White Pine North project, US – update

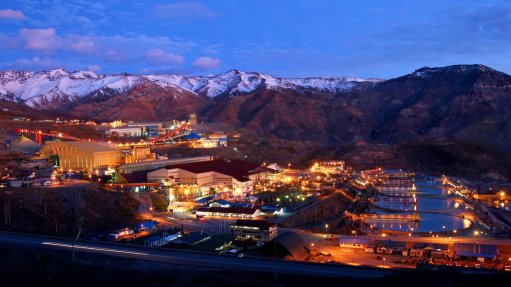

Name of the Project

White Pine North project.

Location

Michigan, US.

Project Owner/s

A joint venture (JV) between Kinterra Copper USA (66%) and Highland Copper Company (34%).

Project Description

A robust set of preliminary economic assessment (PEA) results has established a path for White Pine North advancement. The project is the extension of the historical White Pine mine, which operated from 1953 to 1995.

The PEA considers White Pine North as a standalone project, where potential synergies with the company’s Copperwood development are not considered.

The mine will comprise the Eastern, Center and Western sectors.

The proposed mine has 21.8-year mine life, with average life-of-mine payable copper production of 93.5-million pounds a year and 1.2-million ounces of silver a year.

The PEA envisions that the deposit will be mined with a mix of conventional highly mechanised, drill-and-blast and continuous mining room-and-pillar mining methods.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $821-million and an internal rate of return of 20.8% at a copper price of $4/lb.

Capital Expenditure

Initial capital expenditure is estimated at $615-million.

Planned Start/End Date

Not stated.

Latest Developments

Highland Copper will sell its 34% interest to JV partner Kinterra Copper for a total of about $30-million.

The transaction follows its earlier announcement in November 2024 and is governed by a membership interest purchase agreement with Kinterra.

The total consideration comprises $18.3-million in cash, net of the outstanding principal and accrued interest on a loan previously advanced by Kinterra to Highland Copper’s wholly owned subsidiary, Upper Peninsula Copper Holdings.

The loan balance is expected to amount to about $11.7-million at closing.

As part of the agreement, the parties have also agreed to suspend cash calls under the White Pine joint operating agreement. Highland Copper will not be required to fund cash calls through to closing, with any such amounts to be recorded and allocated between the parties only if the transaction does not proceed.

Highland Copper has said proceeds from the sale will be used to fund planned corporate activities and work at its Copperwood project, eliminate existing debt and streamline the company’s overall corporate structure.

The parties are targeting January 2026 for the closing of the transaction, with an outside date of February 27, 2026. Completion remains subject to customary closing conditions.

Key Contracts and Suppliers

None stated.

Contact Details for Project Information

Highland Copper, email info@highlandcopper.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation