Wicheeda rare earth element project, Canada – update

Photo by Defense Metals Corp

Name of the Project

Wicheeda rare earth element project.

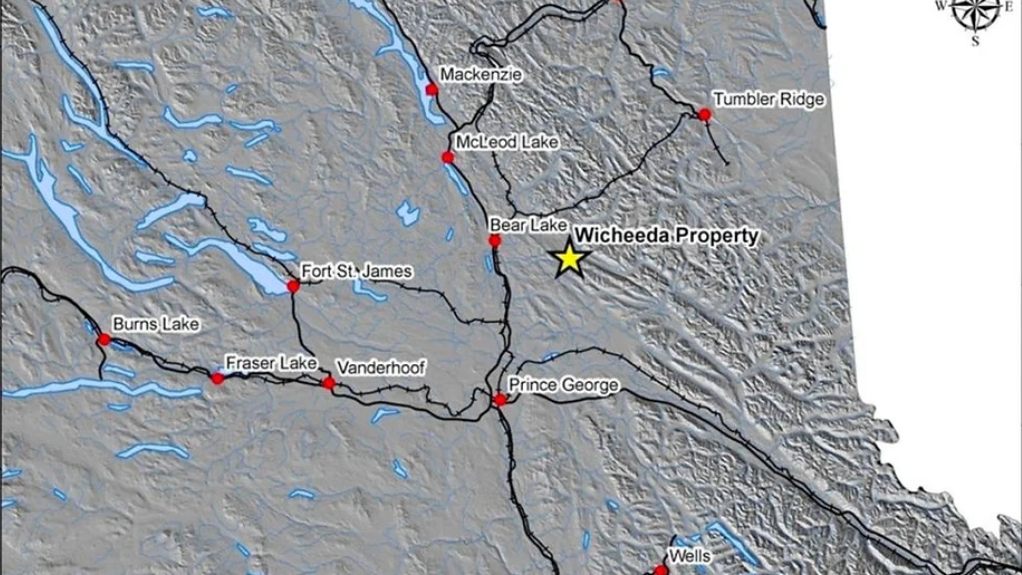

Location

North-east of Prince George, in British Columbia, Canada.

Project Owner/s

Exploration and rare earths development company Defense Metals Corp.

Project Description

Wicheeda is one of the most advanced undeveloped rare earth projects in North America and Europe. The project has proven and probable reserves of 25.46-million tonnes grading 2.43% total rare-earth oxide (TREO), 961 parts per million (ppm) praseodymium oxide, 2 661 ppm neodymium oxide, 11 ppm terbium oxide and 33 ppm dysprosium oxide. The project’s reserves support a 15-year life-of-mine with an average production of 31 900 t/y of TREO in concentrate, yielding about 5 200 t of TREO in a high-value mixed rare-earth carbonate after the removal of cerium and lanthanum.

Mined ore will be crushed at a facility near the pit and transported by conveyor to sustain a 1.8-million-tonne-a-year mill feed to the on-site flotation plant. The plant will produce a high-grade rare earth mineral concentrate averaging 50% TREO.

Waste rock will be placed in a waste rock storage facility adjacent to the pit.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of $1.8-billion and an internal rate of return of 24.6%, with after-tax payback of 3.7 years from the start of construction.

Capital Expenditure

Initial capital is estimated at $1.4-billion.

Planned Start/End Date

Not stated.

Latest Developments

Defense Metals announced a letter of interest from Export Development Canada (EDC) on June 5 that could result in up to $250-million in debt financing committed towards project development.

The nonbinding letter positions EDC as a potential mandated lead arranger in the financing structure for the project, which is being advanced as a strategic source of critical minerals for the global clean energy and defence sectors.

Defense Metals completed a prefeasibility study in April, confirming the project’s strong economics and development potential.

Key Contracts, Suppliers and Consultants

Hatch and SRK Consulting (PFS).

Contact Details for Project Information

Defense Metals Corp senior VP, corporate development and interim CFO Alex Heath, tel +1 604 354 2491 or email alex@defensemetals.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation