Zanaga iron-ore project, Congo-Brazzaville – update

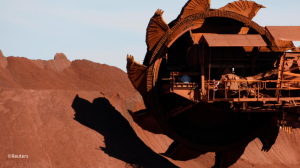

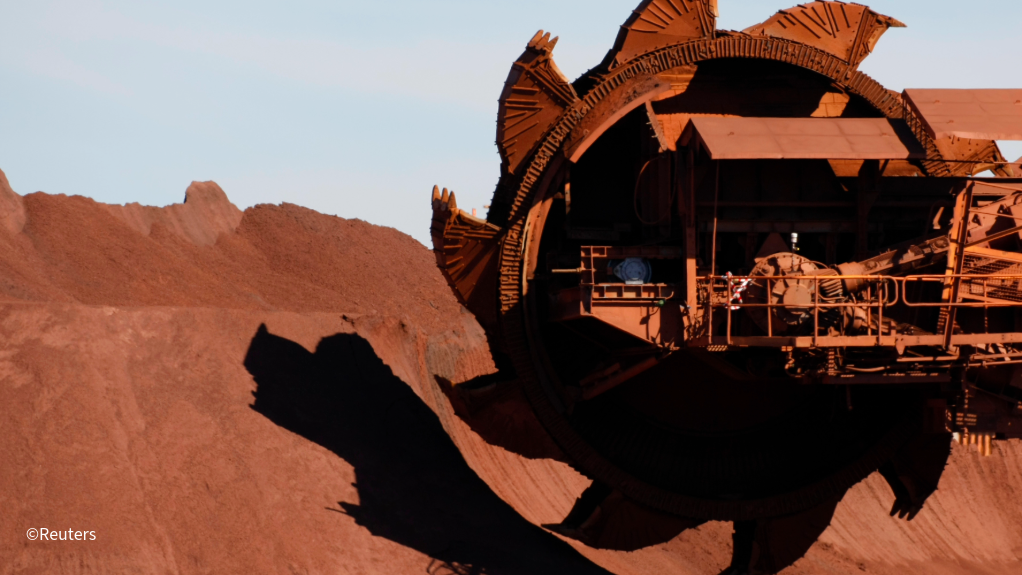

Photo by ©Reuters

Name of the Project

Zanaga iron-ore project.

Location

The Zanaga project is located 30 km west of Zanaga, a regional centre of the Lekoumou department of Congo-Brazzaville.

Project Owner/s

Iron-ore exploration and development company Zanaga Iron Ore Company (ZIOC).

Project Description

The Zanaga project hosts one of the largest iron-ore reserves in the world with a Joint Ore Reserves Committee-compliant 6.9-billion-tonne iron-ore resource and with 2.1-billion tonnes in iron-ore reserves.

The project is expected to be completed in phases.

Stage 1 involves development to an initial 12-million tonnes a year of high-quality iron-ore product, while Stage 2 will entail an 18-million-tonne-a-year expansion to 30-million tonnes a year of total product.

Stage 1 has been designed as a standalone business case and does not rely on or require the Stage 2 expansion. The Stage 1 operation will mine the higher-grade upper hematite ores over a 30-year mine life, producing a 66% iron content and a premium-quality iron-ore pellet feed product with low impurities.

The initial openpit mining operation will use contractor mining to exploit free-dig material with a very low strip ratio, with simpler processing requirements resulting in low initial power demand. The ore will be upgraded into a high-grade pellet feed using conventional gravity and flotation concentration methods before being pumped to the port through a slurry pipeline. The project's onshore port facilities and infrastructure will include a filter plant to dewater the concentrate, and a covered ore-storage facility, located at a proposed new third-party port that will be built 9 km north of the existing Port of Pointe-Noire.

Stage 2 will involve the openpit mining of the magnetite orebody. The strip ratio will be lower than that of Stage 1, as the upper hematite cap will have been mined. The processing plant will be expanded, with a second concentrator using magnetic separation to produce a blended 67.5% iron content, premium-quality iron-ore pellet feed product. The increased power requirements will be supplied by planned power-generation expansion projects in Congo-Brazzaville. A second slurry pipeline will be constructed to transport the ore to port, where the port facilities will be expanded as part of the proposed deep-water port development.

The staged development approach adopted by Glencore in the feasibility study has demonstrated significant advantages over the prefeasibility study announced in November 2012, which considered a single-stage 30-million-tonne-a-year development at a capital cost of $7.5-billion.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

Not stated.

Capital Expenditure

Stage 1 is expected to cost $2.2-billion, including contingency, and Stage 2 $2.5-billion.

The first-stage operation could potentially finance the second-stage expansion through project cashflows, limiting the level of additional equity required for the operation.

Planned Start/End Date

Not stated.

Latest Developments

ZIOC has announced that, together with its 100% subsidiary MPD Congo, it has signed a memorandum of understanding with Centrale Électrique du Congo (CEC) SA to evaluate potential solutions to supply the project’s power demand, leveraging CEC's existing assets.

CEC – a private power producer, in Congo-Brazzaville – is owned by the government of Congo Brazzaville (80%) and Eni Congo (20%).

Under the terms of the memorandum, the parties will assess the technical, economic and legal aspects required for power generation and the distribution for the project's requirements for its Stage 1 operations. This will enable it to reach a production capacity of 12-millions tons a year of iron-ore, with further expansions planned.

Key Contracts, Suppliers and Consultants

DRA (process plant study) and P&C (FDSO evaluation process).

Contact Details for Project Information

ZIOC, email info@zanagairon.com.

DRA, tel +27 11 202 8600 or email info@DRAglobal.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation