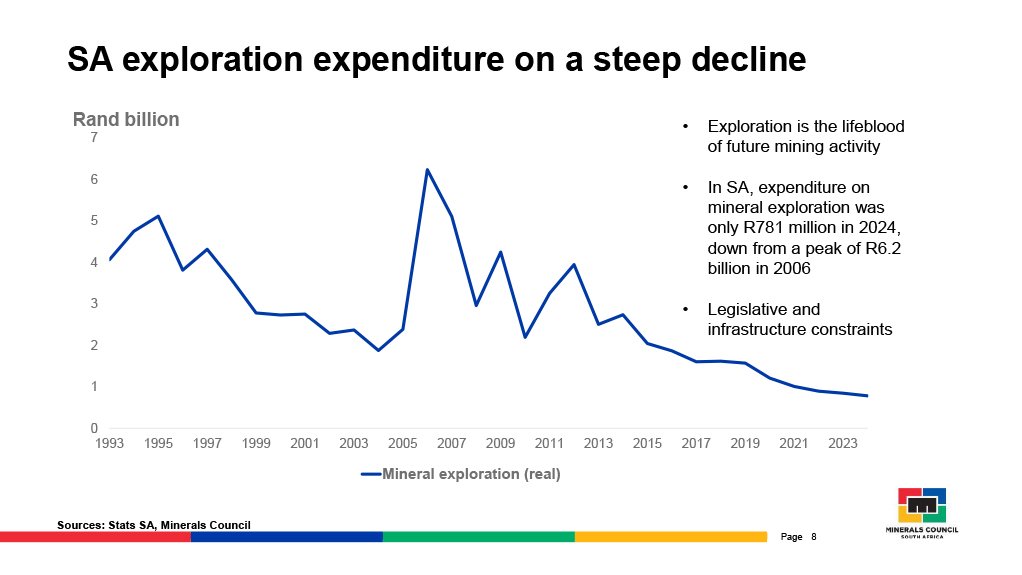

Exploration decline.

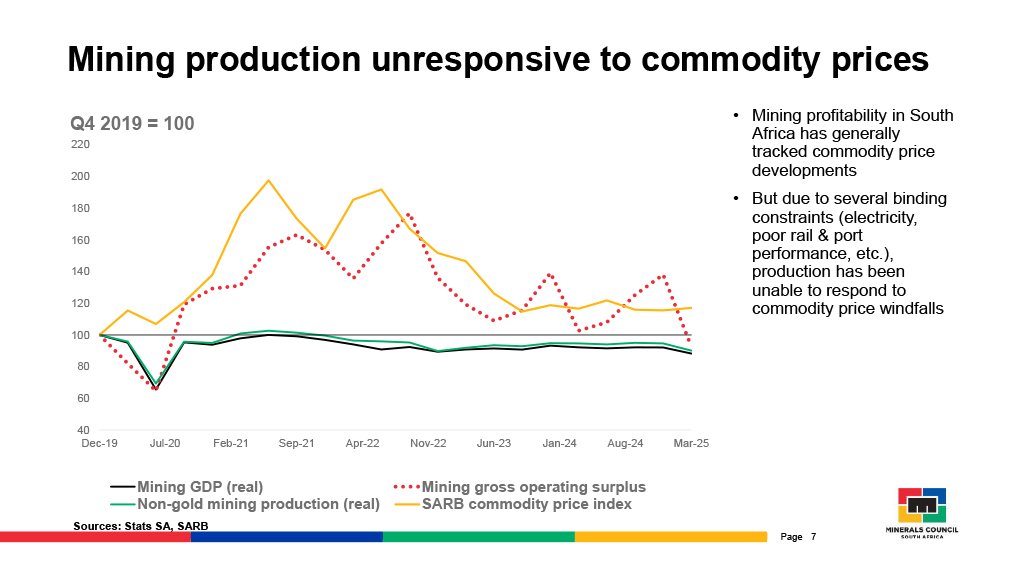

Mining production.

Parliament’s Portfolio Committee on Minerals meeting chaired by Mika Mahlaule.

Photo by Creamer Media

JOHANNESBURG (miningweekly.com) – South Africa has a huge opportunity “right now” to grow its mining sector so that mining is able to provide prosperity for the entire nation, Minerals Council South Africa CEO Mzila Mthenjane emphasised to Parliament’s Portfolio Committee on Minerals on Tuesday, July 1.

Delivering a State of Mining in South Africa presentation to the committee chaired by Mika Mahlaule, Mthenjane was also quick to add, however, that to generate that nation-wide prosperity “we do need to acknowledge our current weaknesses”, which he outlined as including limited exploration investment, rising electricity costs that increase operational expenses, dependence on Eskom’s coal-fired power that presents environmental, social and governance (ESG) risk, inefficient transport that lowers competitiveness, slow licensing processes that deter investment, and a lack of advanced mining technology skills owing to the migration of expertise.

“The South African mining industry remains a key pillar of South Africa's economy. Whilst it has experienced a recession as a result of issues related to electricity and logistics, we're seeing a very, very positive collaboration within business itself, and more importantly, at a national level.

“The efforts of Operation Vulindlela and more recently Operation Vulindlela 2.0 are beginning to show results where electricity and logistics are concerned, and I think we're also going to begin to see some very positive crime and corruption results.

“Our mining industry is one that has been operating for more than 100 years, and this is one of the key strengths that we need to leverage today and going into the future.

“We need to act with speed and it’s something that should bring us all together in what I'd like to think is politics and profit for the benefit of our people in South Africa and the region,” Mthenjane pointed out.

SOUTH AFRICA’S STRENGTHS

South Africa strengths, he said, centred on being a leading global producer of platinum group metals (PGMs), manganese, and chromium, plus having significant remaining gold reserves that could be pursued using technology.

South Africa’s hosting 80% of global PGM reserves, exportation of large volumes of manganese and production of chromium at global scale were supported, he outlined, by high-grade ores contributing to competitive on-mine costs and efficient processing capabilities, including those of a value-adding kind.

Bad maintenance drawbacks must be overcome to enable road, rail, and port infrastructure already in place to improve export competitiveness.

He also pointed to the plus points of South Africa’s active patent development, strong extraction and processing skillsets, and the emerging adoption of advanced extraction and processing technologies across different minerals.

SOUTH AFRICA’S OPPORTUNITIES

Mthenjane highlighted the opportunity to leverage off global demand for copper, chromium, manganese, and PGMs, which is being driven by renewable energy, electric vehicles and battery storage.

“Expansion into clean-energy metals can drive sector growth and attract investment,” he pointed out, “and downstream beneficiation and value-addition strategies can increase profit margins and export value.”

South Africa also had the advantage of being able to leverage by-products to diversify revenue streams and enhance the economic viability of mining operations and junior mining companies were already pointing to growth potential in underexplored areas.

Re-establishing abandoned mines and expanding existing operations present the opportunity to increase critical mineral output.

Improved resource custodianship can increase the reserve size and extend life-of-mine duration. Investing in solar and wind energy can reduce operational costs and improve ESG ratings. Improved ESG performance can attract responsible investors and enhance security of supply. Adoption of automation, AI, and digitisation can improve mining efficiencies. And collaborative R&D with universities and OEMs can position South Africa in mining innovation, were all points prominently displayed on presentation slides.

SOUTH AFRICA’S WEAKNESSES

Lower grades in existing copper and gold reserves, leading to higher extraction costs and declining mine lives, featured on South Africa’s list of mining weaknesses, as were the scarcity of new reserve discoveries, and the relatively small copper and iron-ore reserves compared with competitors.

Mining Charter changes and policy inconsistencies were condemned as deterring investment. Uncertainty around carbon tax policies was decried, as was low female participation in the workforce.

THEN THE THREATS

Threats identified included those arising from Australia’s iron-ore strength, Chile’s copper brawn, as was Russia’s larger PGM reserves and lower production costs.

Price volatility in global gold, PGMs and manganese were also cited as having the power to impact investment and revenues, along with loadshedding and unreliable power supply posing production and cost risk.

Failure to improve ESG performance posed investment loss and supply chain exclusion. Carbon border adjustment mechanism, or CBAM, tariffs from the EU put high-emission products at cost risk.

Labour strikes and wage disputes presented production and time-loss risk, and product theft, illegal mining and procurement mafias also present peril.

Meanwhile, poor service delivery by government was exacerbating poverty, inequality and social disorganisation.

ENABLING A JUST ENERGY TRANSITION

The Minerals Council was unequivocal to the Parliamentary committee about its members being supportive of climate change abatement, while ensuring a Just Energy Transition was anchored on social justice, inclusion and environmental restoration.

Social and Labour Plan and Closure Plan projects are being leveraged towards just transition outcomes and the repurposing of mined land was presenting opportunities in agriculture, agroforestry, renewable energy, human settlement developments, biodiversity corridors, light industrial and commercial zones, and training campuses.

Automation and electrification and critical minerals opportunities needed for the low-carbon world were among the many revelations displayed in an array of Minerals Council slides.

PARTNERSHIPS WITH GOVERNMENT ENTITIES

The Mandela Mining Precinct (MMP), the Council for Scientific and Industrial Research (CSIR) and Mintek were singled out for special mention as government entities that have formed partnerships with Minerals Council South Africa.

The council’s largest sectoral public-private partnership is with the MMP where the focus is on sustainability of mines, technology and a people-centric approach to change.

The working relationship with the CSIR centres on the competitive extraction of minerals, and the memorandum of understanding being struck with Mintek includes critical minerals processing and beneficiation.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation